Chapter 9

Investments

459

AP-4B (

1

2

)

Jimmy Company, a public company, purchases a 120-day, $5,000,000 Canadian Government

T-bill on April 1, 2016, when the market interest rate is 6%. Jimmy pays $4,900,000 for the T-bill.

The company plans to sell this T-bill at any time before the maturity date, should the market

situation turn favourable. Assume that Jimmy Company has a year-end date of April 30.

Assume Jimmy Company sold the 120-day, $5,000,000 T-bill for $4,940,000 on May 1, 2016.

Prepare journal entries for the purchase, accruals of interest at the year-end and sale of the

T-bill.

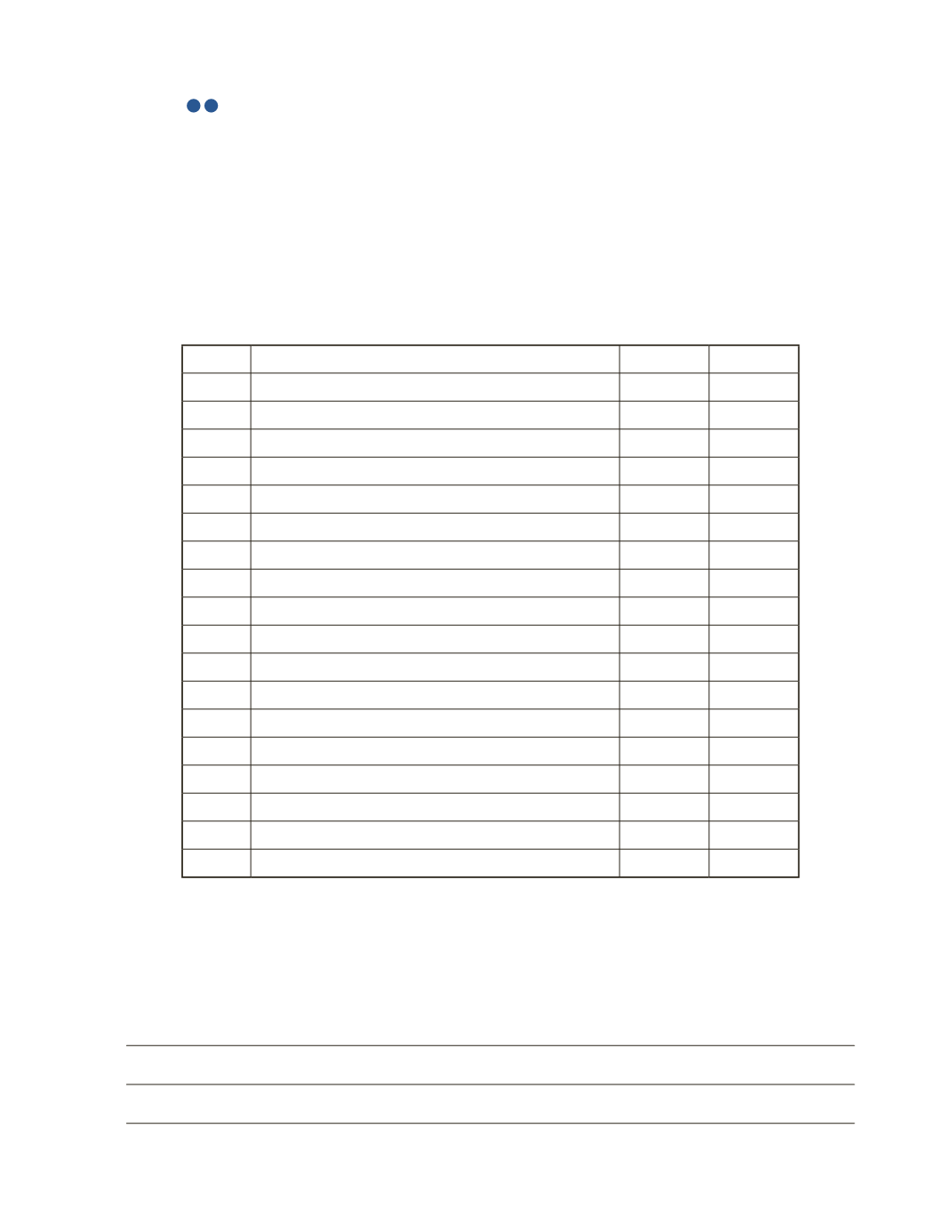

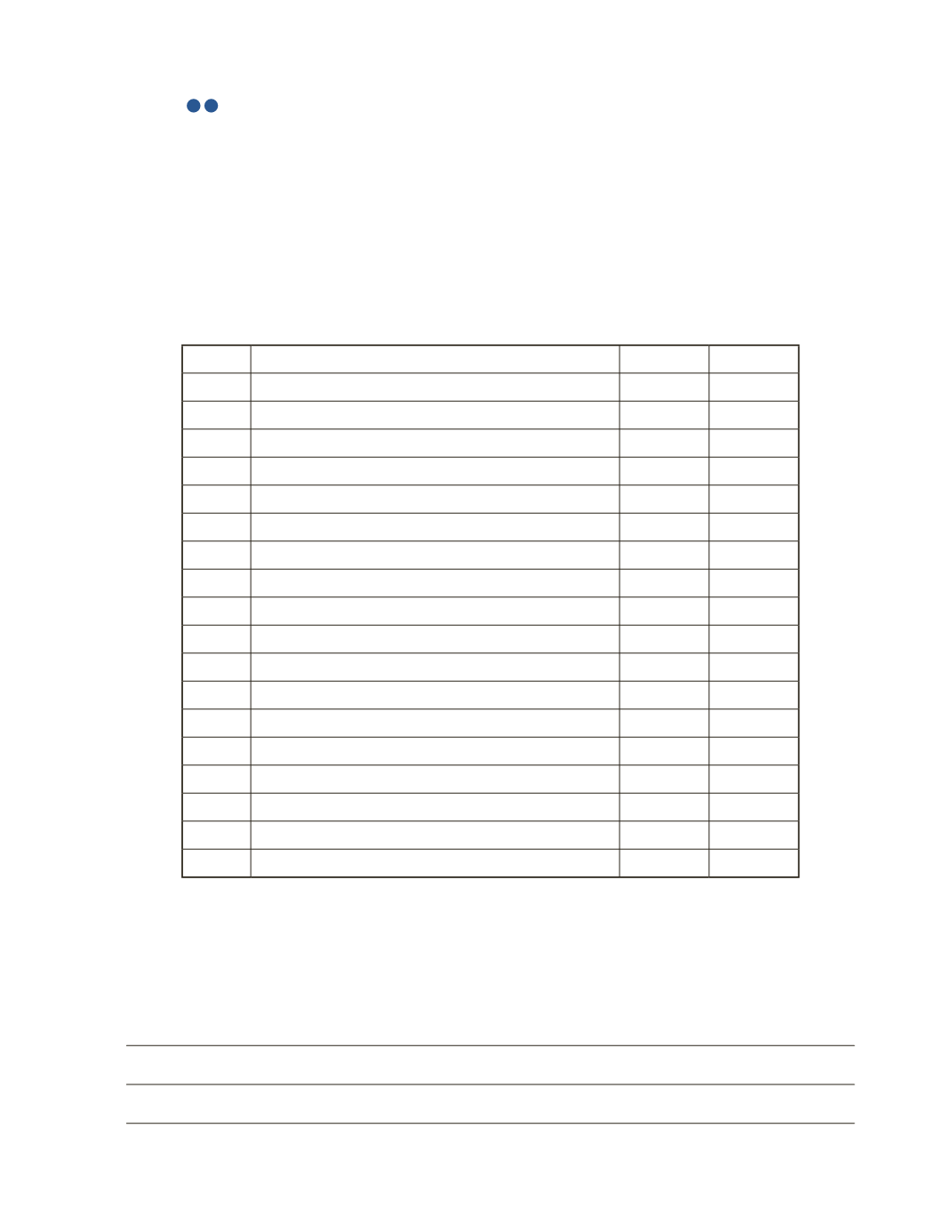

Date

Account Title and Explanation

Debit

Credit

Analysis

Do you think Jimmy Company made the right decision to sell this T-bill on May 1, 2016?

Explain.