55

Chapter 2

Accounting for Receivables

AP-17A (

7

)

Lakisha Ogata operates a proprietorship selling machinery. Because of the high value of

the machinery sold, Lakisha often requires customers to sign a note. Lakisha originally sold

a Gadget machine to Neil Marcin for $10,000 on November 14, 2016. The sale was initially

recorded as an account receivable, but now Lakisha decides to ask Neil to sign a note. On

December 1, 2016, Neil signs a one-year note to be paid on maturity, plus 5% interest.

Lakisha’s company has a year-end of April 30. Prepare the journal entries to reflect the

transactions related to the receivable and note.

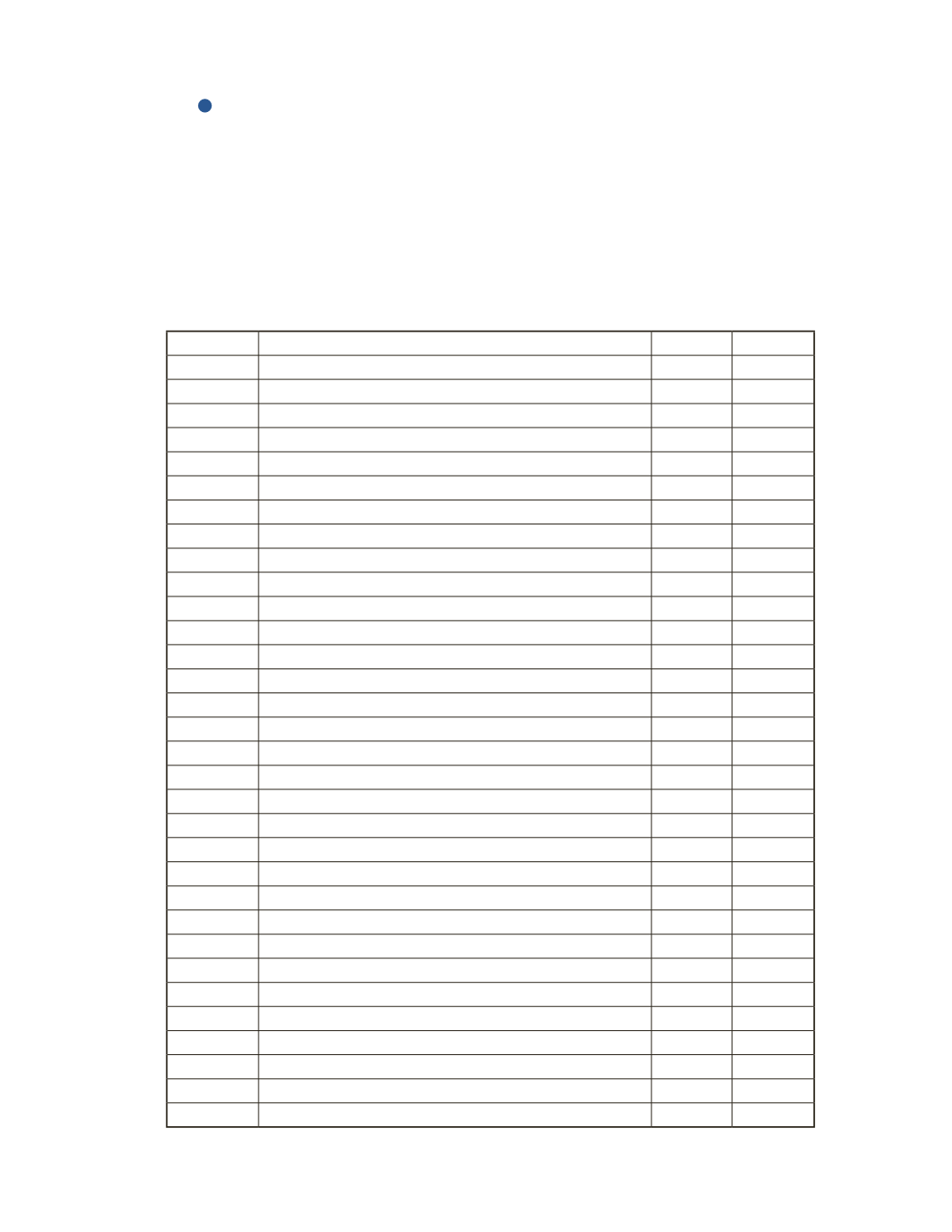

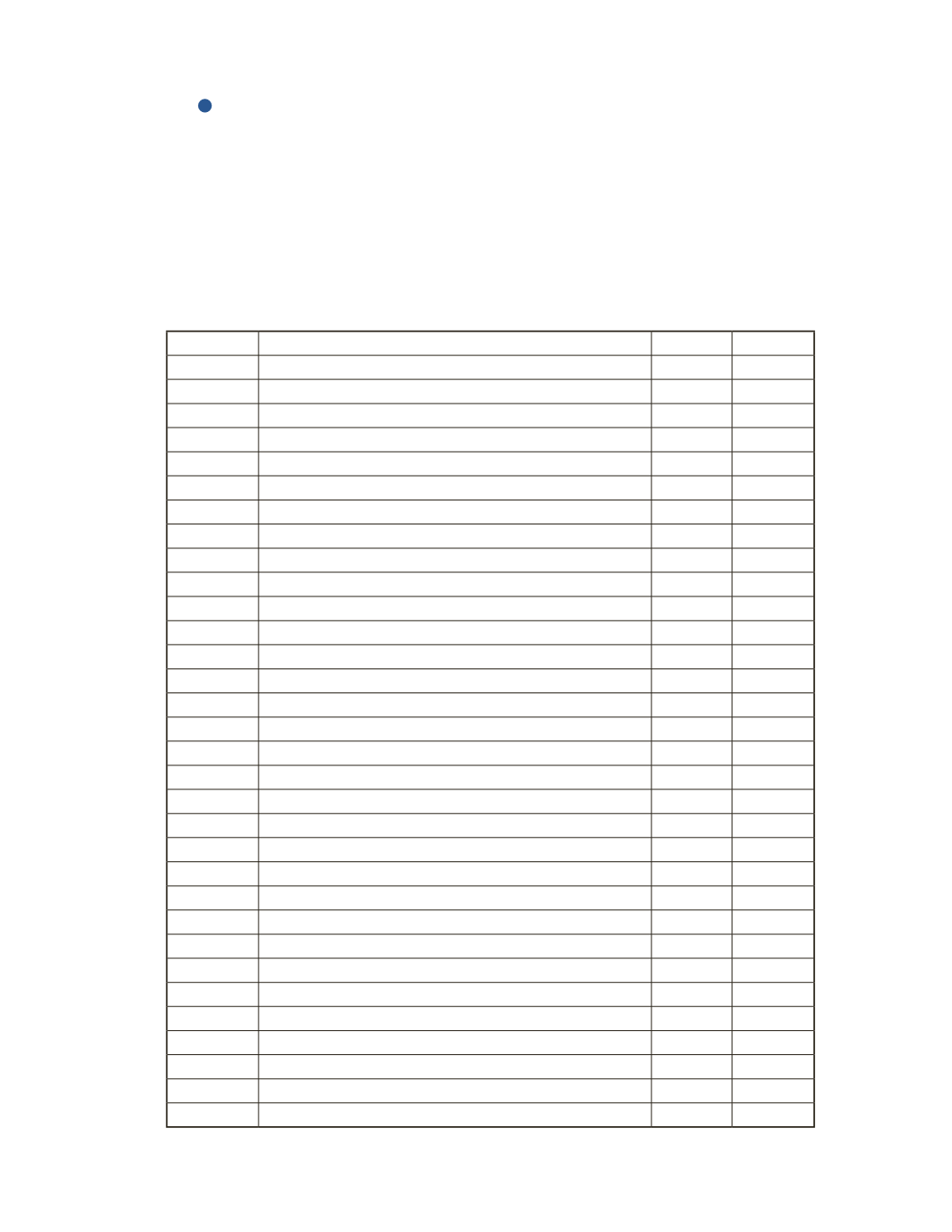

Date

Account Title and Explanation

Debit

Credit