Chapter 6

Corporations: Contributed Capital and Dividends

276

AP-14A (

6

)

Tross Co. was incorporated and began operations on January 1, 2014. Tross Co. presented the

following information at the end of the 2016 fiscal year.

Common Shares, unlimited authorized, 75,000 issued and outstanding $225,000

Retained Earnings

148,000

Tross Co. declared a 15% stock dividend on December 31, 2016. The common shares were

issued in 2014 for $3.00 each, but the current market price is $5.20 per share. The date of

payment is January 5, 2017.

Prepare the journal entries to record the declaration and payment of the dividend.

The company uses the retained earnings method to record dividends.

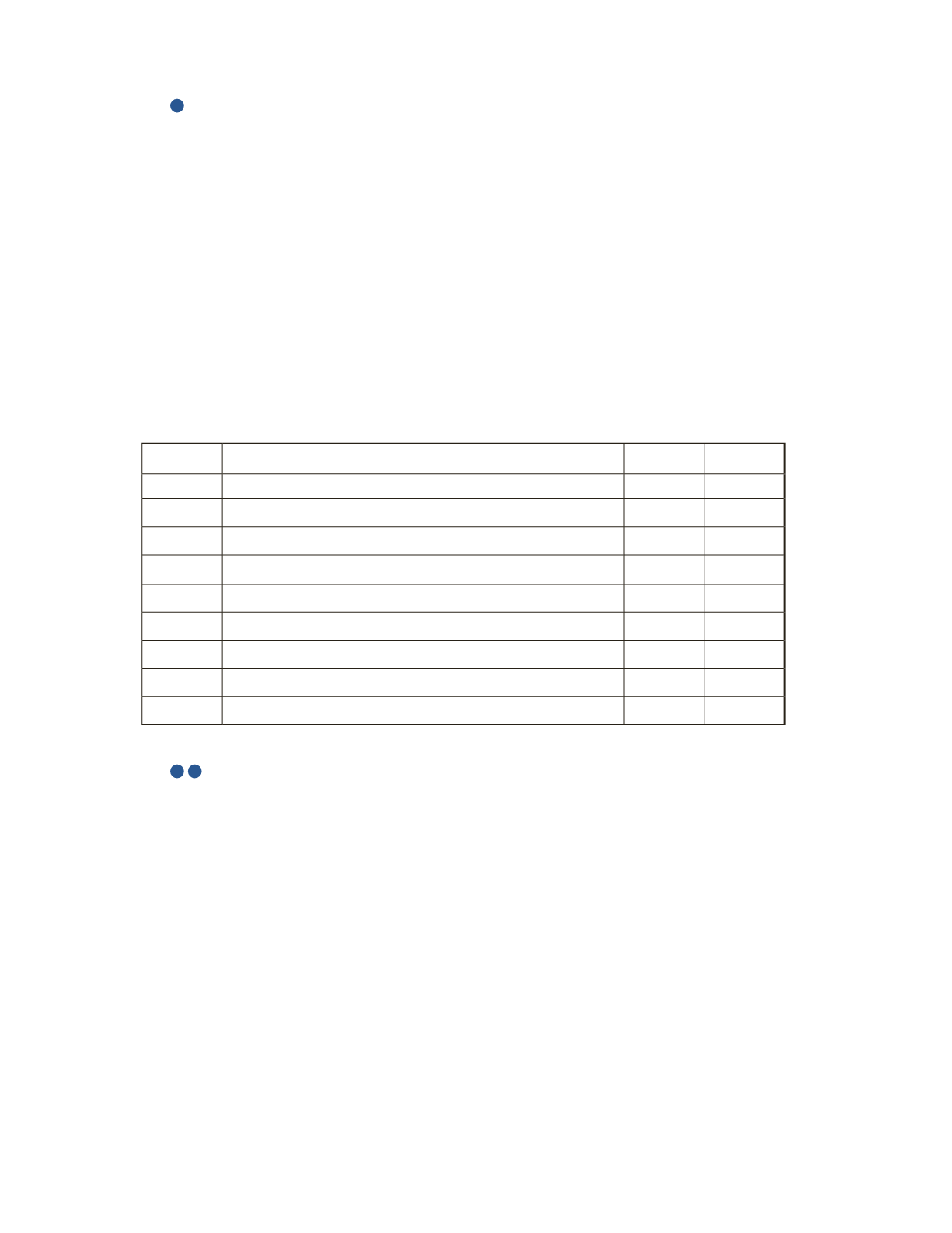

Date

Account Title and Explanation

Debit

Credit

AP-15A (

5

6

)

