Chapter 6

Corporations: Contributed Capital and Dividends

272

AP-10A (

5

)

Martin Inc. was formed on January 1, 2014. Its shares were all issued during the first year of

operations and were comprised as follows: 80,000 common shares and 10,000, $2 cumulative

preferred shares. Over the past four years, Martin Inc. has declared and paid the following

cash dividends.

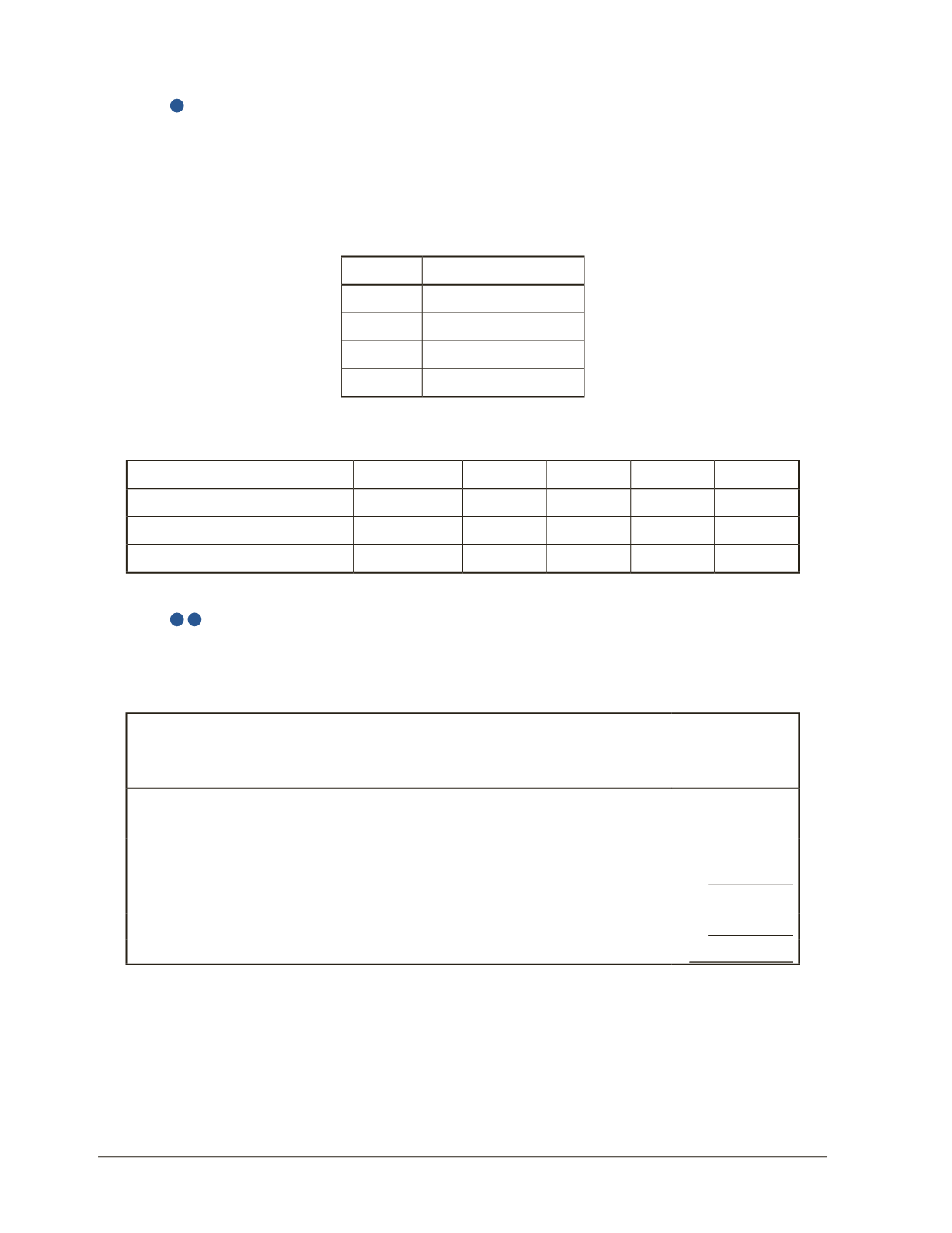

Year

Total

2014

$30,000

2015

$35,000

2016

$0

2017

$45,000

Calculate the amount of dividends paid to each class of shareholders for each year.

