47

Chapter 2

Accounting for Receivables

AP-9A (

2

3

)

During 2016, Jaime Company made total credit sales of $500,000, of which $25,000 was owed

by customers at year-end. On the basis of historical sales, 1% of sales will be uncollectible. Jaime

Company uses the allowance method to account for uncollectible receivables, and uses an

income statement approach to estimate the amount of receivables that will not be collected.

Required

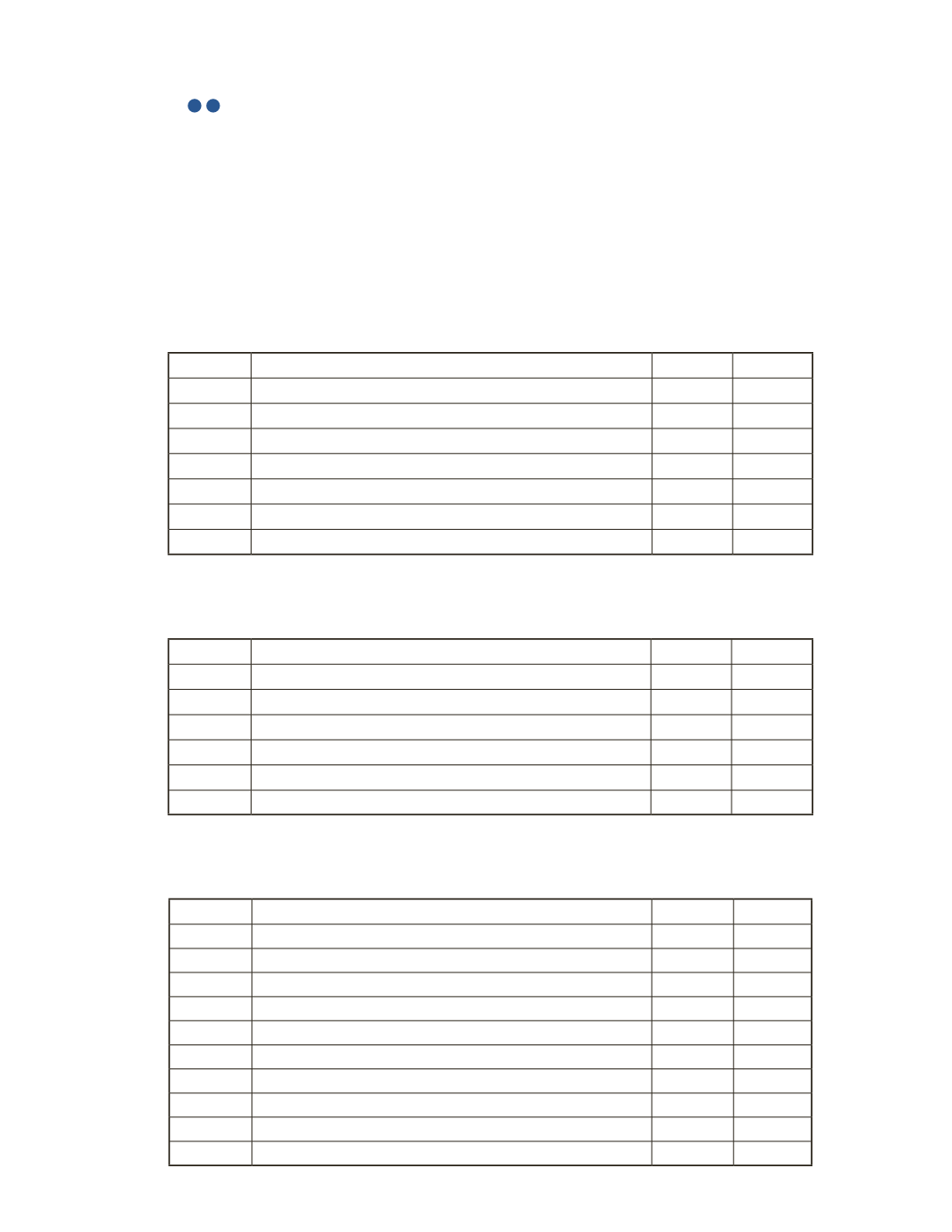

a) Prepare the journal entry on December 31, 2016 to account for the amount deemed

uncollectible.

