Chapter 7

Corporations: The Financial Statements

372

d) If the company had followed IFRS, would the statement of retained earnings be the same

as part b)? Explain.

AP-15B (

2

3

6

)

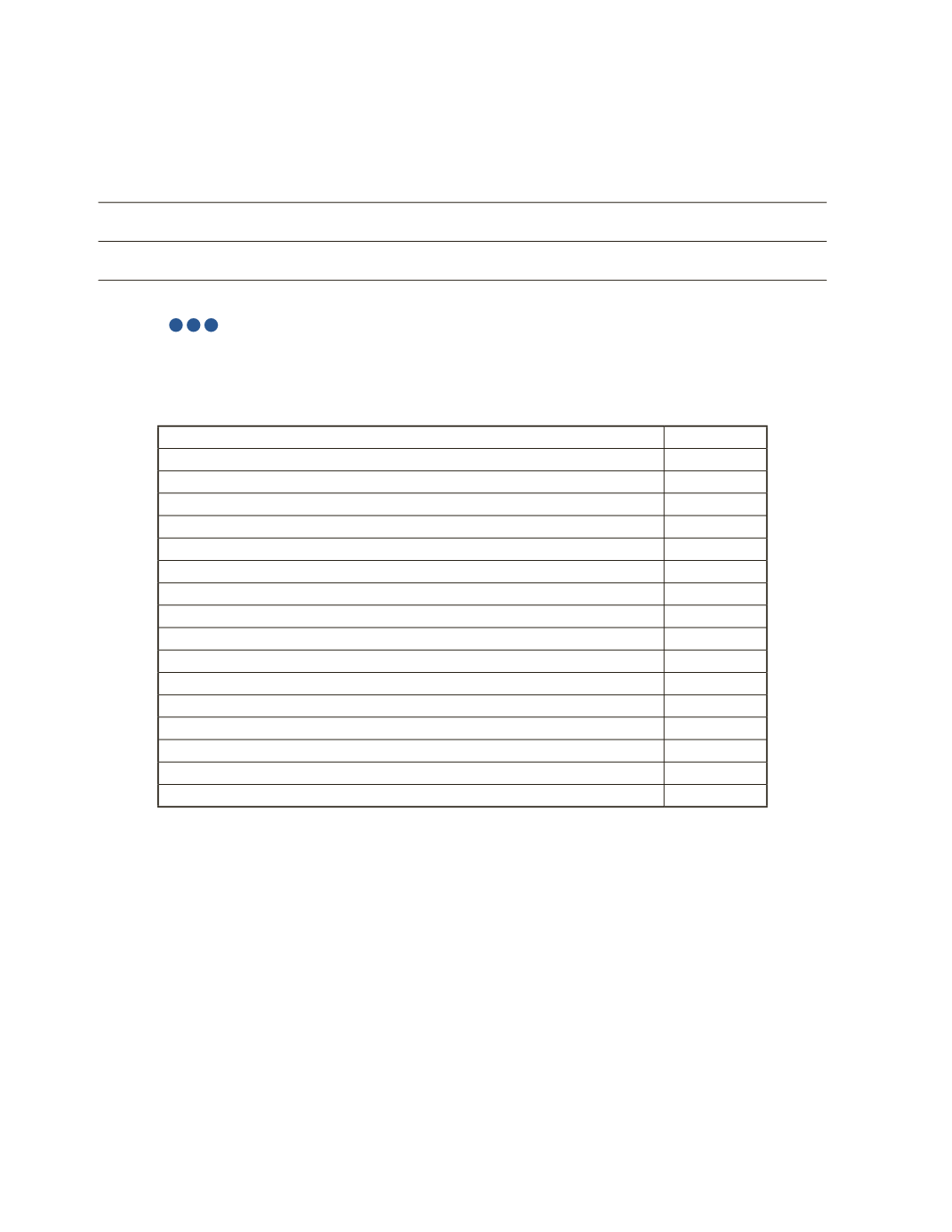

The following information was taken from the accounting records of Cutler Inc. at December

31, 2016. Cutler Inc. is a private corporation and follows ASPE.

Line Item

Amount

Prior-year error—debit to retained earnings

$15,000

Income tax expense on operating income from discontinued operations

19,600

Total dividends

67,000

Common shares, 75,000 shares issued

201,000

Sales revenue

605,000

Interest expense

17,000

Operating income, discontinued operations

56,000

Loss due to lawsuit

16,000

Sales discounts

30,000

Income tax savings on sale of discontinued operations (sold at a loss)

8,750

General expenses

23,000

Income tax expense on continuing operations

73,150

Preferred shares, $7.00, 1,000 shares issued

60,000

Retained earnings, January 1, 2016 (prior to adjustment)

135,000

Loss on sale of assets from discontinued operations

25,000

Cost of goods sold

310,000

Assume a tax rate of 35%. During the year, no shares were issued or redeemed. Preferred

dividends were paid in full.