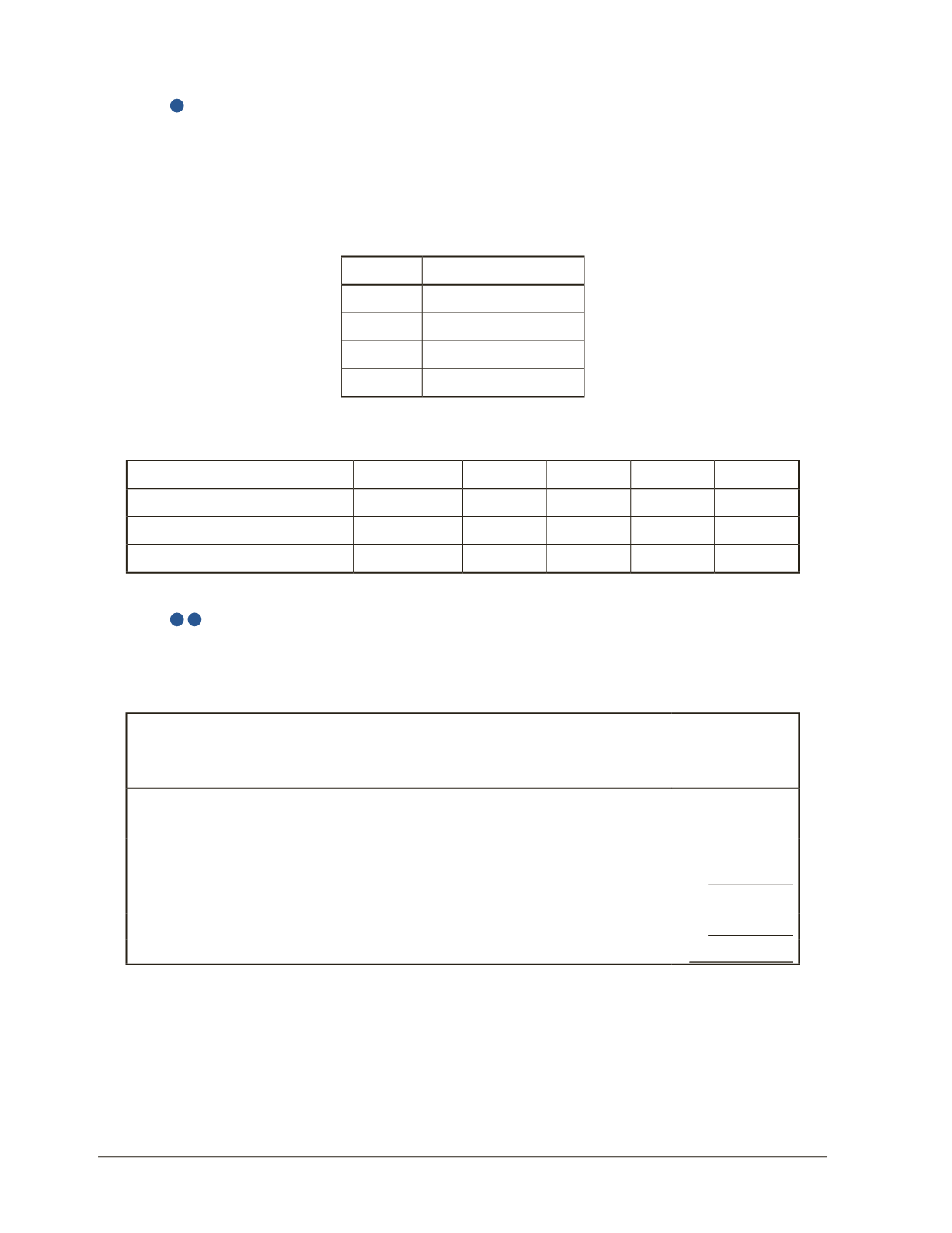

Class of Shares

# of shares

2014

2015

2016

2017

Preferred Shares—cumulative

10,000

Common Shares

80,000

Total dividends paid

$30,000

$35,000

$0

$45,000

AP-11A (

3

5

)

Given below is the equity section of Lizzy Dizzy Corporation at December 31, 2016. Preferred

shares were sold at $100 each.

Lizzy Dizzy Corporation

Shareholders’ Equity

As at December 31, 2016

Share Capital

Preferred Shares, $7, cumulative, 200,000 authorized

$20,000,000

Common Shares, unlimited authorized, 4,000,000 issued

and outstanding

59,000,000

Total Share Capital

79,000,000

Retained Earnings

64,450,000

Total Shareholders’ Equity

$143,450,000

Required

From the information provided above, calculate the following.

a) Calculate the number of preferred shares issued.