43

Chapter 2

Accounting for Receivables

Application Questions Group A

AP-1A (

2

)

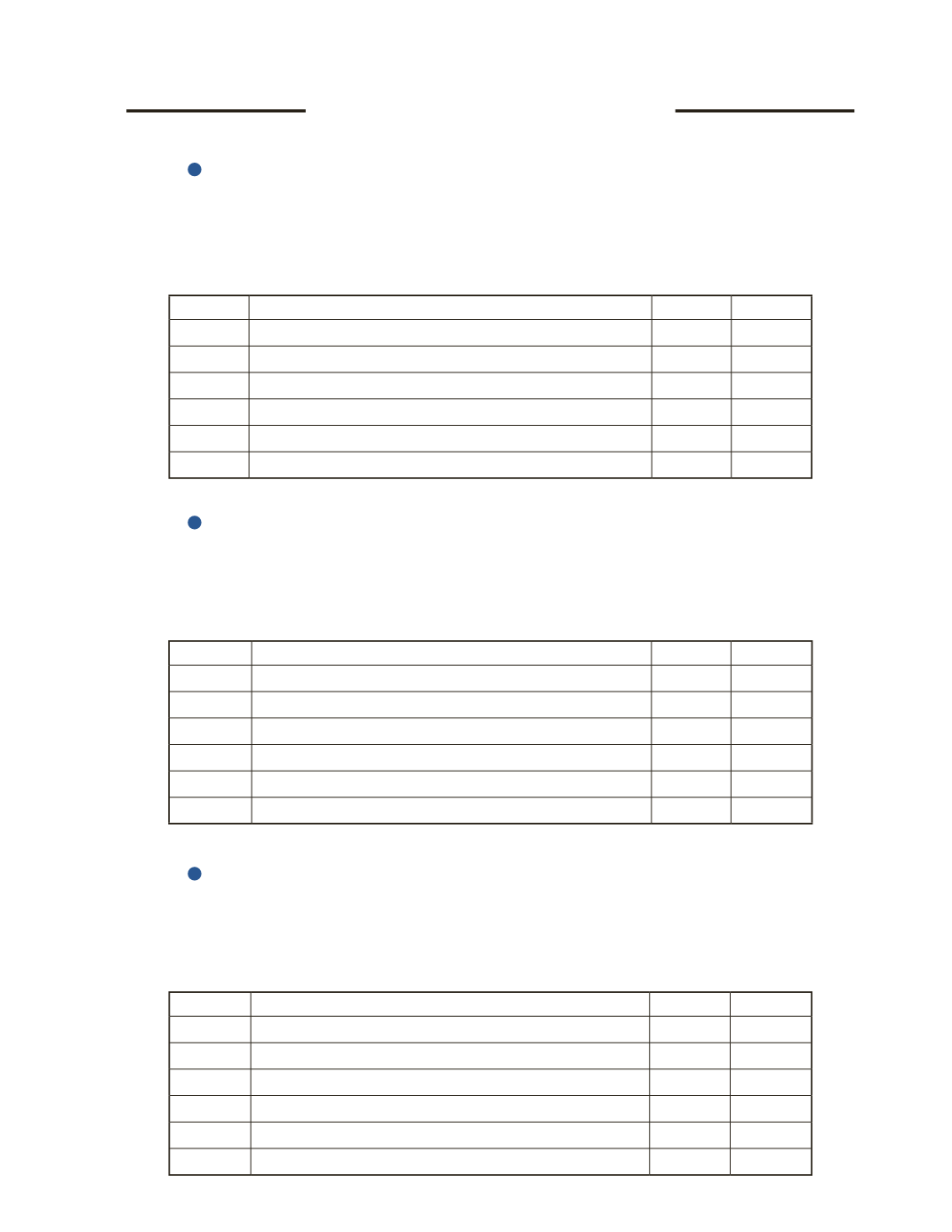

On December 31, 2016, your company decides that an allowance for doubtful accounts is

required in the amount of $6,000. There is a zero balance in the account. Prepare the journal

entry to set up the required allowance.

