Chapter 8

Non-Current Liabilities

426

AP-16B (

6

)

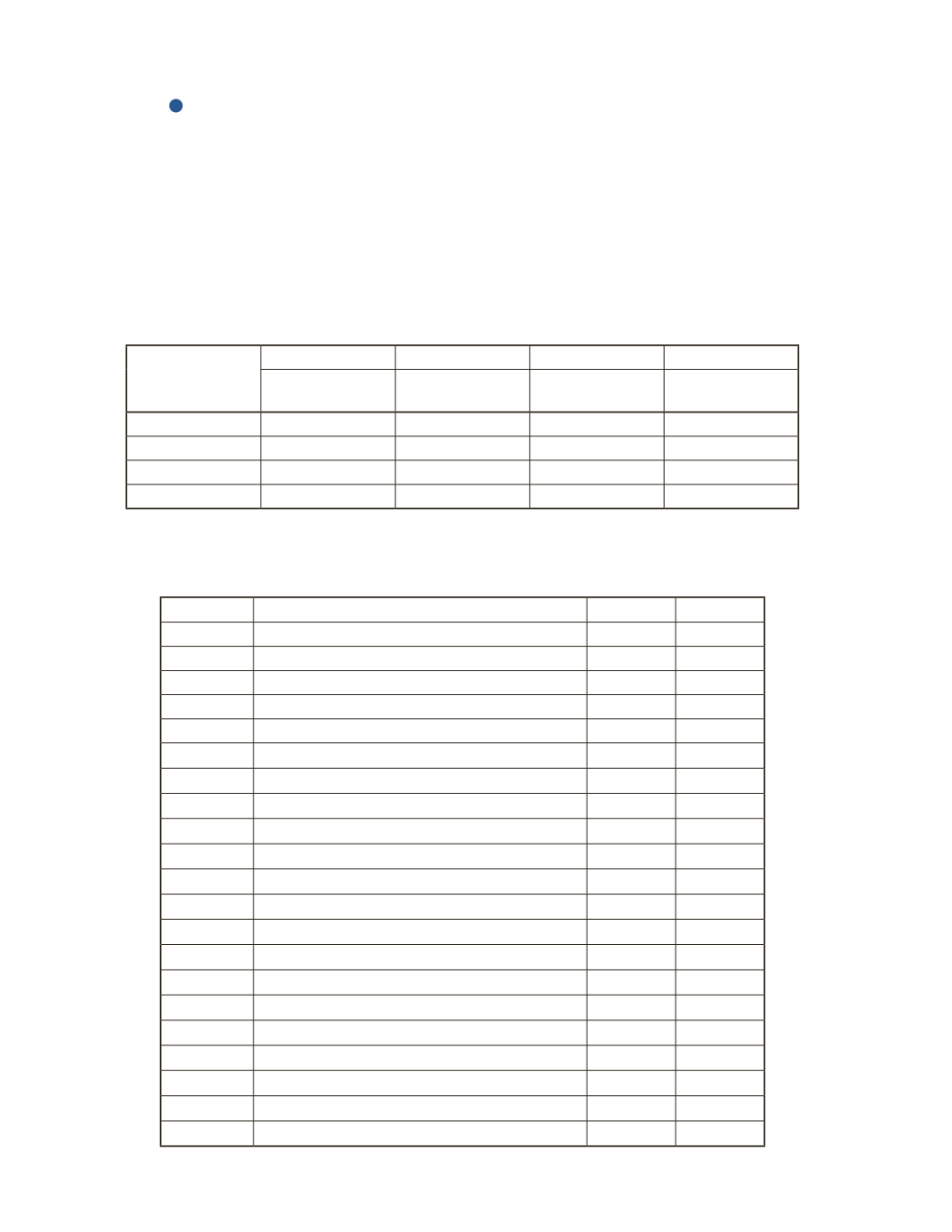

On January 1, 2016, Hala Ltd. issued a three-year, $150,000 note payable to finance the purchase of

factory equipment, with an interest rate of 6%. The repayment is done annually on December 31.

