Chapter 9

Investments

460

AP-5B (

1

2

)

On July 1, 2016, Landmark Company, a public company, decided to buy $140,000 worth of

10-year bonds at par with an annual interest rate of 7%, issued by a private company. Interest

is paid semi-annually on January 1 and July 1. The company intends to trade the bonds within

the next two years. Landmark Company records the bonds using fair value through profit and

loss method. The company’s year-end is on November 30.

Required

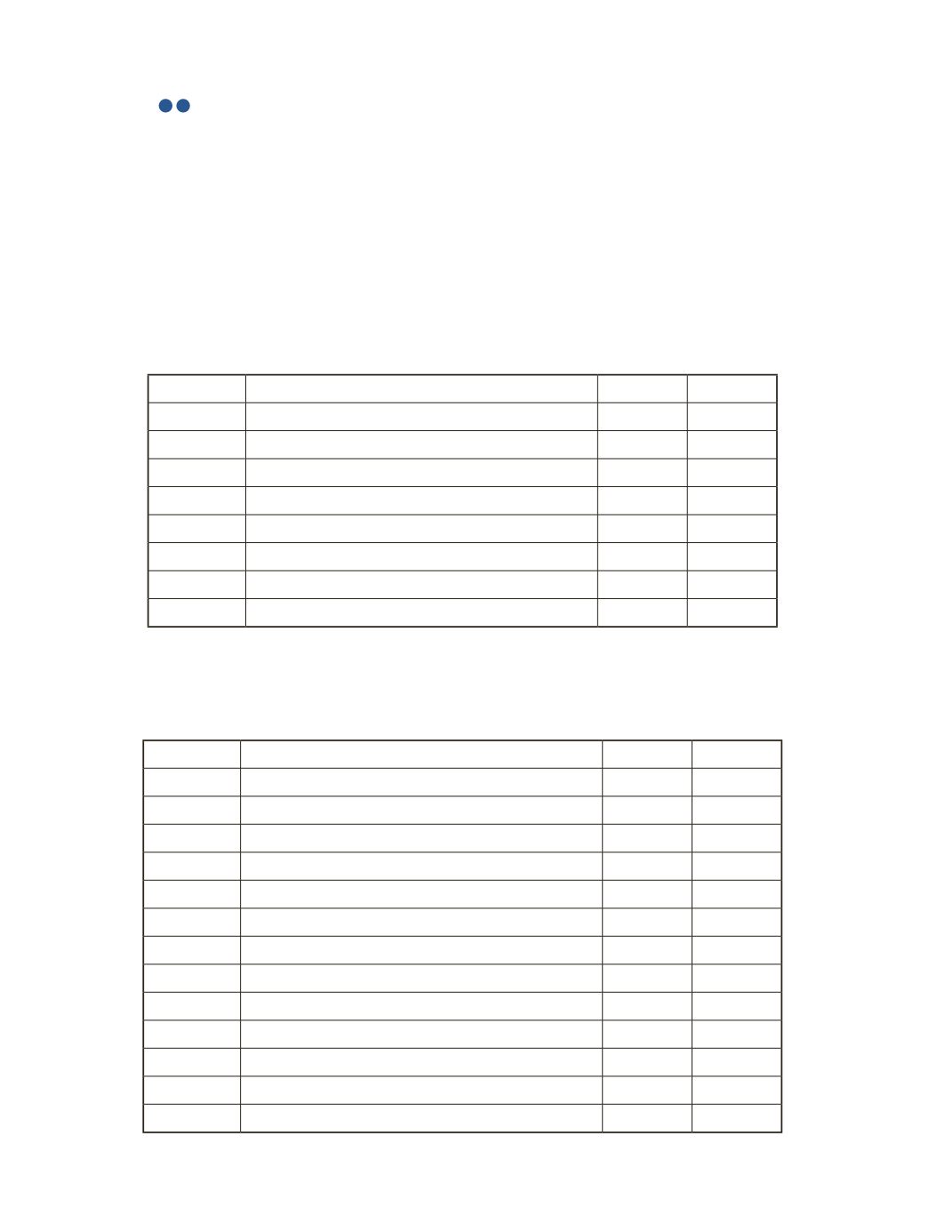

a) Record acquisition of the bonds.

