Chapter 9

Investments

437

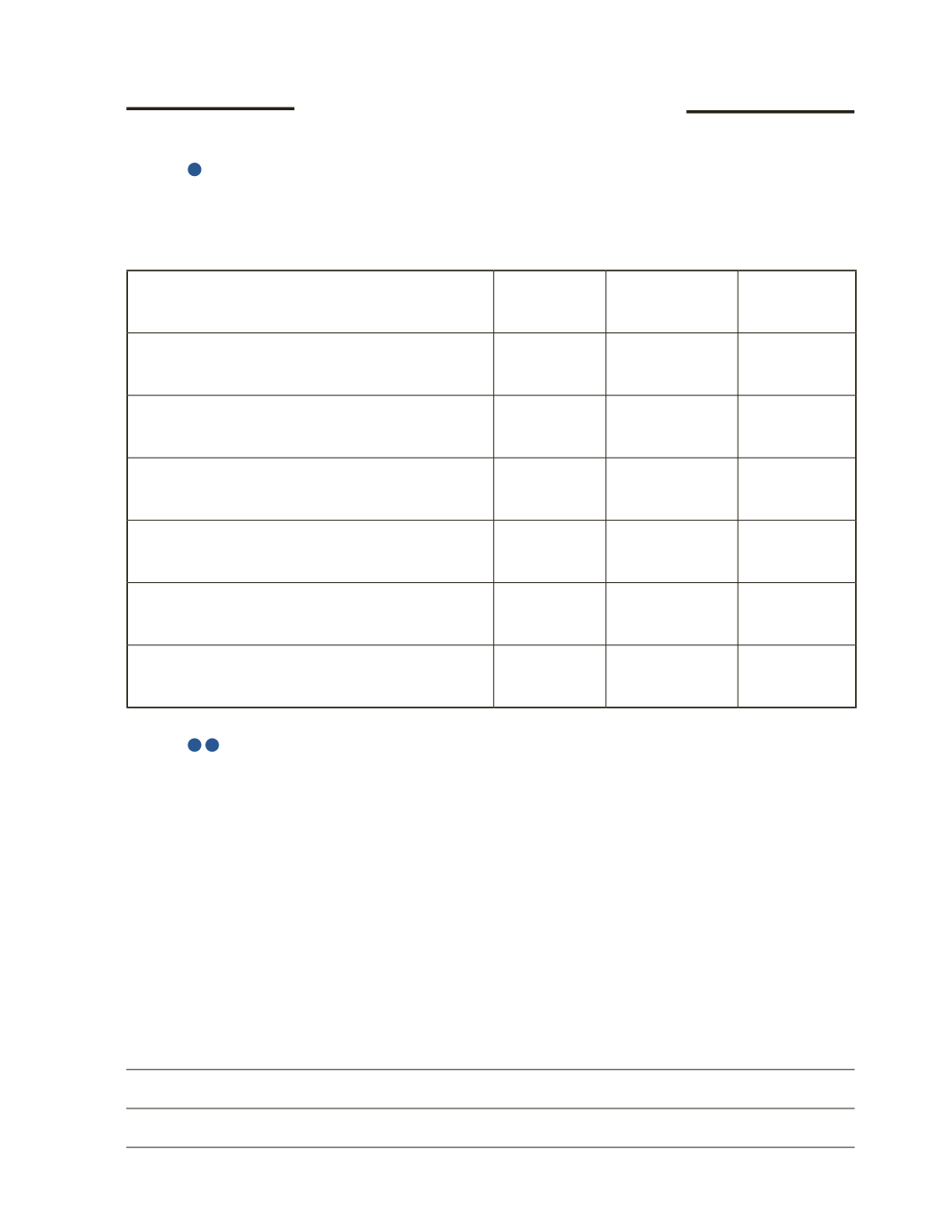

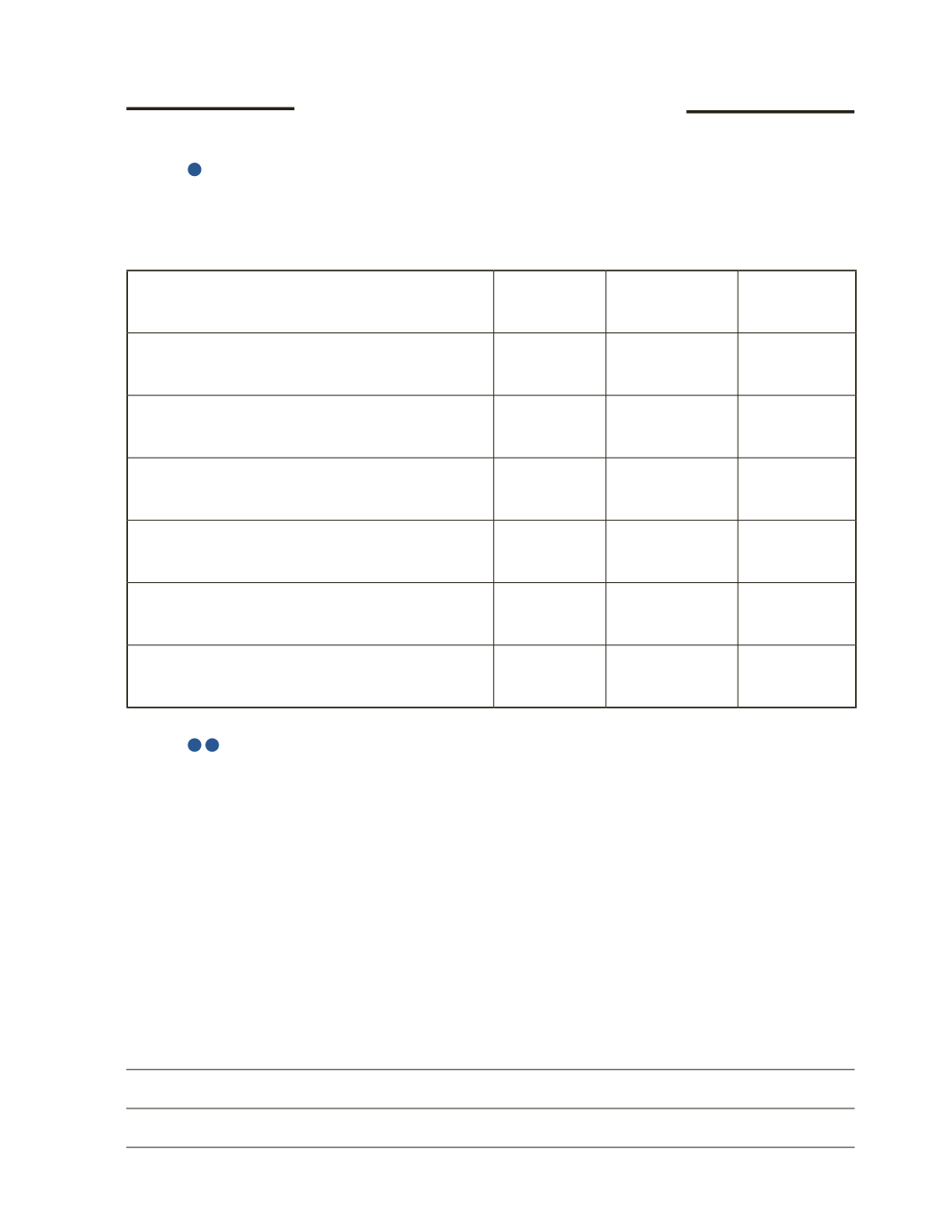

Application Questions Group A

AP-1A (

1

)

Affy Company makes some investments in 2016. Affy Company has adopted IFRS standards

since 2011. Complete the following table for each of the investments.

Investments

Non-Strategic

or Strategic

Investment

Classification on

Affy Company’s

Balance Sheet

Accounting

Treatment

A 90-day treasury bill purchased on November 15,

2016 that Affy plans to hold for interest revenue until

maturity.

A two-year provincial bond purchased on April 1, 2016

that Affy is planning to sell before the year-end of

December 31, 2016.

A five-year bond issued by a private business on

November 1, 2016 that Affy is planning to hold until

maturity.

10% of common shares of Smith Company purchased

on November 2, 2016 with significant influence over

the investee.

6% of common shares of John Company purchased on

December 2, 2016, which Affy is planning to hold for a

short period of time before selling to make a profit.

45% of common shares of Steve Company, with which

Affy has just signed a long-term business alliance

agreement.

AP-2A (

1

2

)

Kaman Company is a public company. It decided to purchase a $200,000, 90-day treasury bill

(T-bill) on March 1, 2016 for $198,000. The investment will mature on May 29, 2016. Kaman

plans to hold this investment until maturity. The market rate for this type of T-bill is set at 4%

annually. The company’s year-end is March 31.

Round your answers to the nearest whole dollar.

Required

a) What kind of accounting methods should be considered to record this investment?