Chapter 7

Corporations: The Financial Statements

348

d) If the company had followed IFRS, how would the section of assets on the statement of

financial position be different?

AP-15A (

2

3

5

)

Below is the adjusted trial balance for SandStone Corp. as at September 30, 2016.

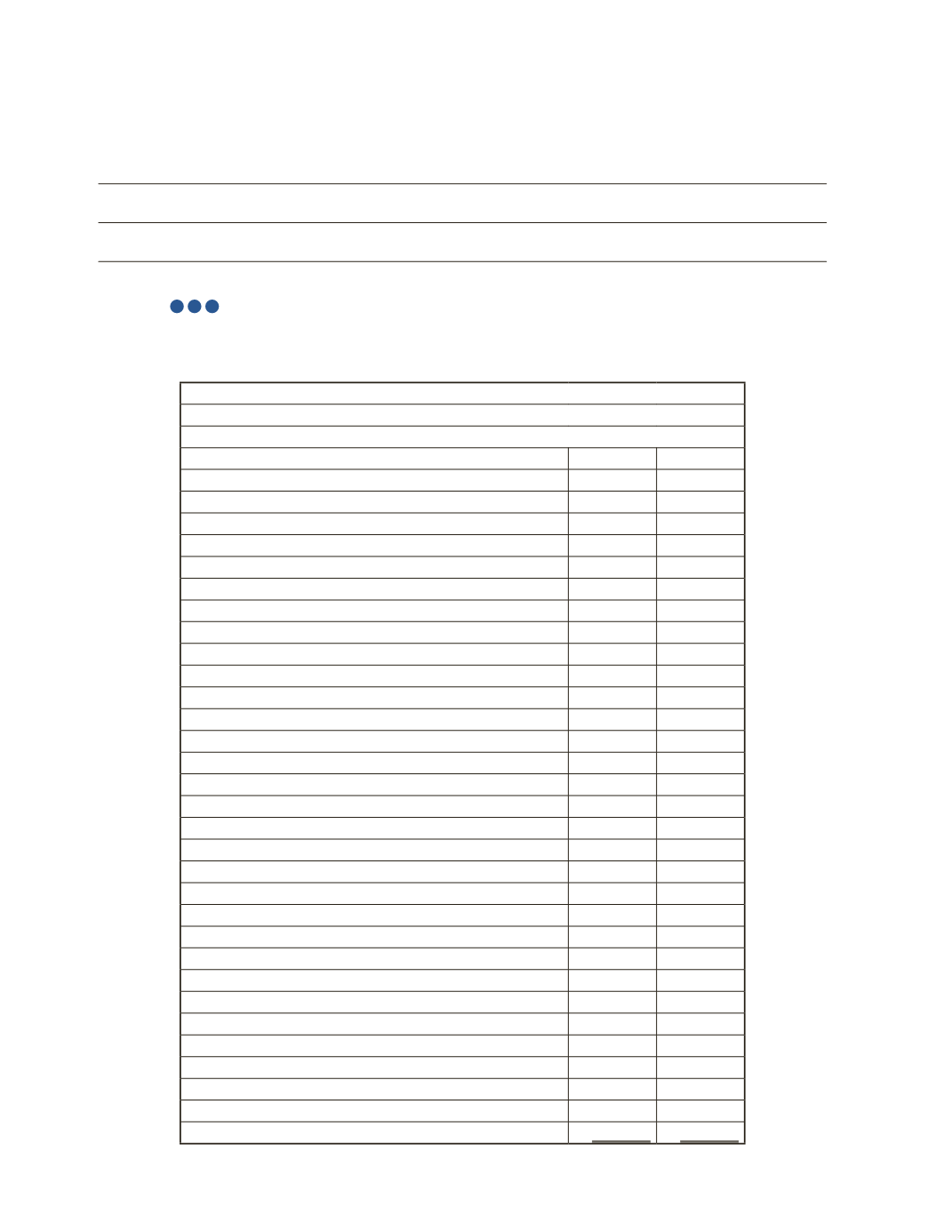

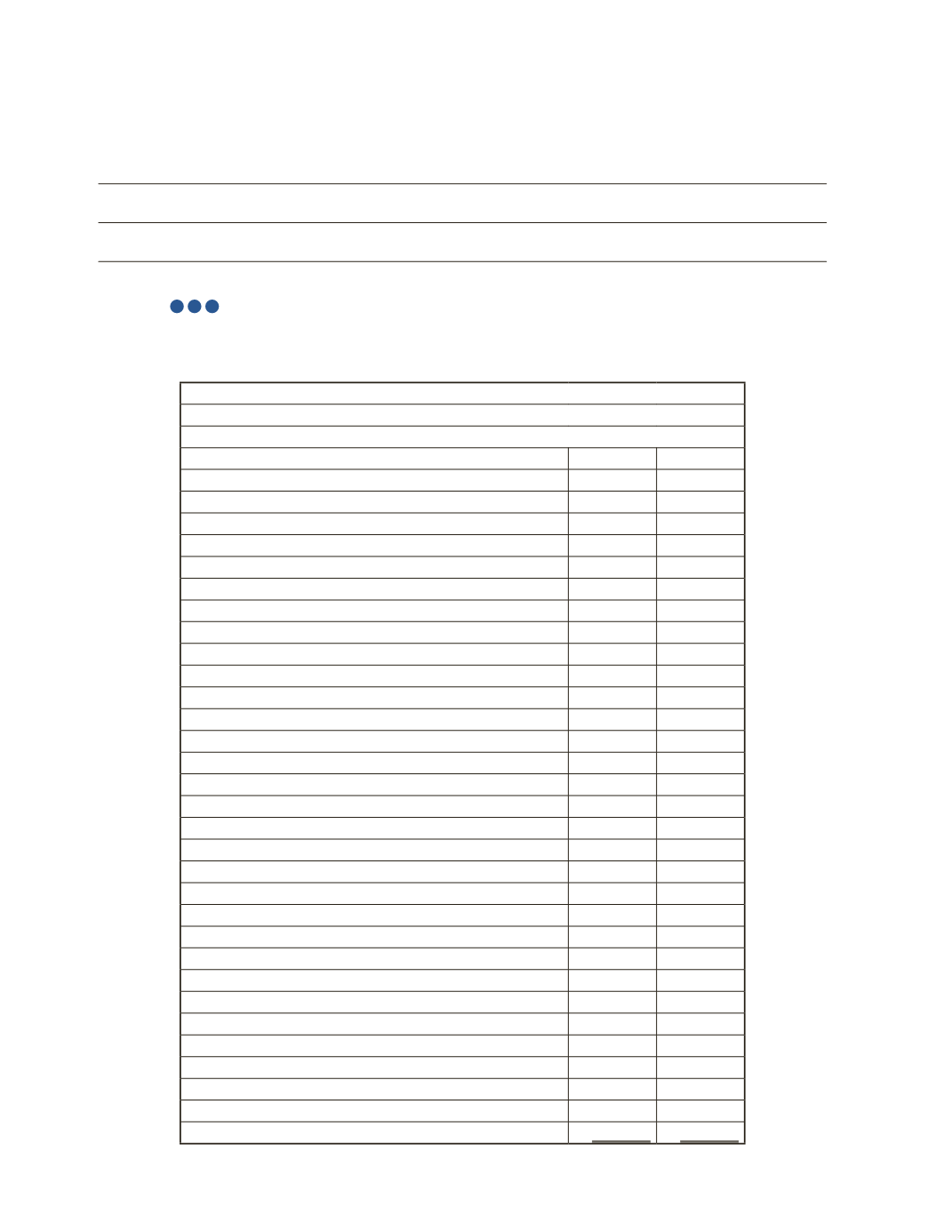

SandStone Corp.

Adjusted Trial Balance

September 30, 2016

Debit

Credit

Accounts Payable

$20,470

Accounts Receivable

$23,000

Accumulated Depreciation

8,050

Cash

19,550

Common Shares

8,750

Cost of Goods Sold

40,250

Depreciation Expense

10,120

Gain on Disposal of Equipment

2,530

Gain on Sale of Assets from Discontinued Operations

13,400

Income Tax Benefit (Continuing Operations)

10,788

Income Tax Benefit (Discontinued Operations)

6,240

Insurance Expense

10,350

Interest Expense

5,520

Interest Payable

3,910

Inventory

25,875

Loan Payable

46,000

Loss from Discontinued Operations

29,000

Preferred Shares

5,890

Prepaid Insurance

8,050

Equipment

50,600

Rent Expense

19,550

Retained Earnings

35,512

Sales Discounts

11,060

Salary Expense

20,700

Salary Payable

9,775

Sales Returns and Allowances

3,450

Sales Revenue

115,000

Supplies Expense

7,400

Unearned Revenue

14,260

Utilities Expense

16,100

Total

$300,575

$300,575