Chapter 9

Investments

447

AP-11A

(

4

)

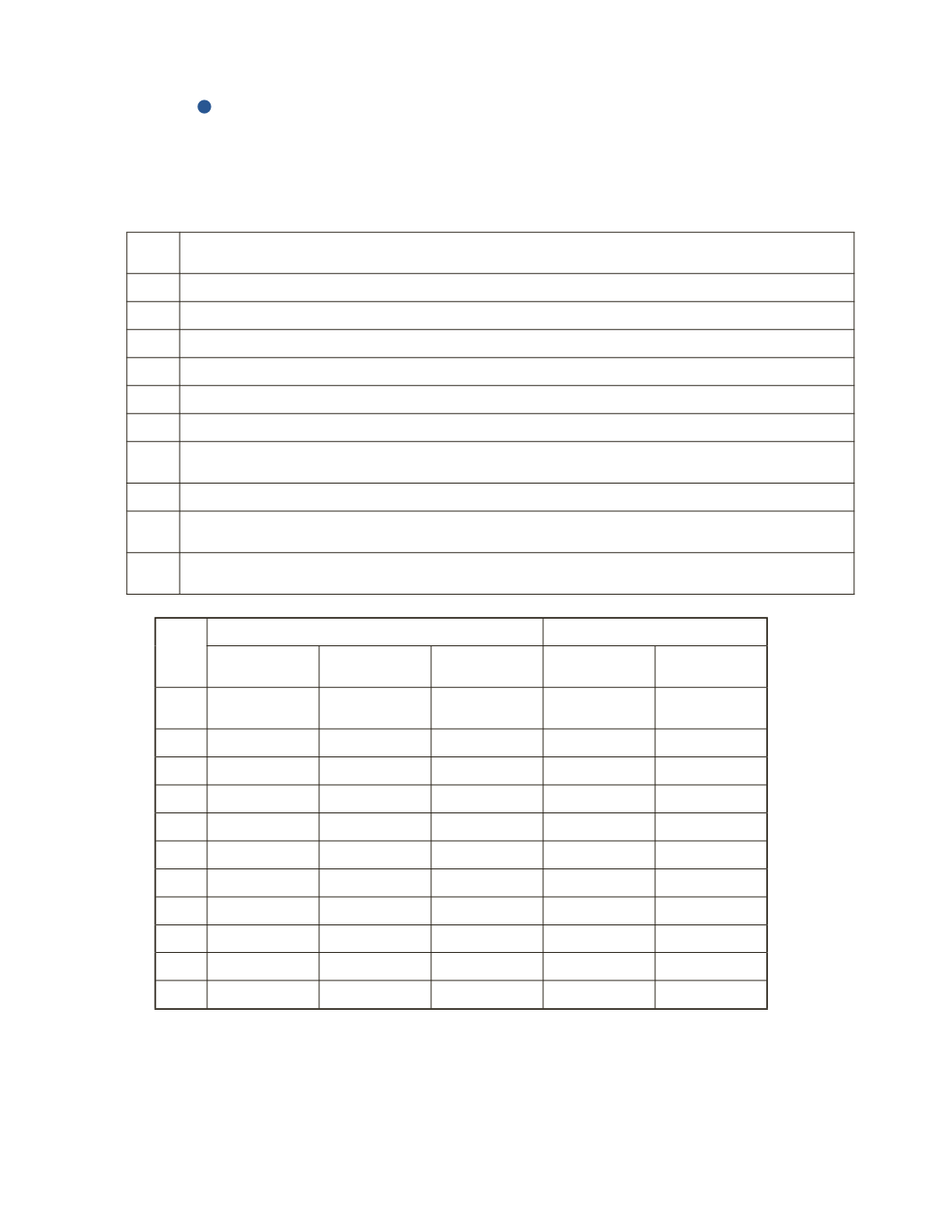

Different accounting methods of recording investments impact different accounts in either

the balance sheet or income statement. From a list of transactions given below, indicate how

each account is impacted for the investor. The first one is completed for you as an example.

Item

No.

Transaction

1

The $300 interest accrued on a 90-day T-bill.

2

Interest receipt in cash of $4,800 with interest revenue of $4,300 from a long-term investment bond.

3

Sale of a long-term investment bond for $10,300 cash before maturity, with a book value of $10,900.

4

Accrued interest revenue of $520 for a non-strategic long-term bond investment at year-end.

5

An adjustment of a market price increase of $900 for a non-strategic long-term bond investment.

