Chapter 8

Non-Current Liabilities

413

AP-6B (

4

)

On July 1, 2016, Dilly Company received $562,316 cash for the sale of a 10-year bond with

a face value of $500,000. The bond bears an interest rate of 12%, to be paid semi-annually.

At the time of the sale, the market interest rate was 10%. The year-end is December 31.

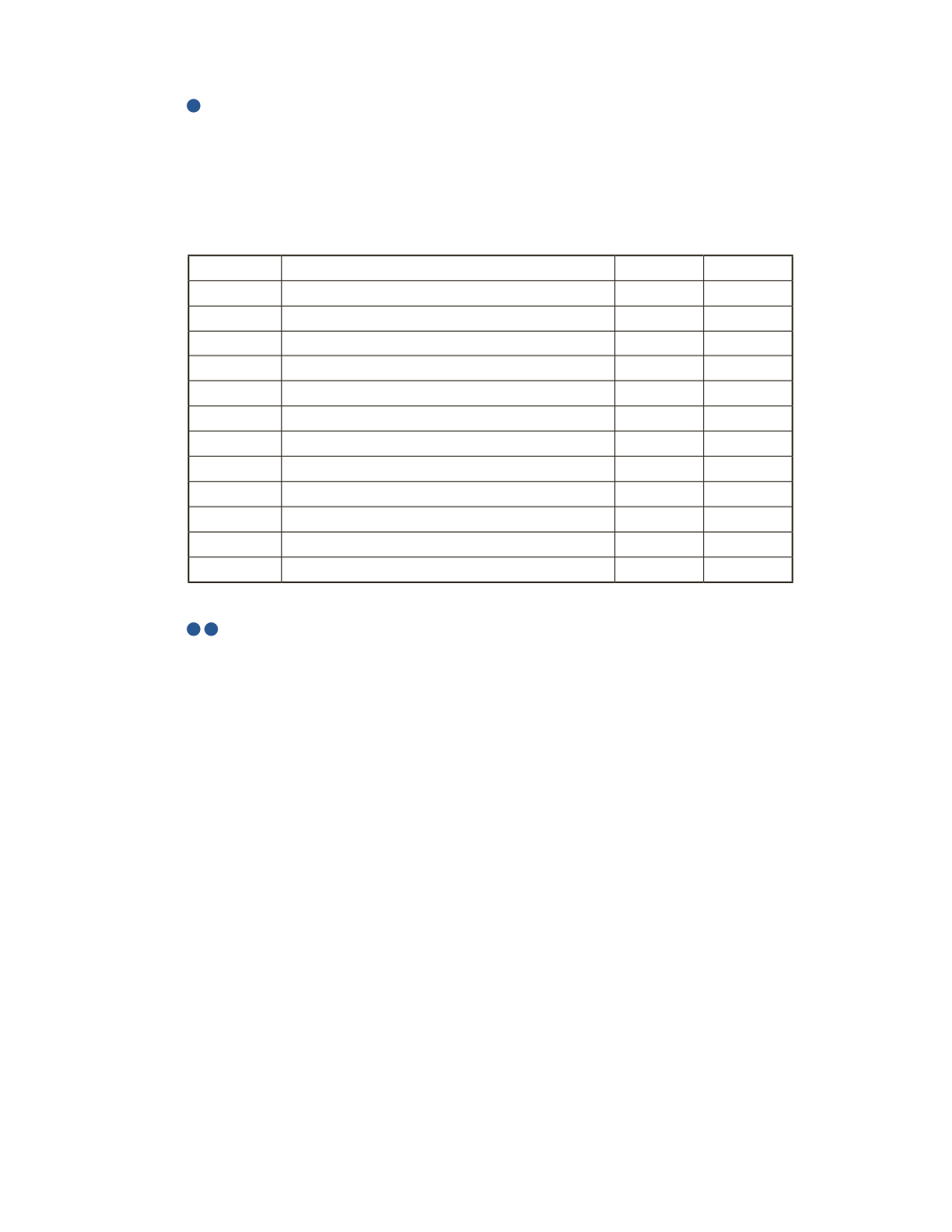

Prepare a journal entry to record the issuance of bond.

Date

Account Title and Explanation

Debit

Credit

AP-7B (

3

5

)

On May 1, 2016, Sweet Lily Flower Inc. issued $30,000 worth of bonds with a 5% interest rate.

