Chapter 7

Corporations: The Financial Statements

359

c) If the company adhered to IFRS , there was no specific rule on how to present the

expenses on the statement of comprehensive income. Is that true or false? Explain.

AP-9B (

2

3

)

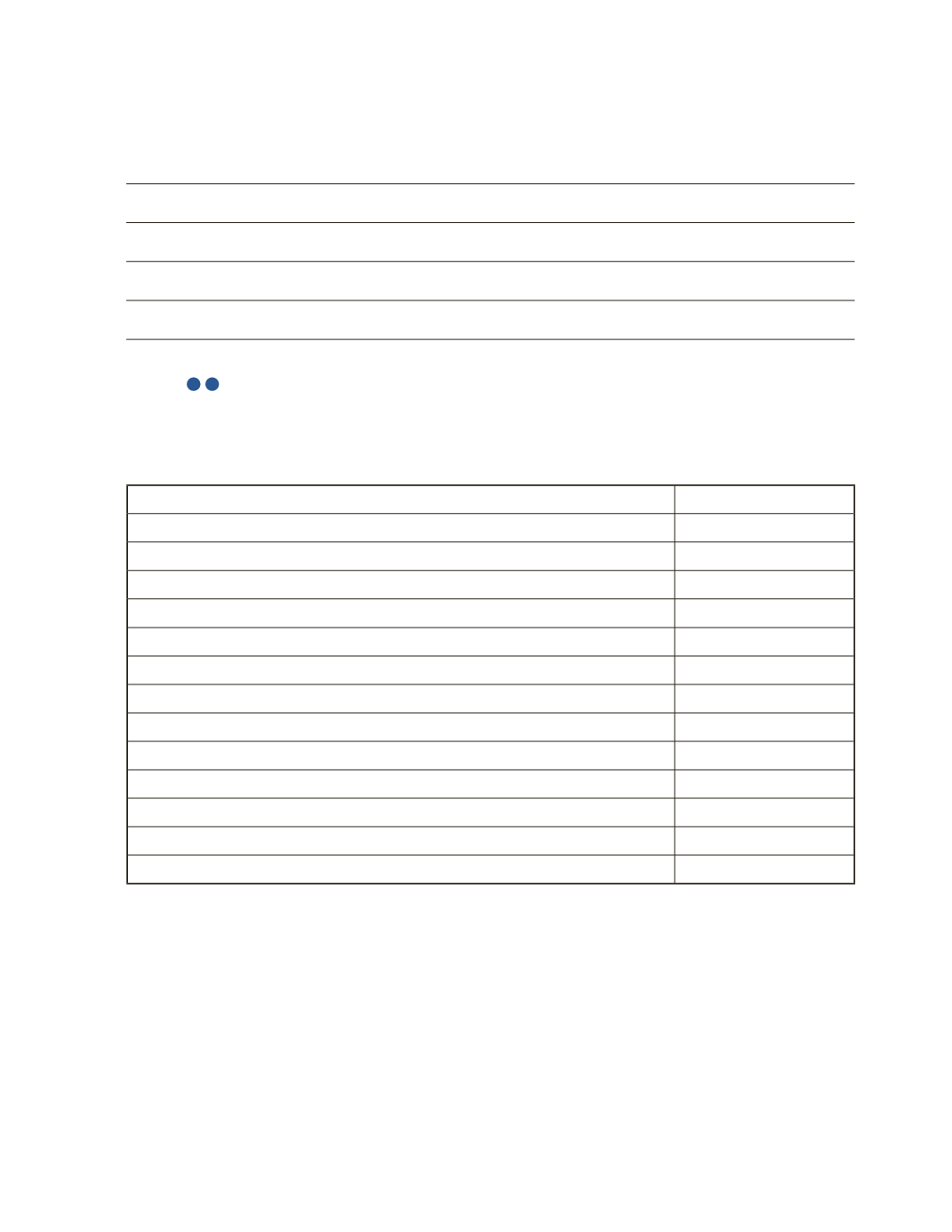

The following information was taken from the accounting records of Splinter Inc. at December

31, 2016. Splinter Inc. is a public corporation and follows IFRS.

Line Item

Amount

Common shares, 50,000 outstanding on January 1, 2016

$350,000

Common shares, 70,000 outstanding on December 31, 2016

120,000

Cost of Goods Sold

468,000

Dividends paid

50,000

Gain on Sale of Assets

6,200

General operating expenses

210,000

Income tax expense on continuing operations

29,850

Income tax expense on operating income from discontinued operations

18,600

Interest Expense

8,700

Operating income from discontinued operations

62,000

Prior year error—debit to Retained Earnings

6,000

Retained Earnings, January 1, 2016 (prior to adjustment)

410,000

Sales revenue

780,000