Date

Account Title and Explanation

Debit

Credit

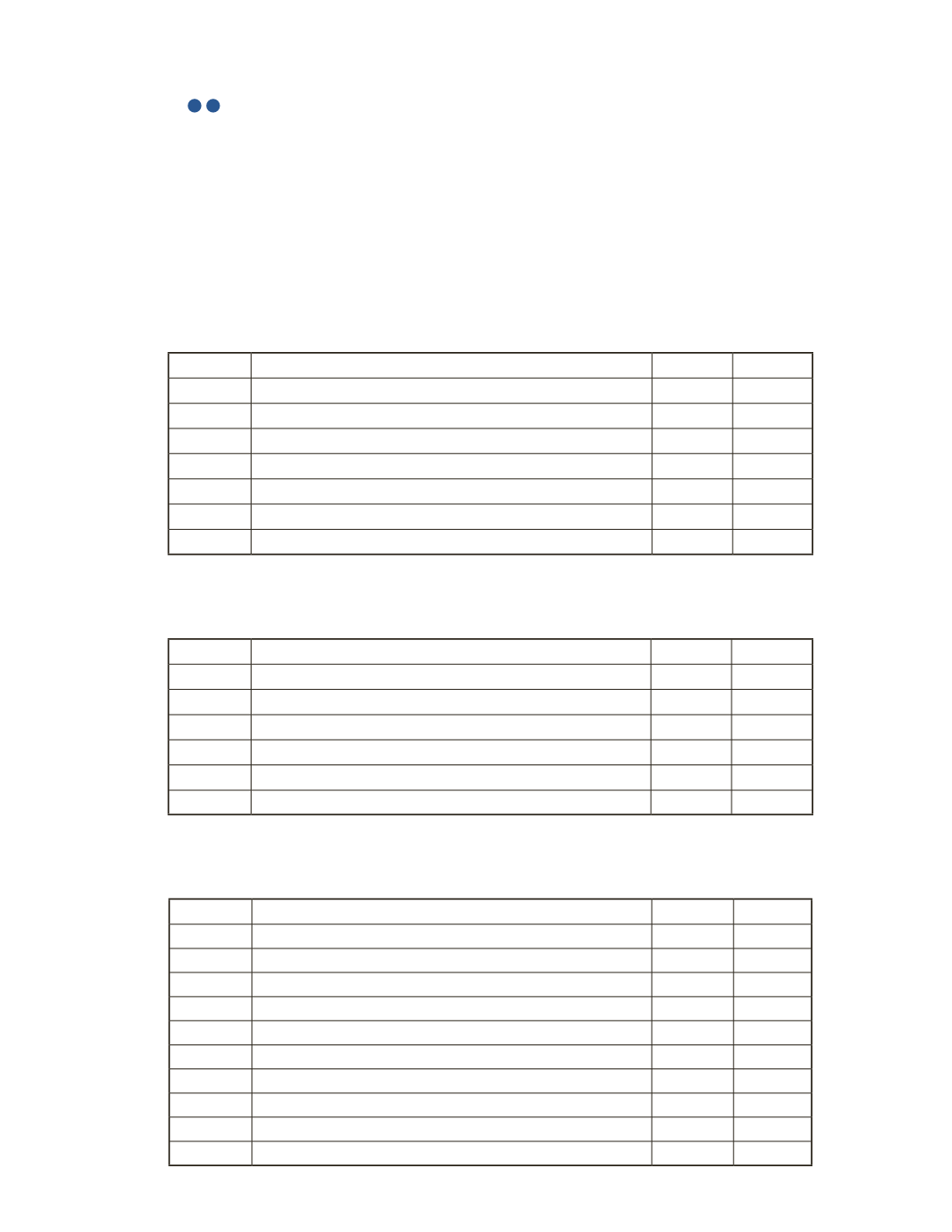

b) On January 20, 2017, Mrs. L. Green, who owes the company $500, informs Jaime Corporation

that she will be unable to pay the amount. Prepare the necessary journal entry.

Date

Account Title and Explanation

Debit

Credit

c) On February 14, 2017, Mrs. L. Green wins a lottery and decides to repay the full amount owing

to Jaime Corporation. Prepare the necessary journal entries.

Date

Account Title and Explanation

Debit

Credit