Chapter 7

Corporations: The Financial Statements

381

Critical Thinking

CT-1 (

2

3

5

6

7

)

Manipulation of financial statements by overstating revenue (or profit) and understating

expenses (or costs), is one of the most common methods to commit accounting fraud. One of

the famous case is WorldCom. In 2003, the company reported that it had overstated earnings

and understated expenses for a total value of $74.5 billion.

One of the primary methods it used was to classify regular operating expenses as capital

expenditure (also known as capital investment). By doing that, it allowed the company to

amortize operating expenses over several financial periods.

Required

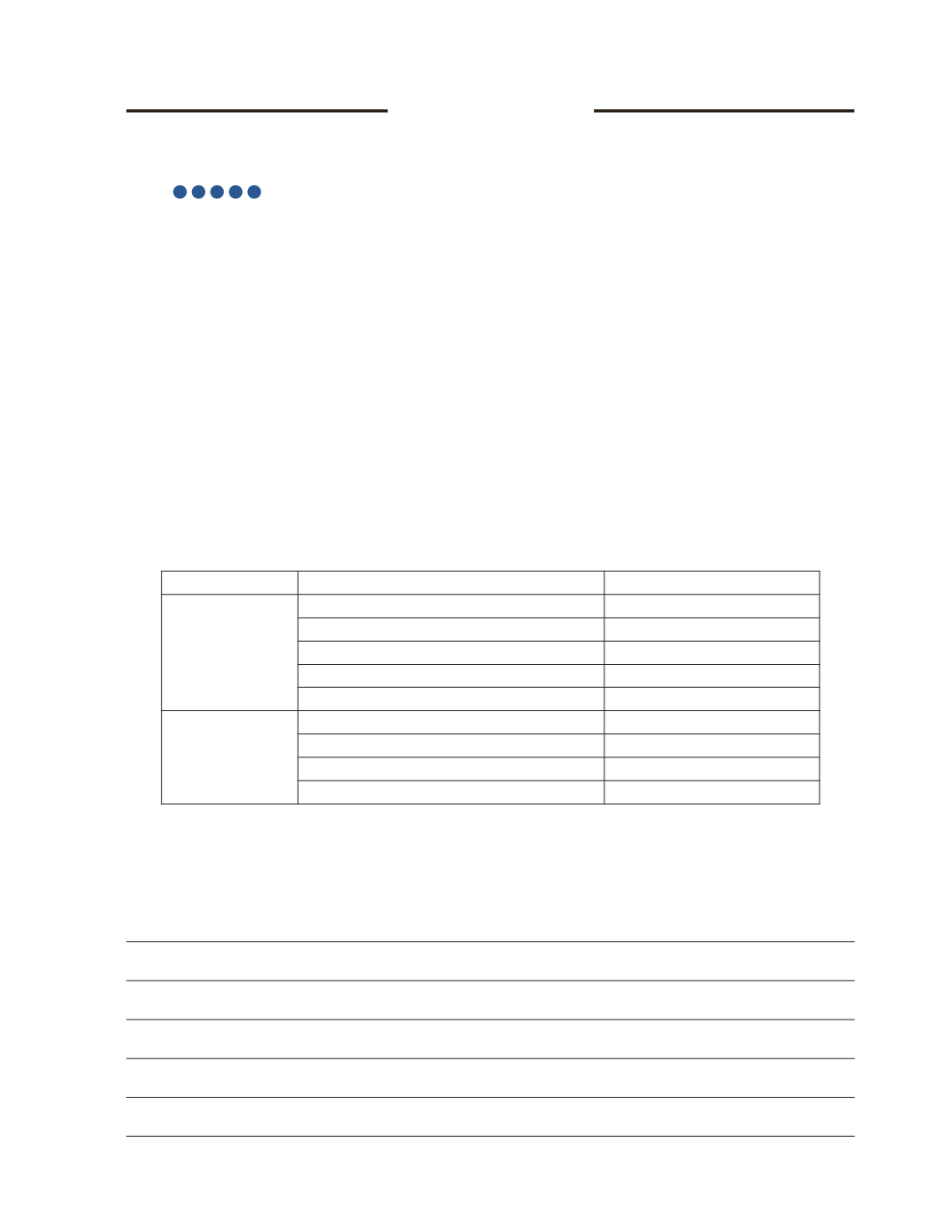

a) Discuss the impact this activity would have on the statement of comprehensive income

and statement of financial positions, by specifying which item would be overstated or

understated. Fill in your answer in the provided table.

Statement Name

Item

Overstated or Understated?

Statement of

Comprehensive

Income

Operational Expenses

Depreciation and Amortization Expenses

Net Income

Tax Expense

Earnings Per Share

Statement of

Financial Position

Non-Current Assets

Accumulated Depreciation and Amortization

Long-Term Investments

Retained Earnings

b) Discuss what impact this activity would have on the ratios used to evaluate earnings

and dividend performance, by specifying if the ratio would be overstated or understated

(assuming all other factors remain unchanged).