Date

Account Title and Explanation

Debit

Credit

AP-2A (

2

)

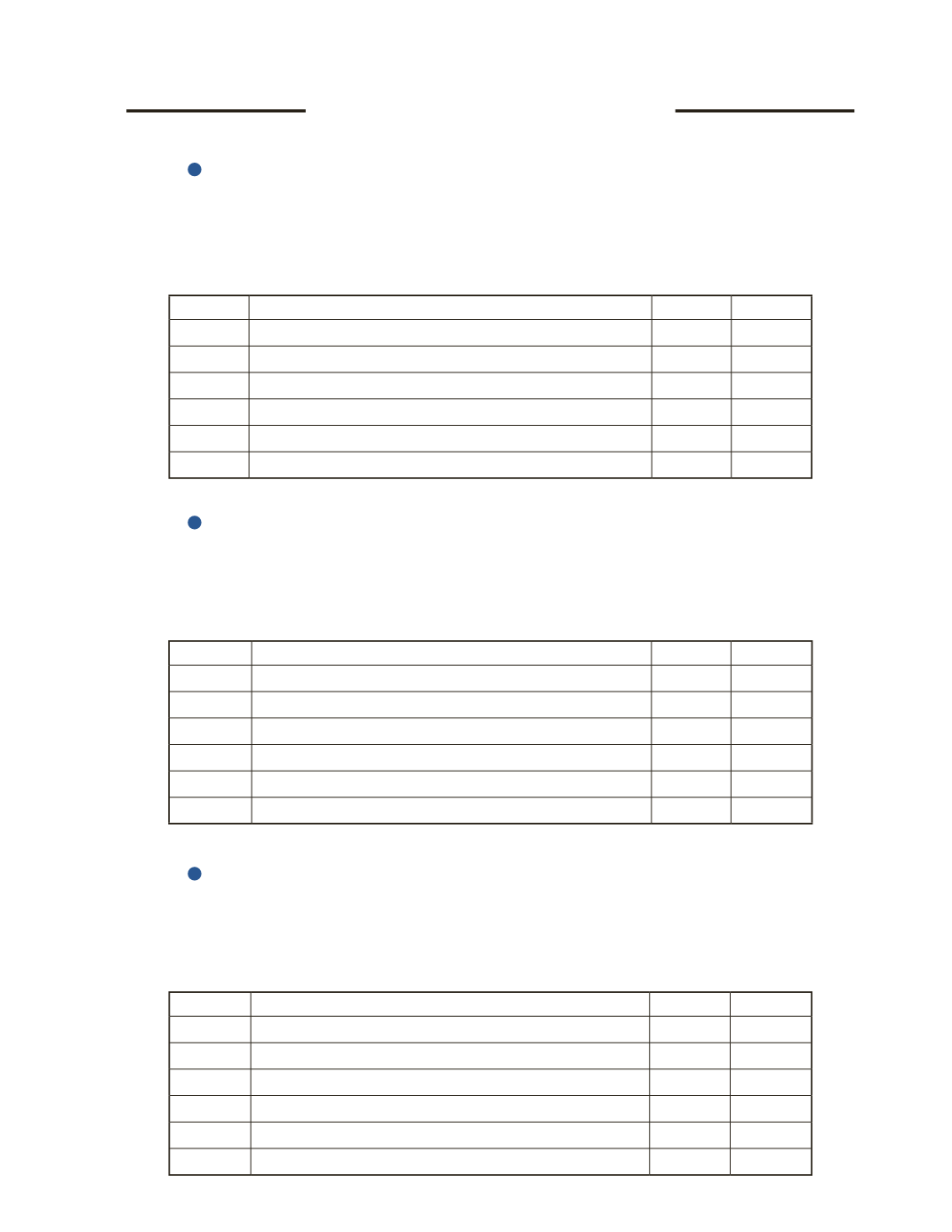

Your company decides that an allowance for doubtful accounts is required in the amount of

$6,000. There is a $4,000 credit balance in the account. Prepare the journal entry to set up the

required allowance on December 31, 2016.

Date

Account Title and Explanation

Debit

Credit

AP-3A (

3

)

Your company uses the income statement approach for estimating bad debt. For the year

ending December 31, 2016, credit sales amounted to $1 million. The estimated bad debt is

0.5% of credit sales. Prepare the journal entry to record bad debt expense for the year.

Date Account Title and Explanation

Debit

Credit