Chapter 8

Non-Current Liabilities

419

AP-11B (

4

7

)

Sam’s Construction is a construction company (with a December 31 year-end) that is planning

to expand its facilities by constructing a new building, and acquiring new equipment. To

complete this project, the company has decided to issue $100,000 worth of 10-year bonds at

5% on March 1, 2016. The interest payment is made semi-annually on September 1 and March

1. Just as the company completes all the necessary contracts, and is ready to issue the bonds,

the market rate increases to 6%, resulting in a price of $92,564 for these bonds.

Note: The premium/discount is amortized using the effective interest method.

Required

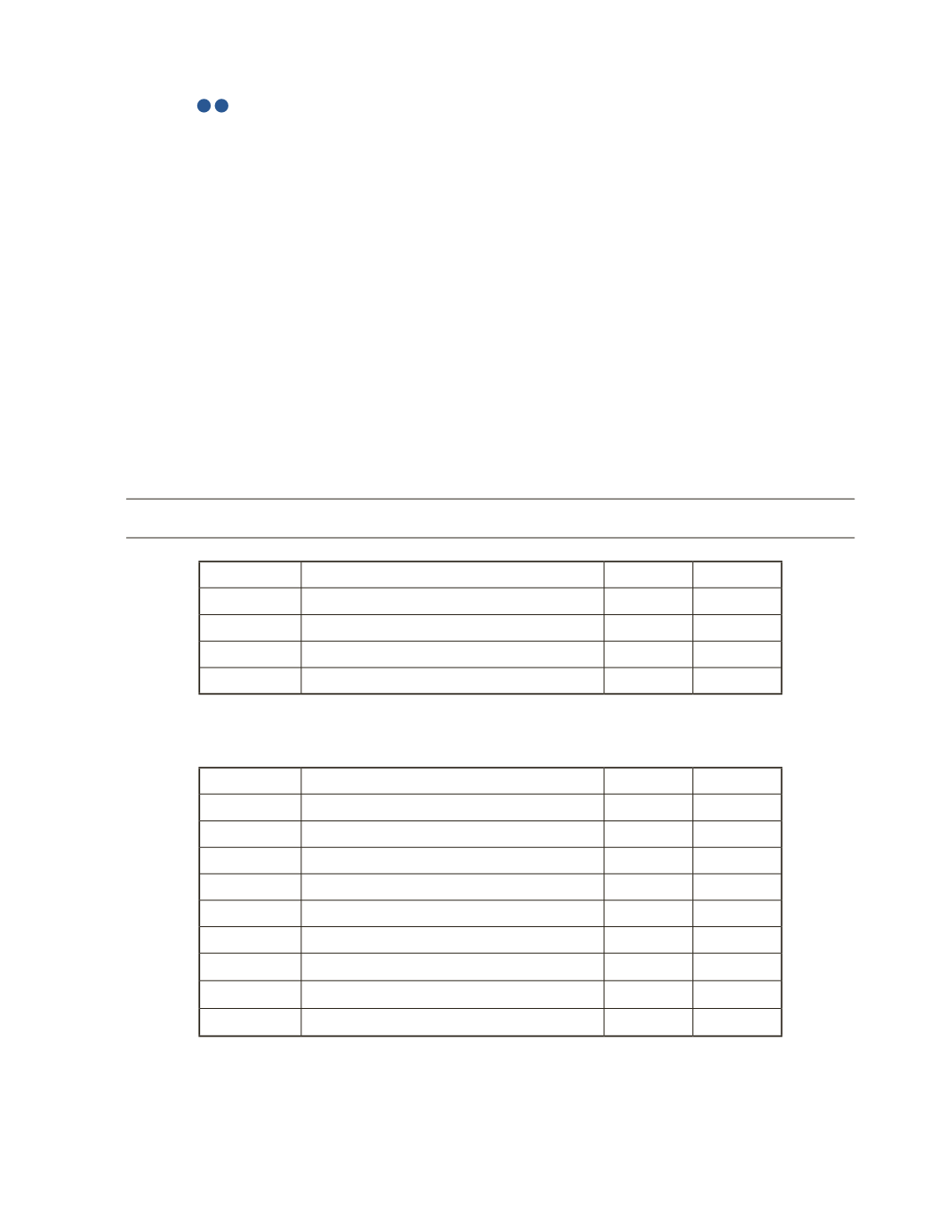

a) Are these bonds issued at a discount or at a premium? Prepare the journal entry for the

issuance of bonds on March 1, 2016.

