45

Chapter 2

Accounting for Receivables

AP-6A (

2

3

)

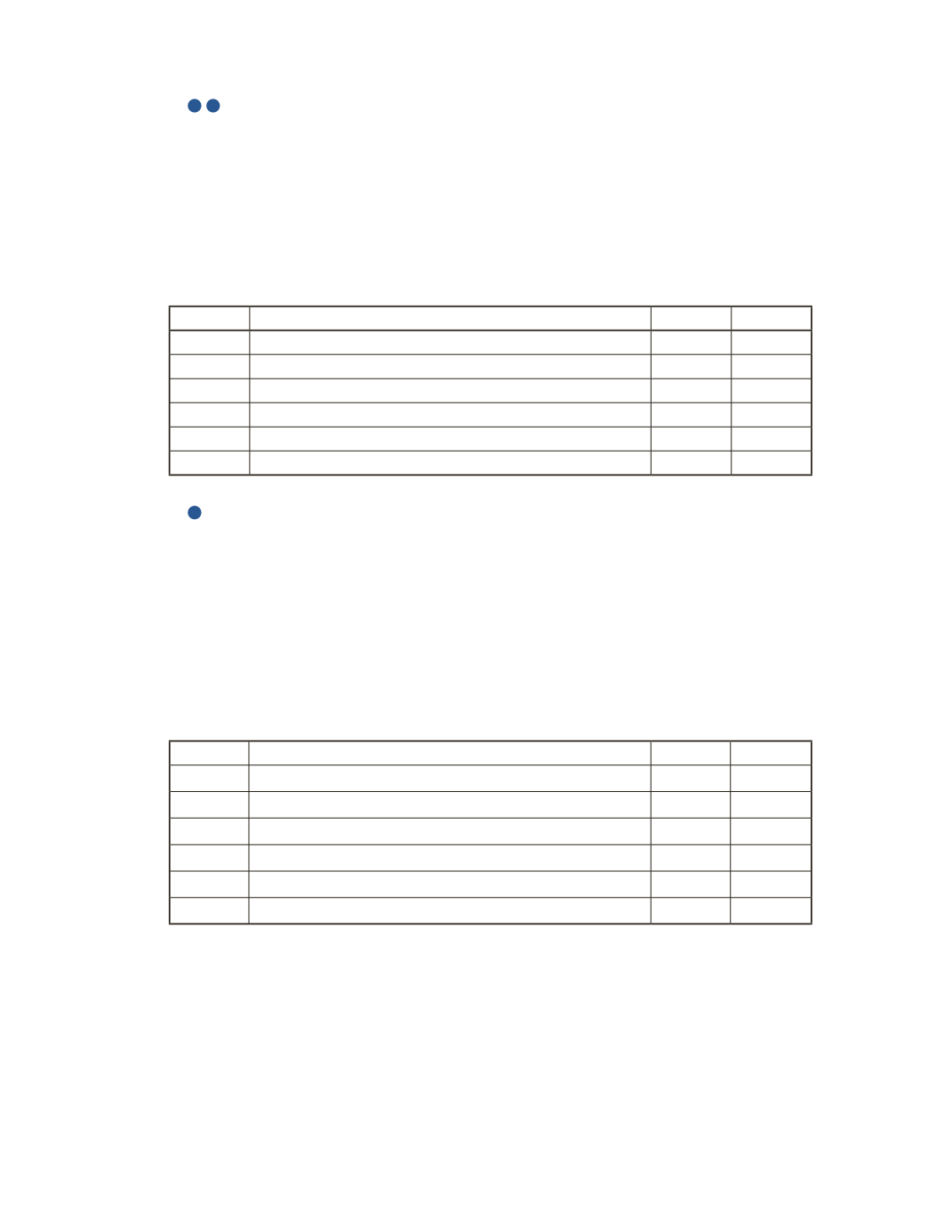

The Green Earth Company uses the allowance method to account for uncollectible

receivables. The company uses the income statement approach for estimating uncollectible

receivables. During the fiscal year 2016, the company had credit sales of $2,300,000.

It estimates that 1.5% of these sales will be uncollectible. Green Earth Company has a

December 31 year-end. Prepare the journal entry to record the uncollectible receivables on

December 31, 2016.

