Chapter 7

Corporations: The Financial Statements

375

Case Study

CS-1 (

2

3

4

5

6

7

)

Kruma Company sells clothes and fashion accessories through its chain of retail stores.

The shareholders’ equity section of Kruma Company’s statement of financial position as at

December 31, 2016 shows the following information.

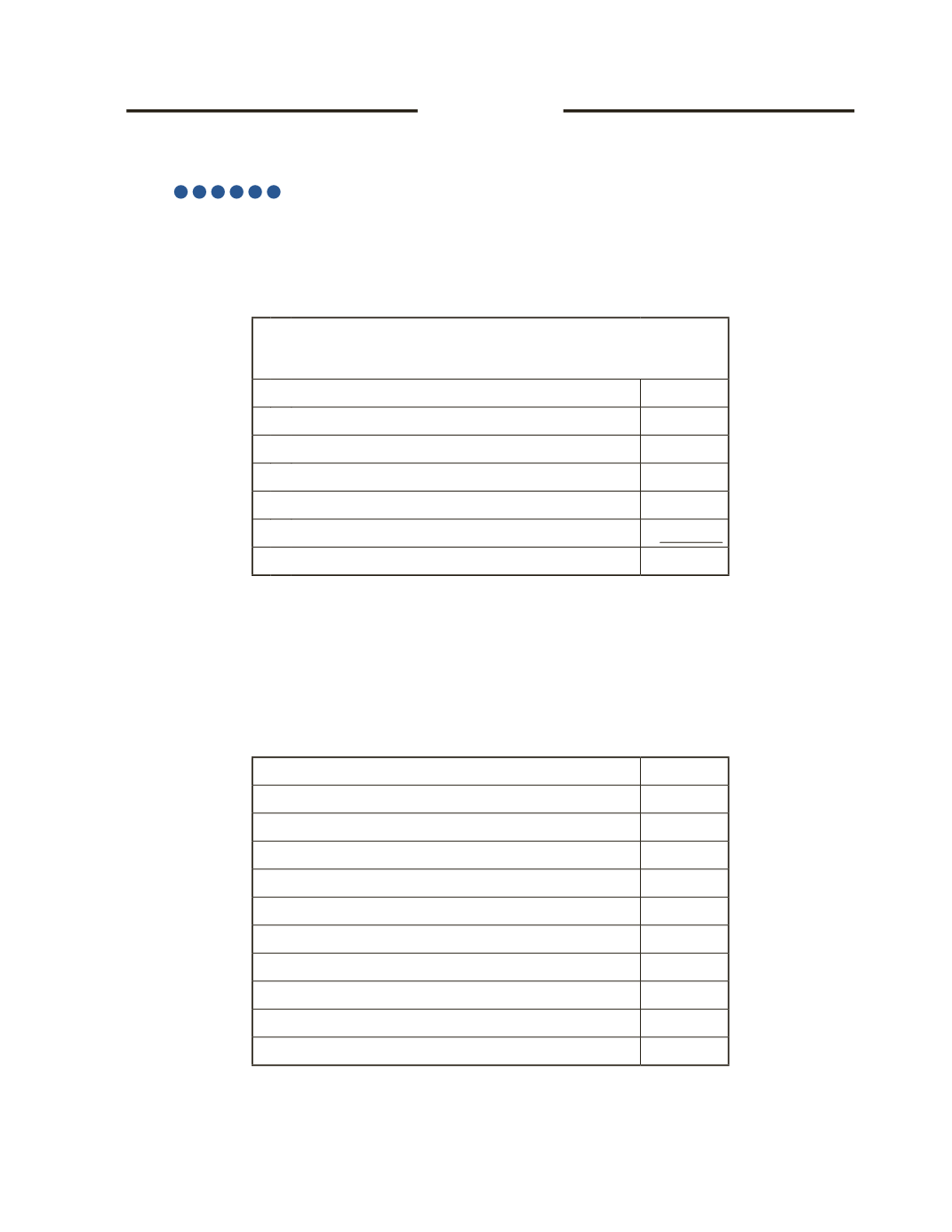

Kruma Company

Statement of Financial Position (partial)

As at December 31, 2016

Shareholders' Equity

Preferred Shares, non-cumulative, $3,

100,000 shares authorized, 40,000 shares issued $1,200,000

Common Shares, unlimited shares authorized,

400,000 shares issued and outstanding

1,600,000

Retained Earnings

1,500,000

Total Shareholders' Equity

$4,300,000

On January 28, 2017, Kruma discovered an accounting mistake made in 2016. Accrual of

interest revenue was understated by $54,000 because interest receivable and interest revenue

of $60,000 were mistakenly recorded as $6,000.