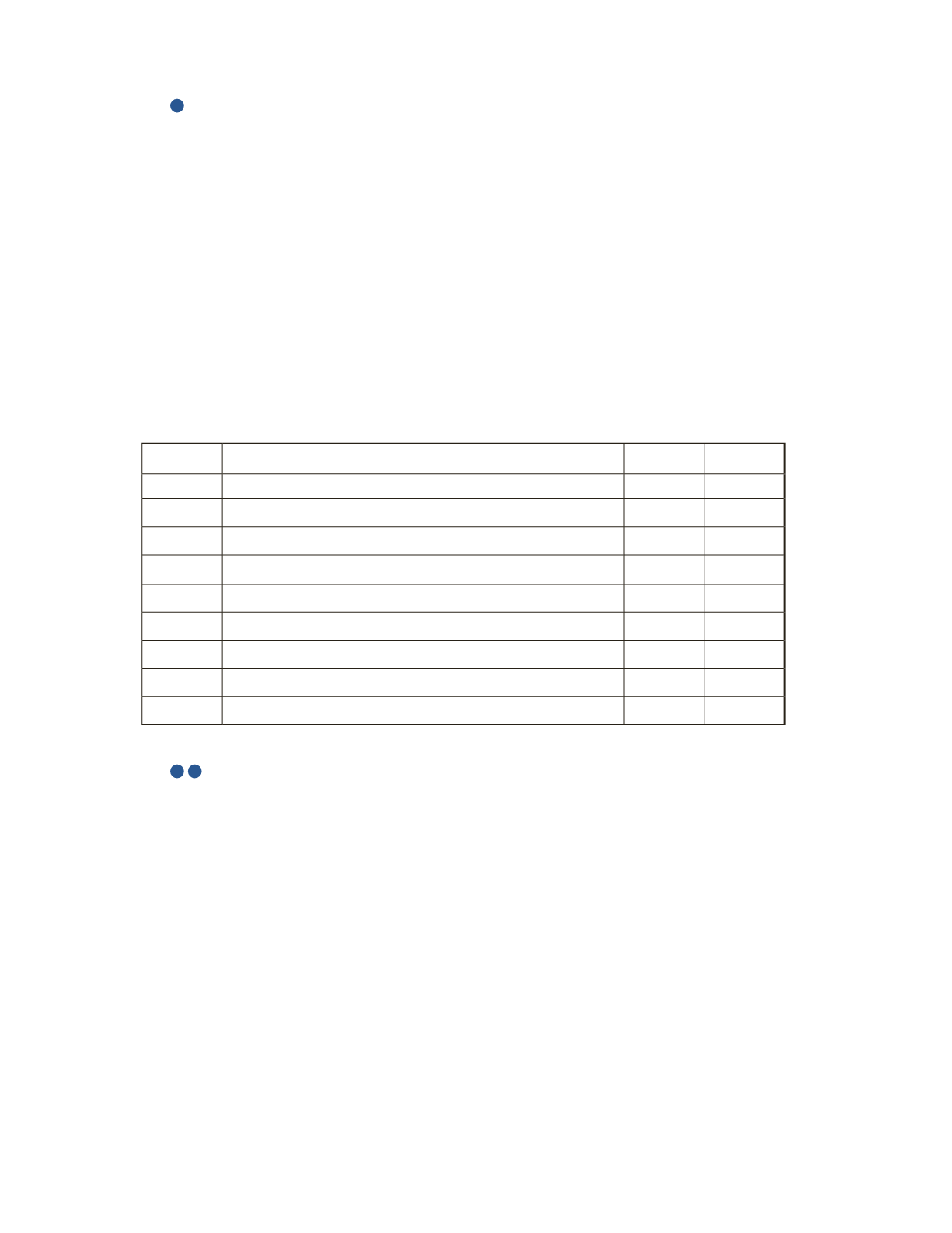

Enigma Inc. is reaching the end of its fiscal year and has declared the following dividends.

• $20,000 cash dividend

• 10% stock dividend (on common shares)

The following information is also available.

• There are 10,000 common shares outstanding, issued for $12 per share

• There are 1,000, $5 non-cumulative preferred shares outstanding

• Common shares are currently trading for $10 per share

• For both dividends, the date of declaration is May 21, 2016 and the date of payment is

May 31, 2016

• Enigma Inc. had net income of $45,000 during the year

• The balance of retained earnings at the beginning of the year was $123,500