Chapter 9

Investments

455

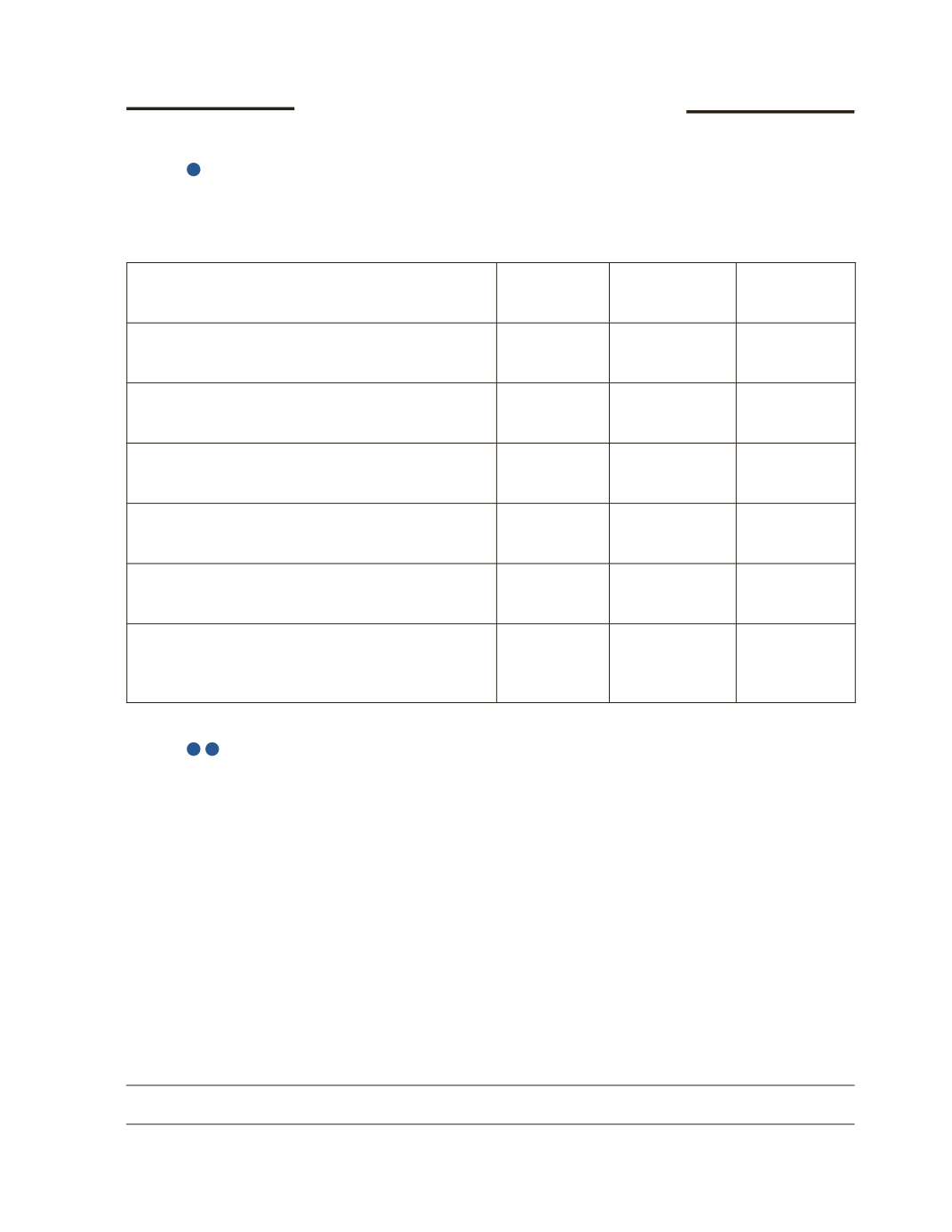

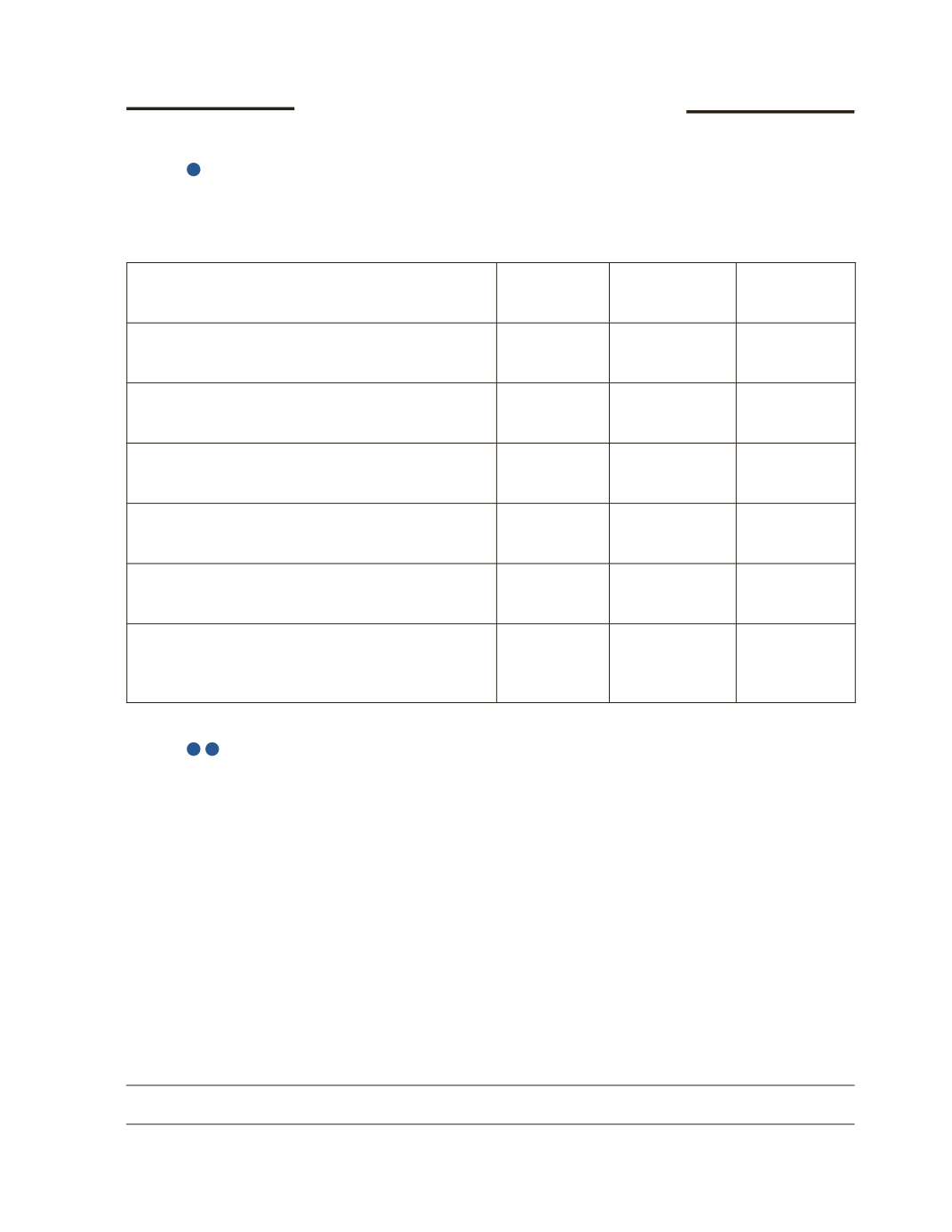

Application Questions Group B

AP-1B (

1

)

Betty Company invests in different instruments before the end of 2016. Complete the

following table for each of the investments.

Investments

Non-Strategic

or Strategic

Investment

Classification on

Betty Company’s

Balance Sheet

Accounting

Method

120-day treasury bill purchased on December 31,

2016 that Betty plans to hold for interest revenue until

maturity.

A 3% common shares of a public company purchased

on February 1, 2016 that Betty Company is planning on

selling before the year-end of December 31, 2016.

A one-year bond issued by a private business on

November 1, 2016 that Betty Company is planning to

hold until maturity.

20% of common shares of Tim Company purchased

on November 18, 2016. Currently, the company has

significant influence over the investee.

15% of common shares of Jerry Company purchased

on December 24, 2016, which Betty is planning to sell

within five months to make a profit.

45% of common shares of Sally Company purchased

on December 30, 2016, with which Betty Company is

trying to acquire more shares to establish control over

the investee in the future.

AP-2B (

1

2

)

Quest Company purchases a $350,000, 120-day treasury bill (T-bill) on March 1, 2016 for

$344,167 in cash. The treasury bill pays 5% interest. Quest plans to hold the T-bill until

maturity to earn interest. The company follows IFRS and its year-end is April 30.

Round your answers to the nearest whole dollar.

Required

a) If the accountant of Quest Company decides to use fair value through profit and loss

methods, would you agree with this? Explain.