Chapter 6

Corporations: Contributed Capital and Dividends

279

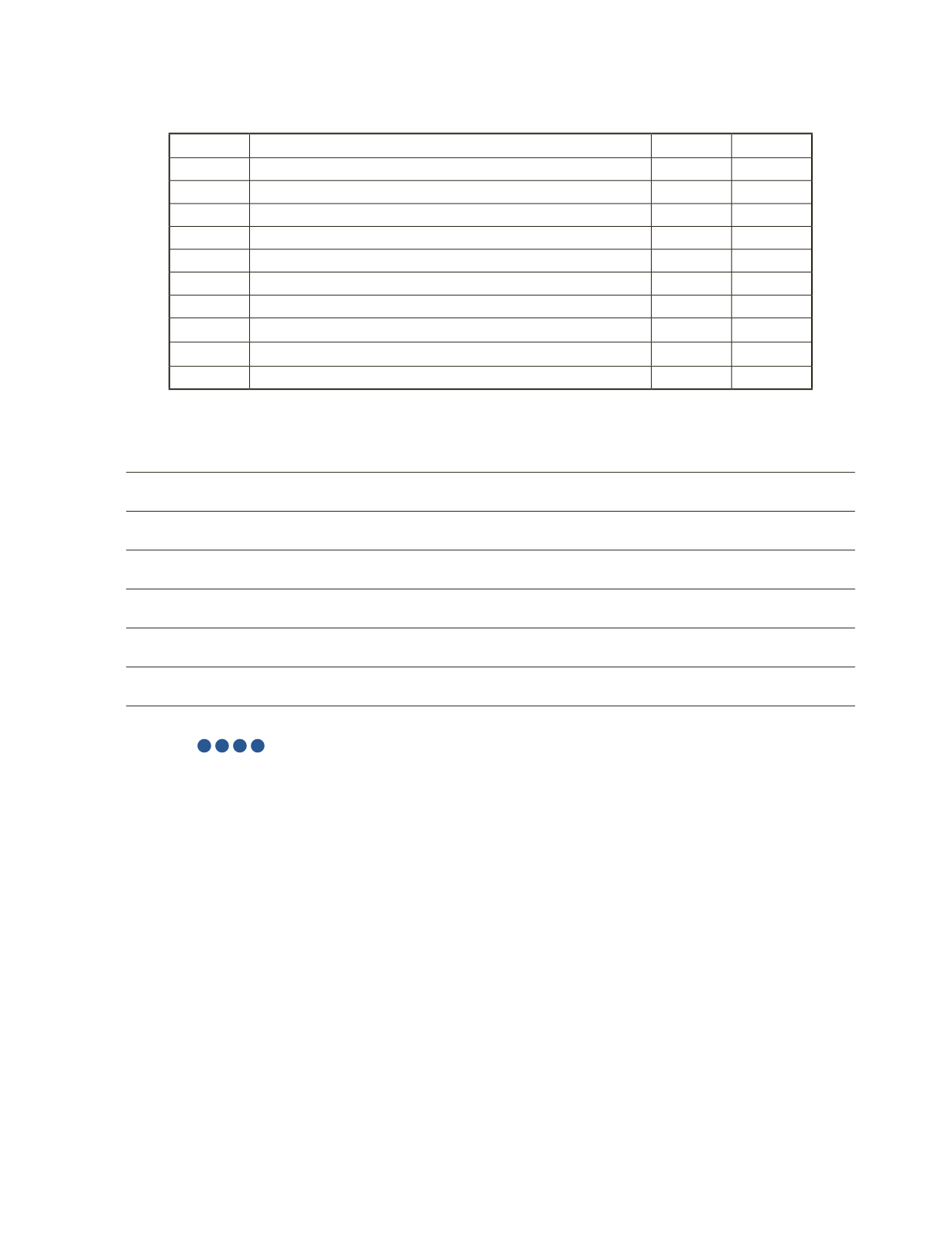

b) Prepare the journal entry for the declaration and payment of the preferred dividend.