Required

a) How much principal will Hala Ltd. pay back at the end of 2016, 2017 and 2018, if the

blended principal plus interest method is used? Assume an equal instalment amount of

$56,117 is determined per year.

Date

A

B

C

D

Cash Payment Interest Expense Reduction of

Principal

Principal Balance

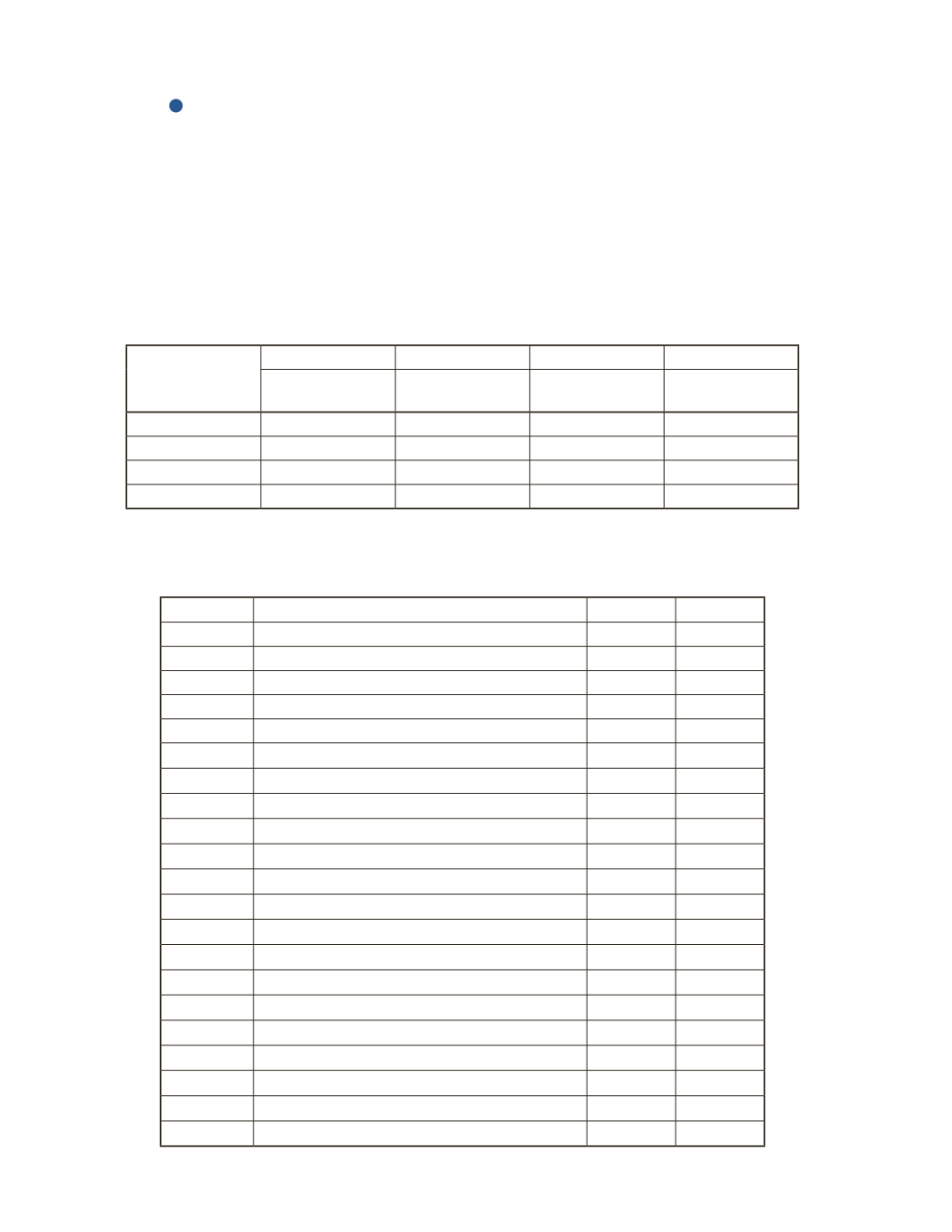

b) Prepare journal entries from January 1 to December 31, 2016. Assume the company’s year-

end is June 30.

Date

Account Titles and Explanations

Debit

Credit