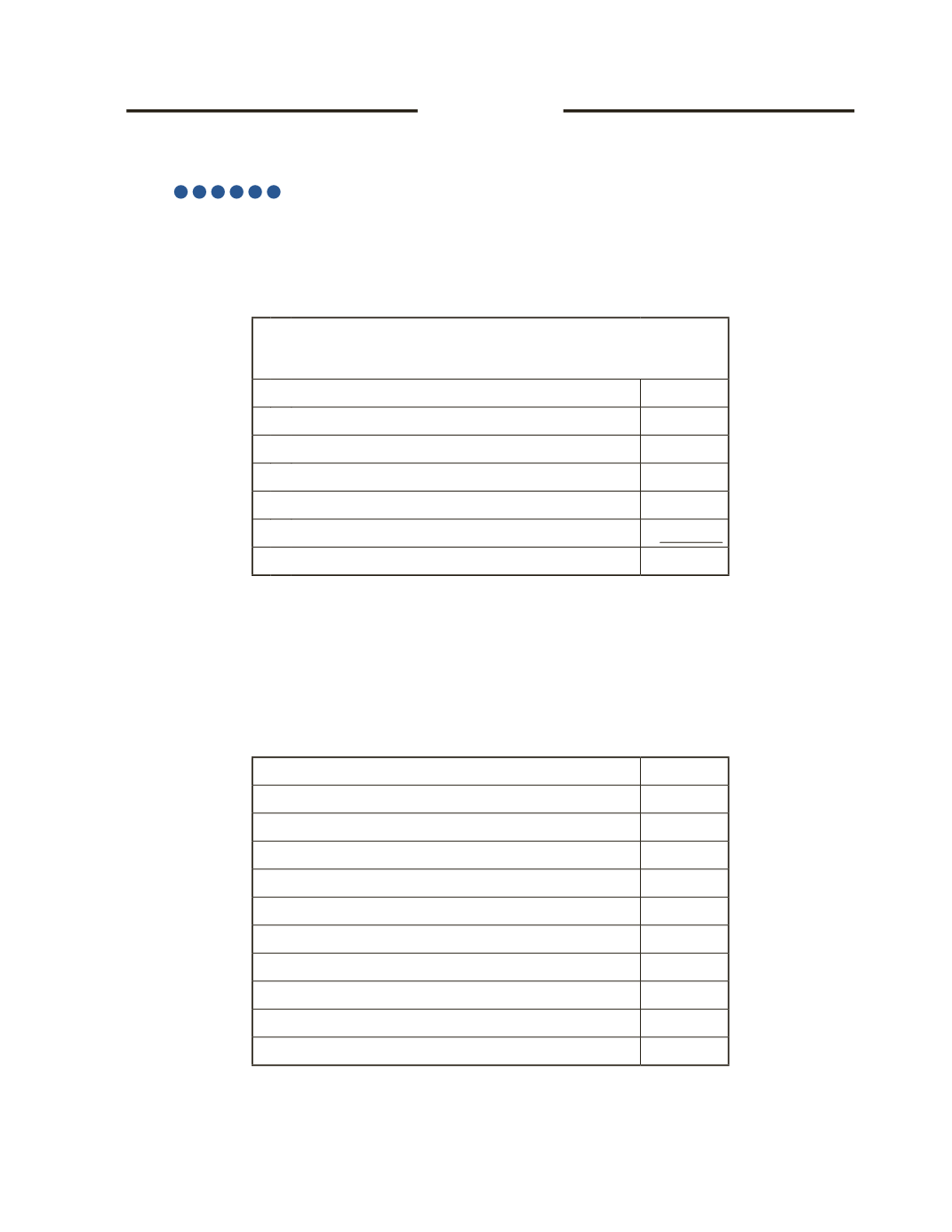

During 2017, Kruma earned and incurred the following revenue and expenses (excluding

income tax expenses). Kruma’s tax rate is 30%.

Sales Revenue

$1,785,000

Interest Revenue

45,000

Gain on Value of Investments

12,000

Gain on Sale of Assets from Discontinued Operations

90,000

Loss on Sale of Assets from Continuing Operations

16,000

Loss on Foreign Currency Translation

30,000

Operating Loss from Discontinued Operations

200,000

Cost of Goods Sold

966,000

Salaries Expense

250,000

Depreciation Expense

174,000

Miscellaneous Operating Expenses

80,000