Date

Account Title and Explanation

Debit

Credit

AP-7A (

2

)

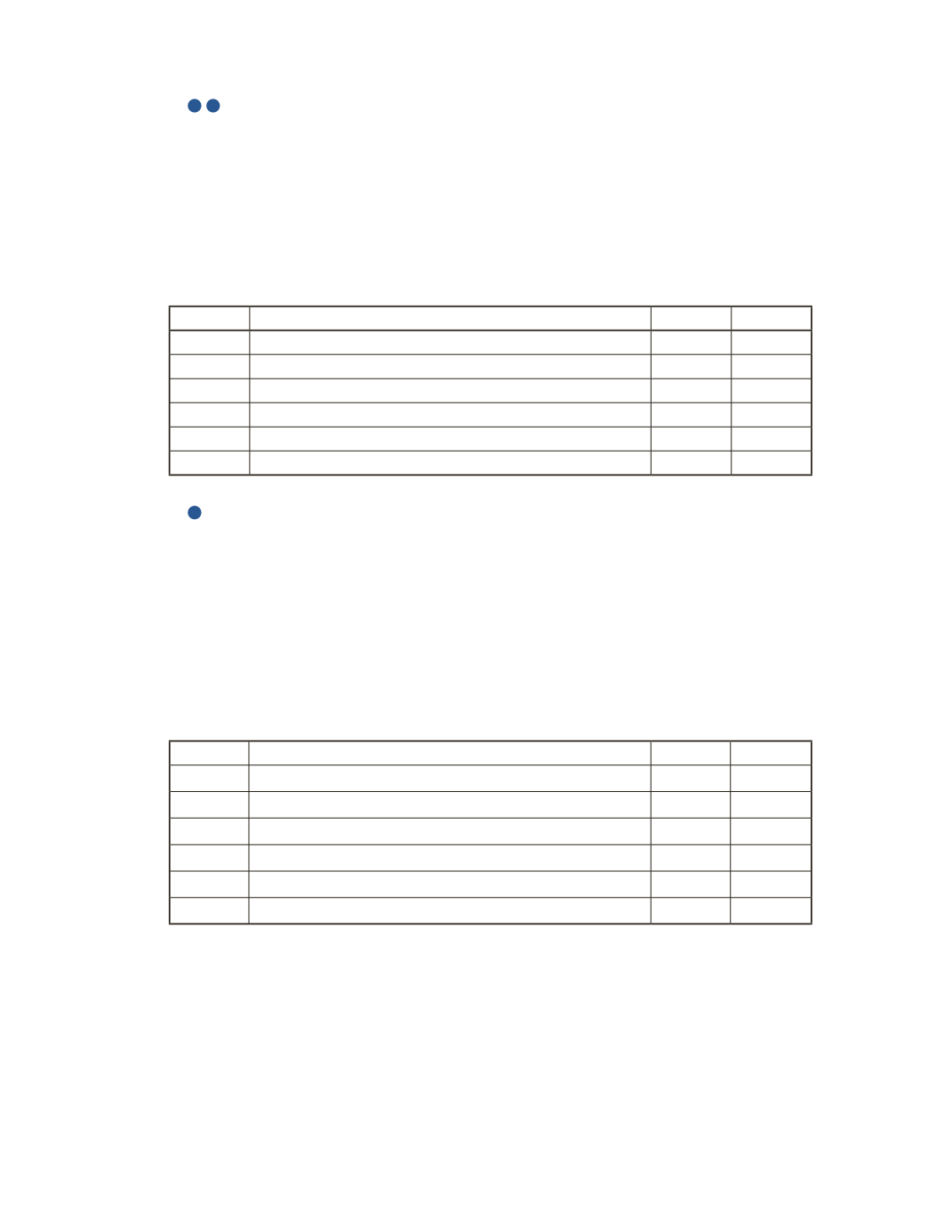

On June 15, 2016, you discover that your customer, Tyrone Huntzinger, has gone bankrupt. He

owes you $1,000.

Required

a) Prepare the appropriate journal entry to write off bad debt assuming AFDA has already

been estimated and recorded in the past.

Date

Account Title and Explanation

Debit

Credit