Chapter 9

Investments

467

AP-11B (

1

4

)

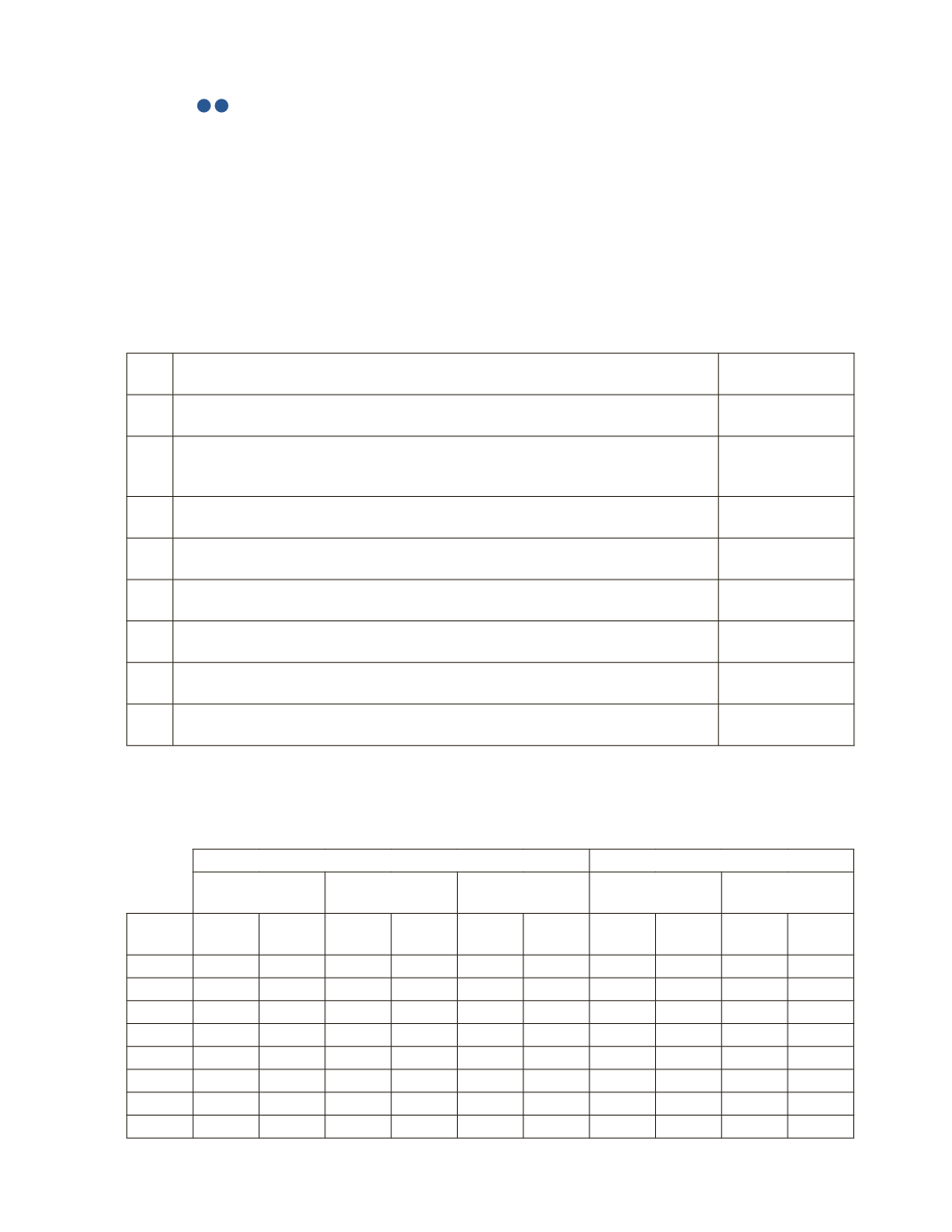

Different accounting methods of recording investments impact different accounts in either

the balance sheet or income statement.

Required

a) Indicate which accounting method should be used under IFRS for recording each

transaction listed in the table below. The first transaction has been completed as an

example.

Item

No.

Scenario

Valuation Method

1 Accrued interest of $150 for a 120-day T-bill that the investor intends to hold until

maturity for interest revenue.

Amortized Cost

2 Sale of a long-term investment bond for $10,300 cash before maturity. The bond

had a book value of $10,000. The purpose of this investment was for earning

interest revenue.

3 Received interest payment of $4,000 for a long-term bond investment. The interest

revenue earned was $4,300.

4 A non-strategic short-term bond investment accrued interest revenue of $200 at

year-end. The purpose of this investment was for trading.