Date

Account Title and Explanation

Debit

Credit

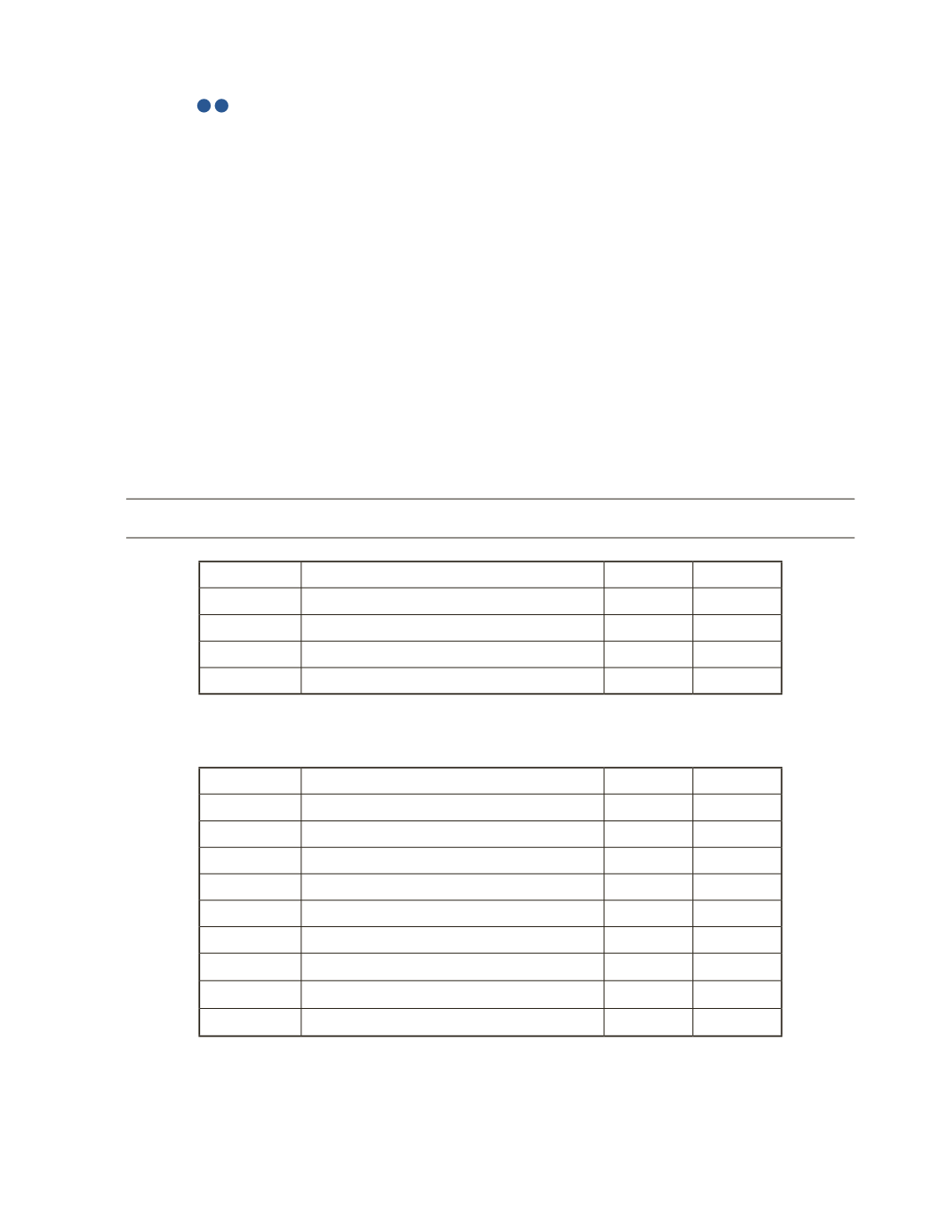

b) Prepare the journal entry for the first payment of interest on September 1, 2016.

Date

Account Title and Explanation

Debit

Credit