Chapter 7

Corporations: The Financial Statements

357

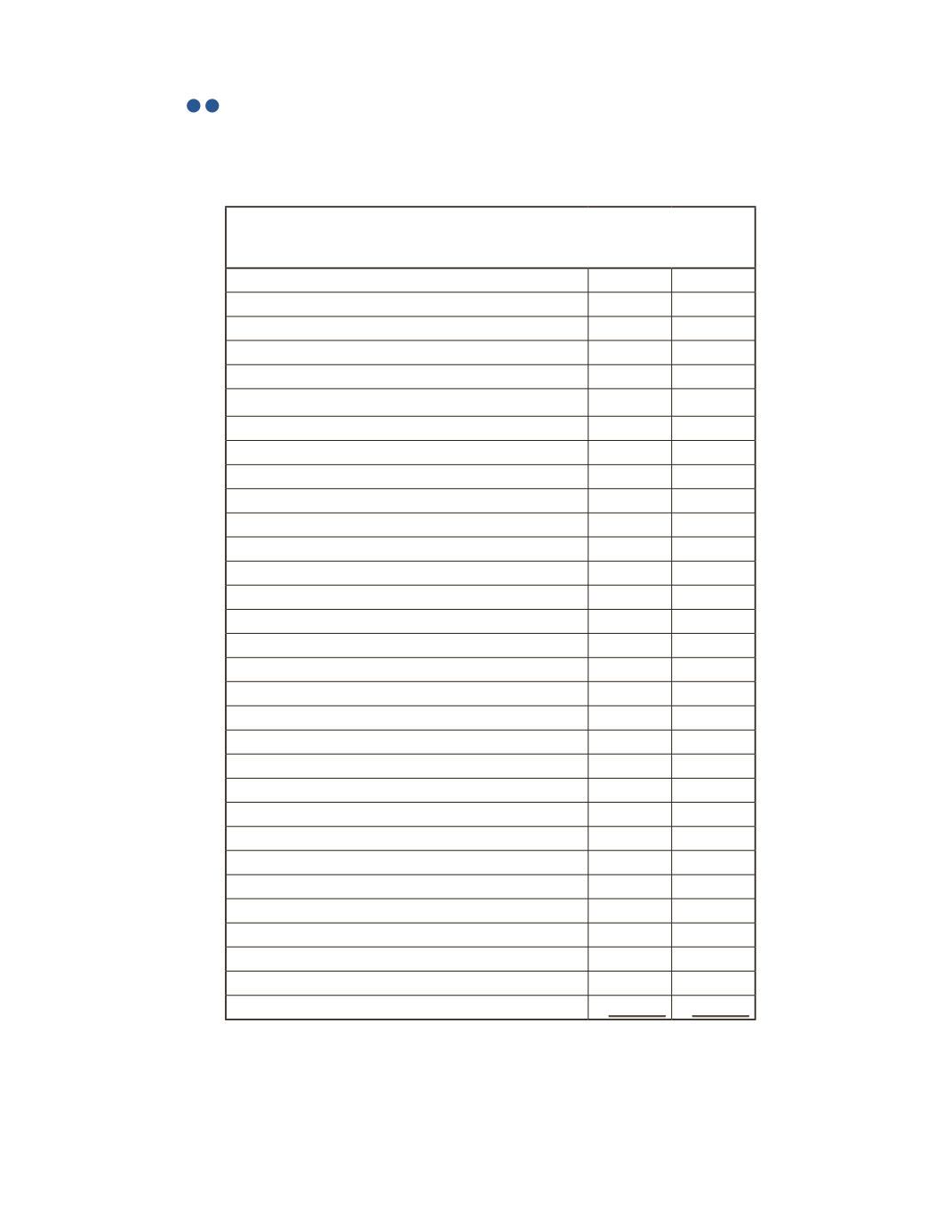

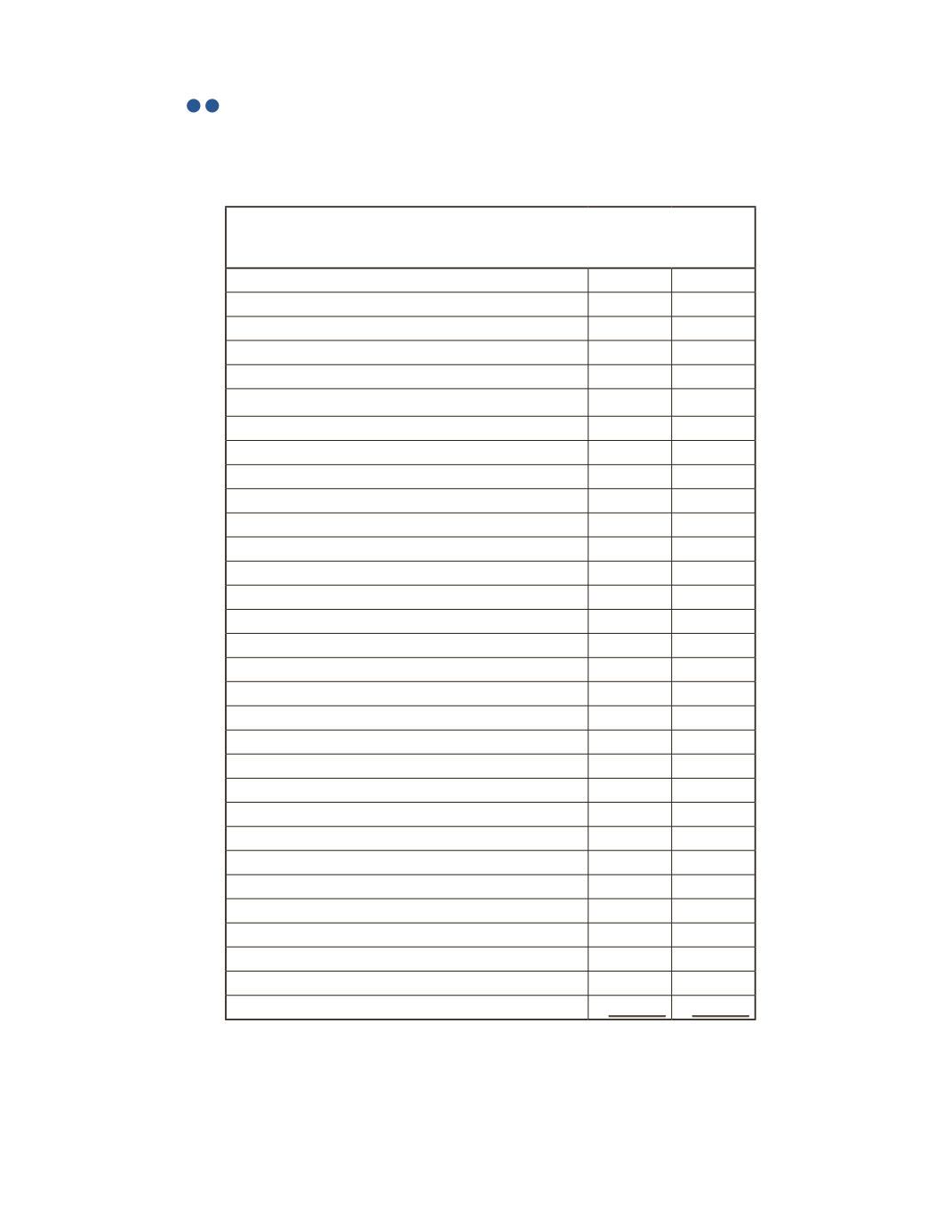

AP-8B (

2

3

)

Below is the adjusted trial balance for Del Ray Company. Dividends paid during the year were

$7,800.

Del Ray Company

Adjusted Trial Balance

March 31, 2016

Debit

Credit

Cash

$33,800

Accounts Receivable

40,300

Prepaid Insurance

5,070

Supplies

84,500

Property, Plant and Equipment

65,000

Accumulated Depreciation

$22,750

Accounts Payable

10,400

Unearned Revenue

9,750

Interest Payable

2,250

Loan Payable

25,000

Preferred Shares

14,500

Common Shares

21,700

Retained Earnings (after dividends)

116,110

Sales Revenue

130,000

Gain on Disposal of Equipment

5,200

Sales Discounts

650

Sales Returns and Allowances

1,950

Cost of Goods Sold

26,000

Depreciation Expense

7,150

Salary Expense

29,900

Rent Expense

7,150

Utilities Expense

8,450

Insurance Expense

10,400

Supplies Expense

15,600

Interest Expense

1,250

Income Tax Expense (Continuing Operations)

8,010

Income Tax Expense (Discontinued Operations)

2,880

Income from Discontinued Operations

8,100

Gain on Sale of Assets from Discontinued Operations

1,500

Total

$357,660

$357,660