51

Chapter 2

Accounting for Receivables

AP-13A (

2

3

)

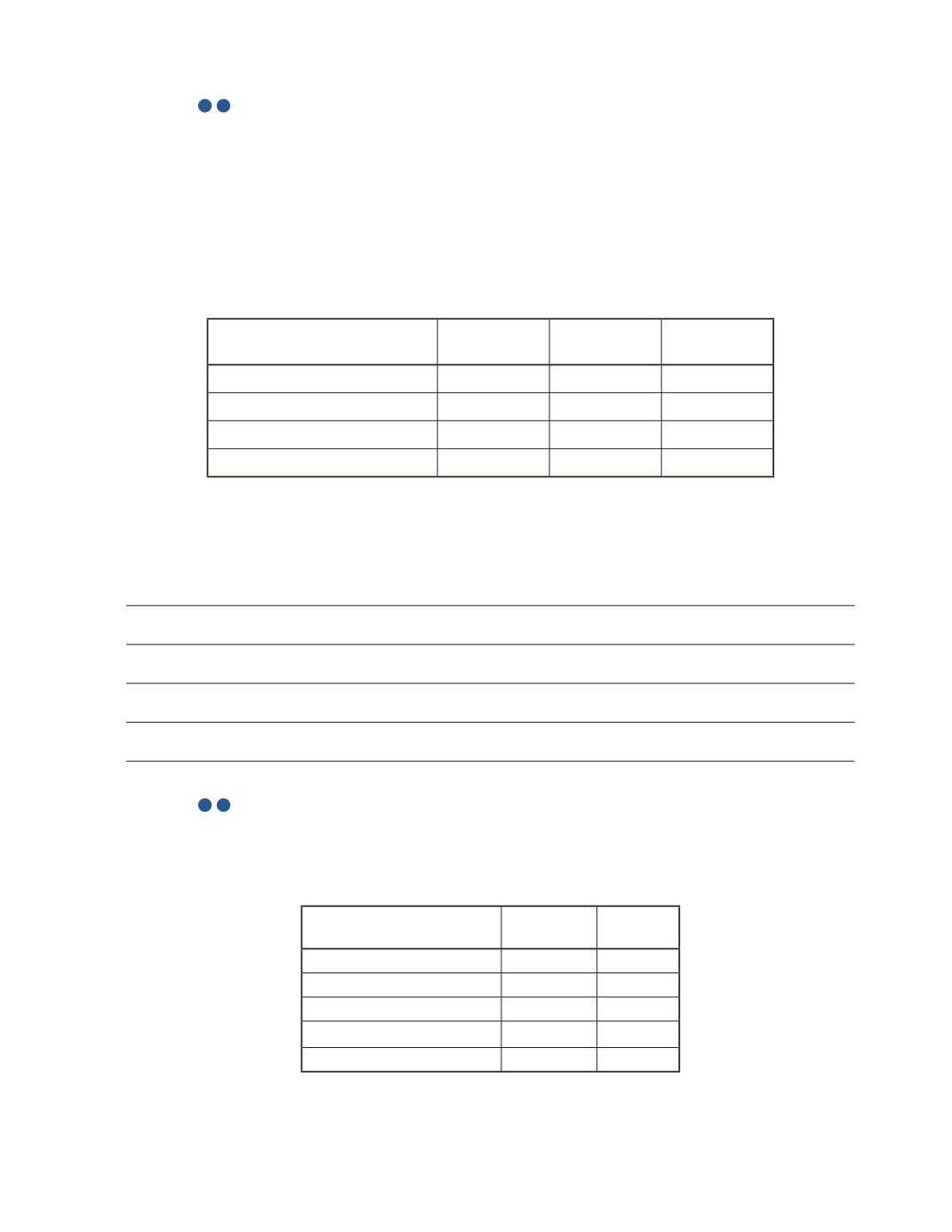

The following chart was prepared by the accountant of Happy Shoes. The percentages are

based on historical performance. Happy Shoes uses the balance sheet approach to estimate

uncollectible receivables.

Required

a) Calculate the company’s bad debt.

Aging Category

Bad Debt % Balance Estimated Bad

Debt

30 days

2%

$76,000

31–60 days

3.5%

45,000

More than 60 days

10%

25,000

Total

$146,000

b) Assume that allowance for doubtful accounts has a debit balance of $1,100. Calculate the

amount of bad debt expense the company will record.