Date

Account Title and Explanation

Debit

Credit

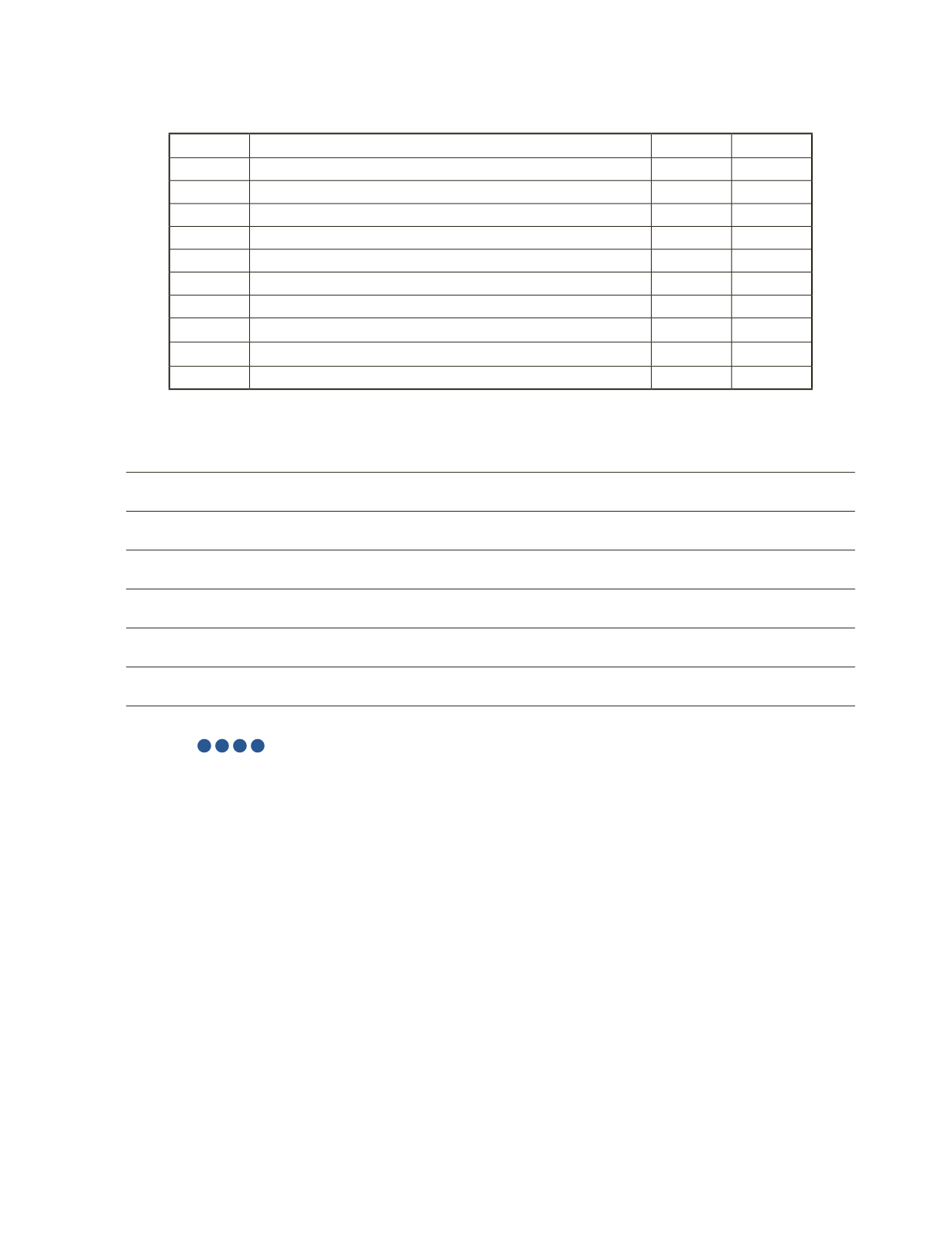

c) Calculate the ending balance of retained earnings for the year ended December 31, 2016.

AP-17A

(

3

4

5

9

)

In 2016, Elizabeth and some of her friends invested money to start a company named

FRIENDZ Corporation. The following transactions occurred during 2016.

Jan 1 The corporate charter authorized to issue 70,000, $5 cumulative preferred shares

and unlimited common shares up to a maximum amount of $20,000,000.

Jan 6 Issued 200,000 common shares at $16 per share. Shares were issued to Elizabeth

and other investors.

Jan 7 Issued another 500 common shares to Elizabeth in exchange for her services

in organizing the corporation. The shareholders agreed that the services were

worth $60,000.

Jan 12 Issued 3,500 preferred shares for $350,000.

Jan 14 Issued 10,000 common shares in exchange for a building acquired. For this

purpose shares were valued at $16.

Nov 15 The first annual dividend on preferred shares was declared.

Dec 20 Paid the dividends declared on preferred shares.