Date

Account Title and Explanation

Debit

Credit

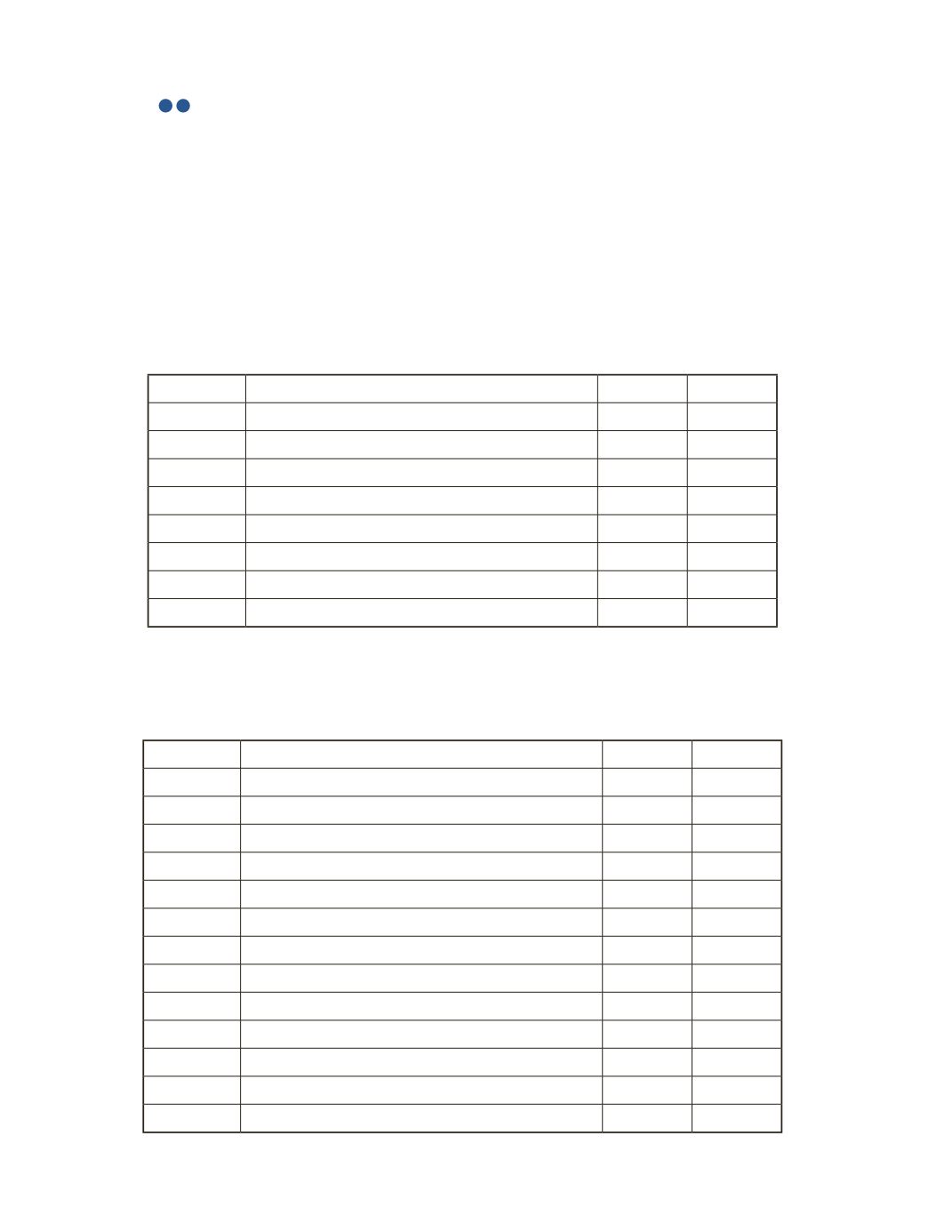

b) Assume that on November 30, 2016, the market value of the bonds increased to $145,000

due to a change of market interest rate. Prepare journal entries to make the adjustment on

this date. You do not need to record the interest accrued for this question.

Date

Account Title and Explanation

Debit

Credit