The bonds were issued at par. Interest is payable semi-annually on November 1 and May 1.

The bonds mature on May 1, 2026. Sweet Lily Flower Inc. has a December 31 year-end.

Required

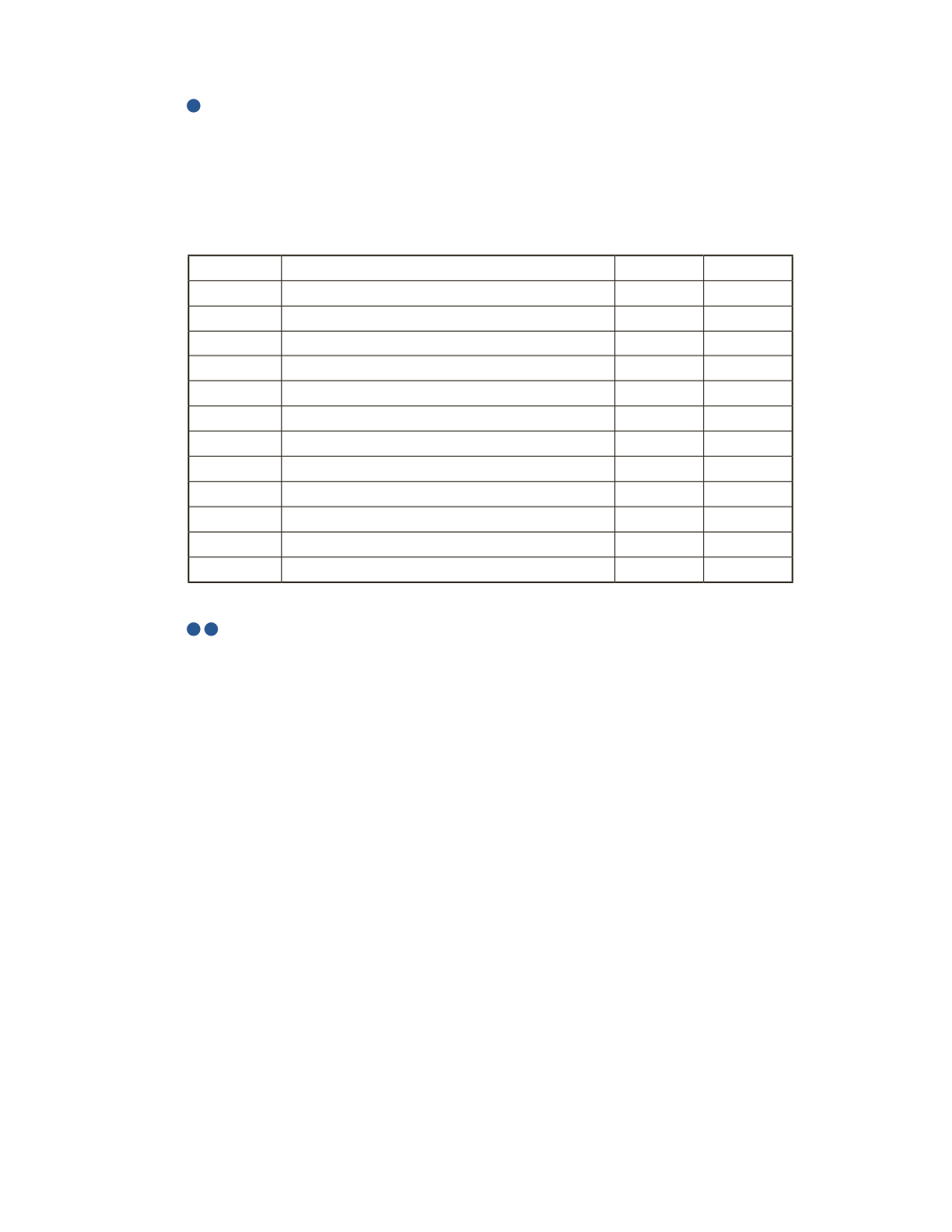

Prepare the journal entries to record the following.

a) The issuance of the bonds payable on May 1, 2016.

b) The payment of interest on November 1, 2016.

c) The required adjusting entry on December 31, 2016.

d) The payment of interest on May 1, 2017.

e) The maturity of the bond on May 1, 2026 assuming the interest has already been paid.