6

The $3,000 cash dividend received from the equity investment recorded using the fair value method.

7

Fair value increase of an equity investment for $1,500. The investment is valued based on the cost

method.

8

The $1,200 cash dividend received for a strategic equity investment using the equity method.

9

The fair value increase of $3,300 for a long-term investment in common shares recorded using the fair

value method.

10

Using the equity method, an associate company reported $100,000 of net profit. The investor owns

35% of an associate’s common shares.

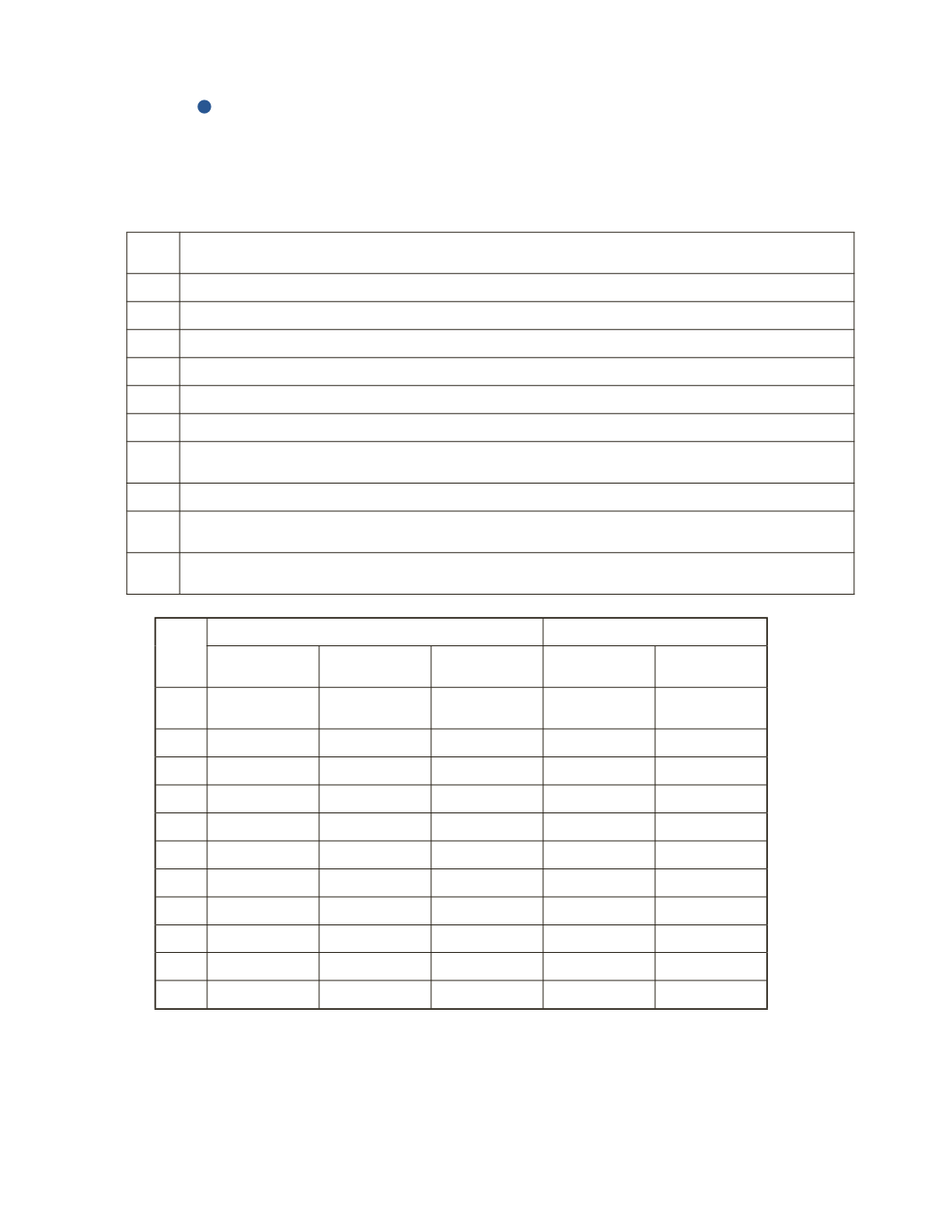

Income Statement

Balance Sheet

Revenue

Expense

OCI

Current Assets Non-Current

Assets

Item

No.

1

+$300

+$300

2

3

4

5

6

7

8

9

10