48

Chapter 2

Accounting for Receivables

AP-10A (

3

)

The 2015 and 2016 sales and accounts receivable information for Velcary Company are shown

below.

At the beginning of 2015, the AFDA account had a $0 balance. During 2015, sales for the year

totalled $1,200,000 with 60% on credit. At December 31 year-end, accounts receivable had

a debit balance of $55,000. Management estimated that 0.5% of all credit sales would be

uncollectible. The company wrote off $3,100 worth of accounts receivable at the end of the

year.

During 2016, sales totalled $1,630,000 with 60% on credit. On December 31, 2016, accounts

receivable has a debit balance of $76,000. During the year, the company wrote off a number

of accounts receivable, leaving the allowance for doubtful accounts with a debit balance of

$4,500. The estimate for bad debt expense for the year has not been determined or recorded.

After reviewing the write-offs, the company decided that the estimated percentage for AFDA

should be increased from 0.5% to 0.75%.

Required

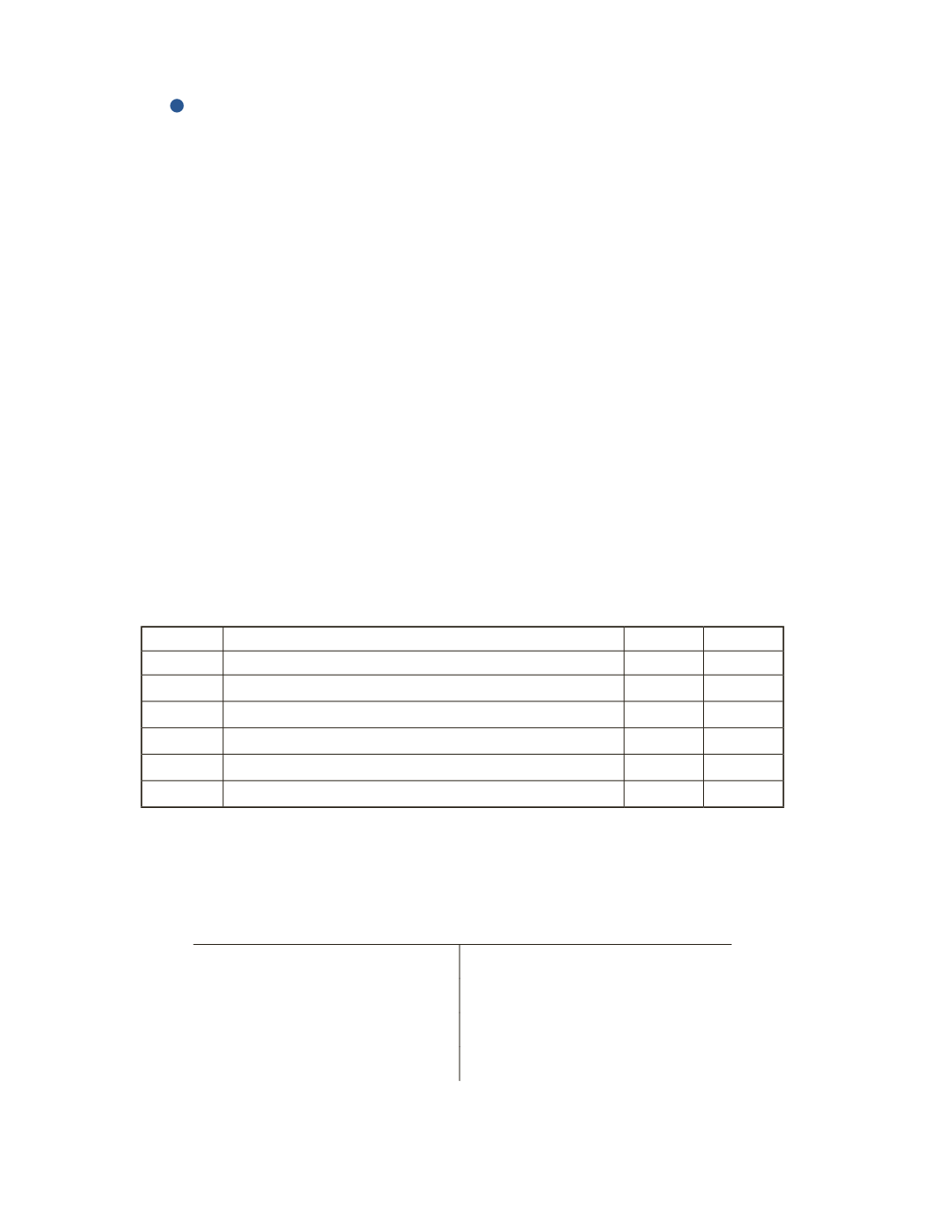

a) Prepare the journal entry to record the bad debt expense for 2016.