AP-14A (

2

3

)

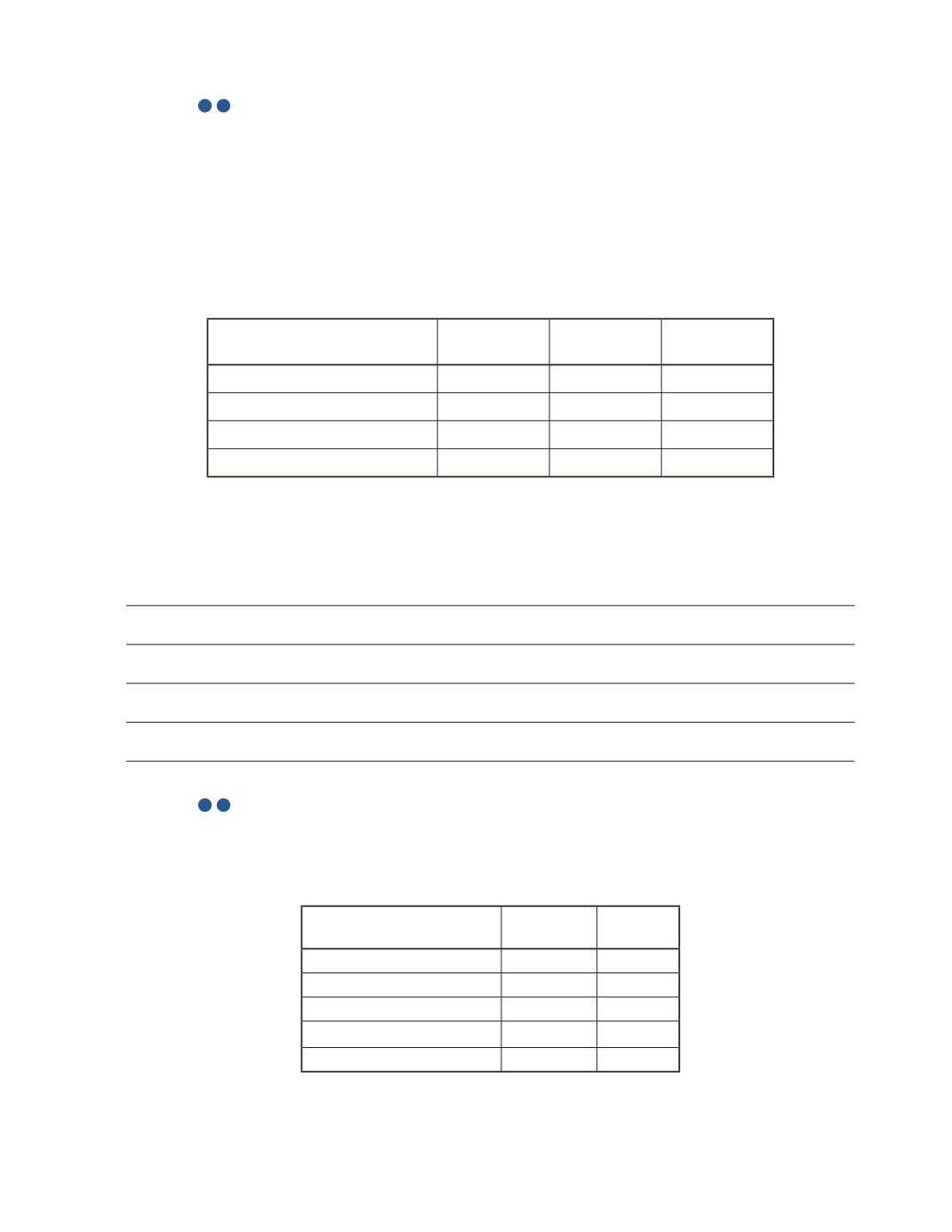

Whitney Fabricators uses the balance sheet approach to estimate uncollectible receivables.

The following is the aging of receivables on December 31, 2016.

Aging category

Bad Debt % Balance

Under 30 days

2% $175,000

31–60 days

4%

40,000

61–90 days

10%

10,000

More than 90 days

60%

3,000

Total

$228,000