5 The fair value of a non-strategic short-term bond decreased by $600. The purpose

of this investment was for trading.

6 The fair value of a long-term bond investment increased by $3,600. This bond is

invested with the purpose of earning interest.

7 An associate company reported $10,000 of net loss. The investor owns 25% of an

associate’s common shares with significant influence.

8 A fair value of a long-term equity investment decreased by $2,000. The investor

has insignificant influence.

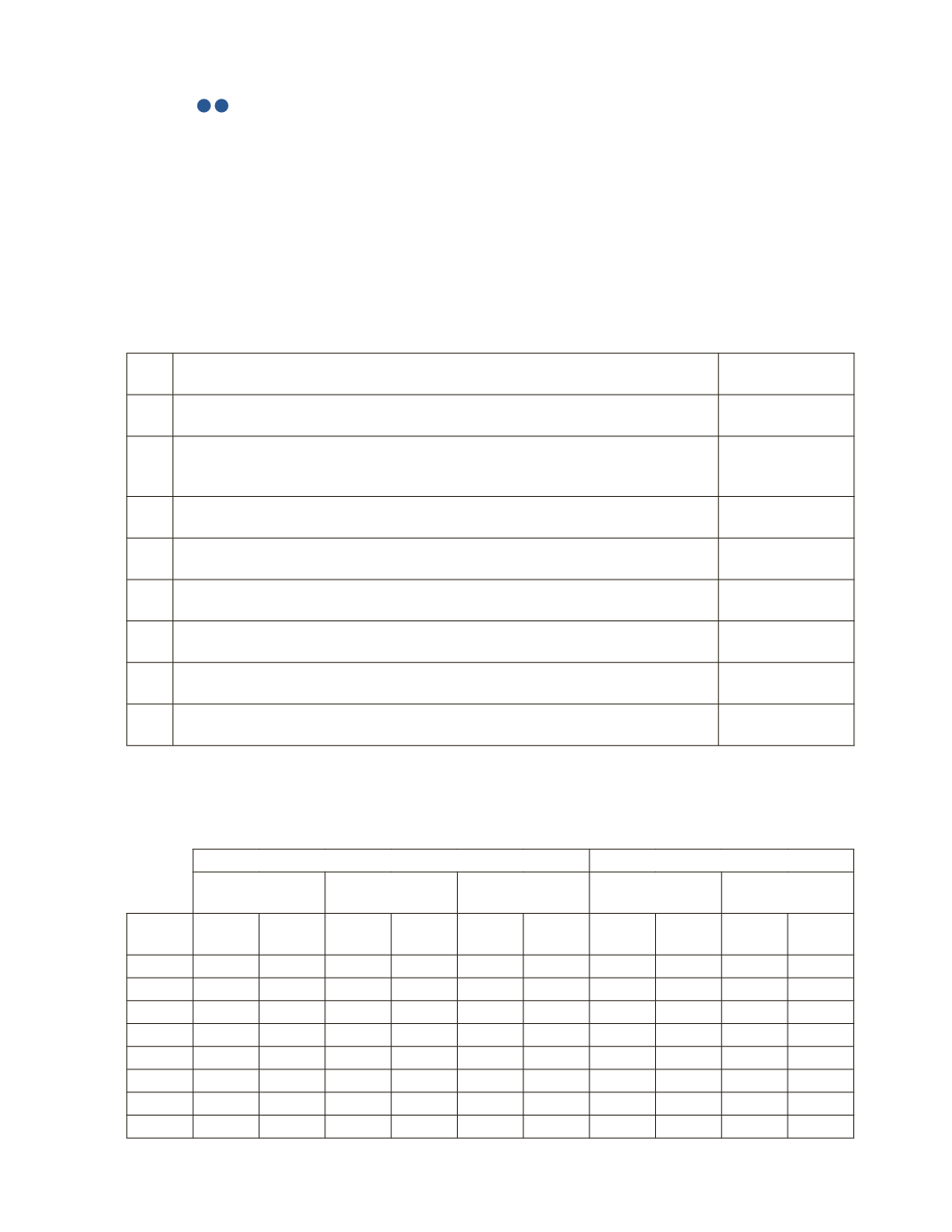

b) Complete the table to show how each transaction from the table above impacts each

account for the investor. Assume the investor follows IFRS. The first row has been

completed as an example.

Income Statement

Balance Sheet

Revenue

Expense

OCI

Current Assets

Non-Current

Assets

Item

No.

Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

1

150

150

2

3

4

5

6

7

8