Date

Account Title and Explanation

Debit

Credit

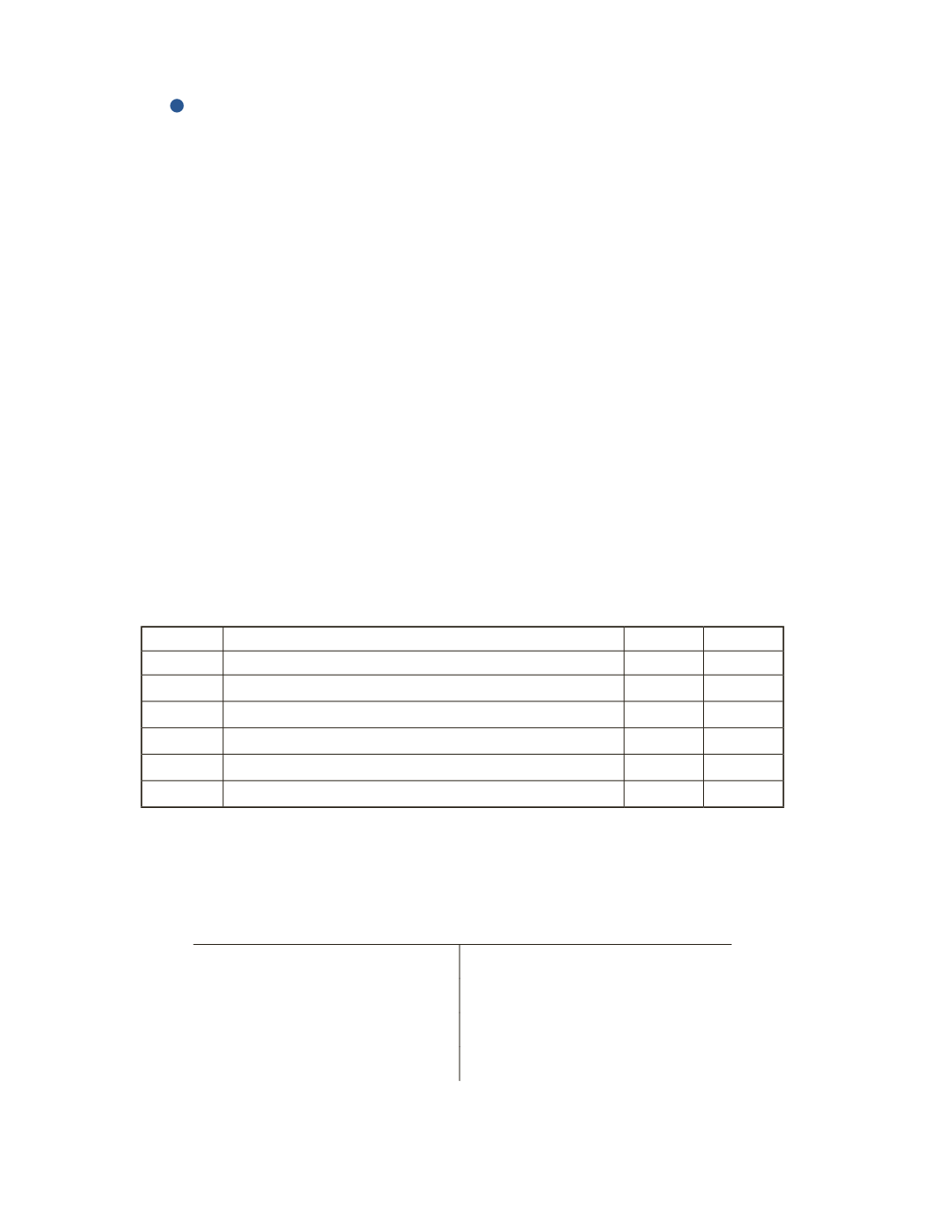

b) Prepare a T-account for the allowance for doubtful accounts and enter all related

transactions for year 2015 and 2016.