Chapter 6

Corporations: Contributed Capital and Dividends

263

Application Questions Group A

AP-1A (

7

)

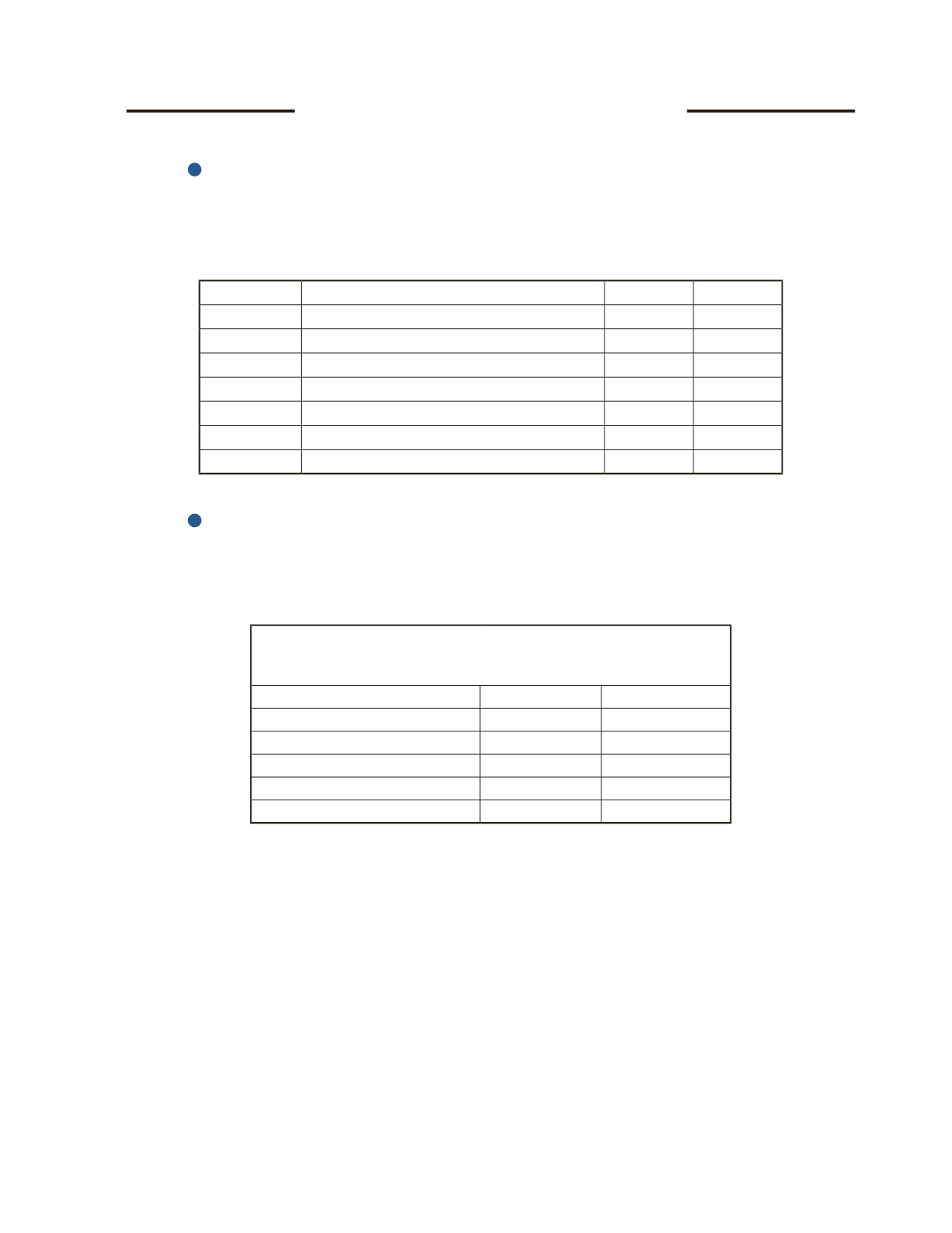

At year-end on December 31, 2016, Shuster Home Decor Inc. has accounting income (before

income tax expense calculation) of $102,000. Write the journal entry to record the income tax

expense. Assume the tax rate is 30%.

Date

Account Title and Explanation

Debit

Credit

AP-2A (

8

)

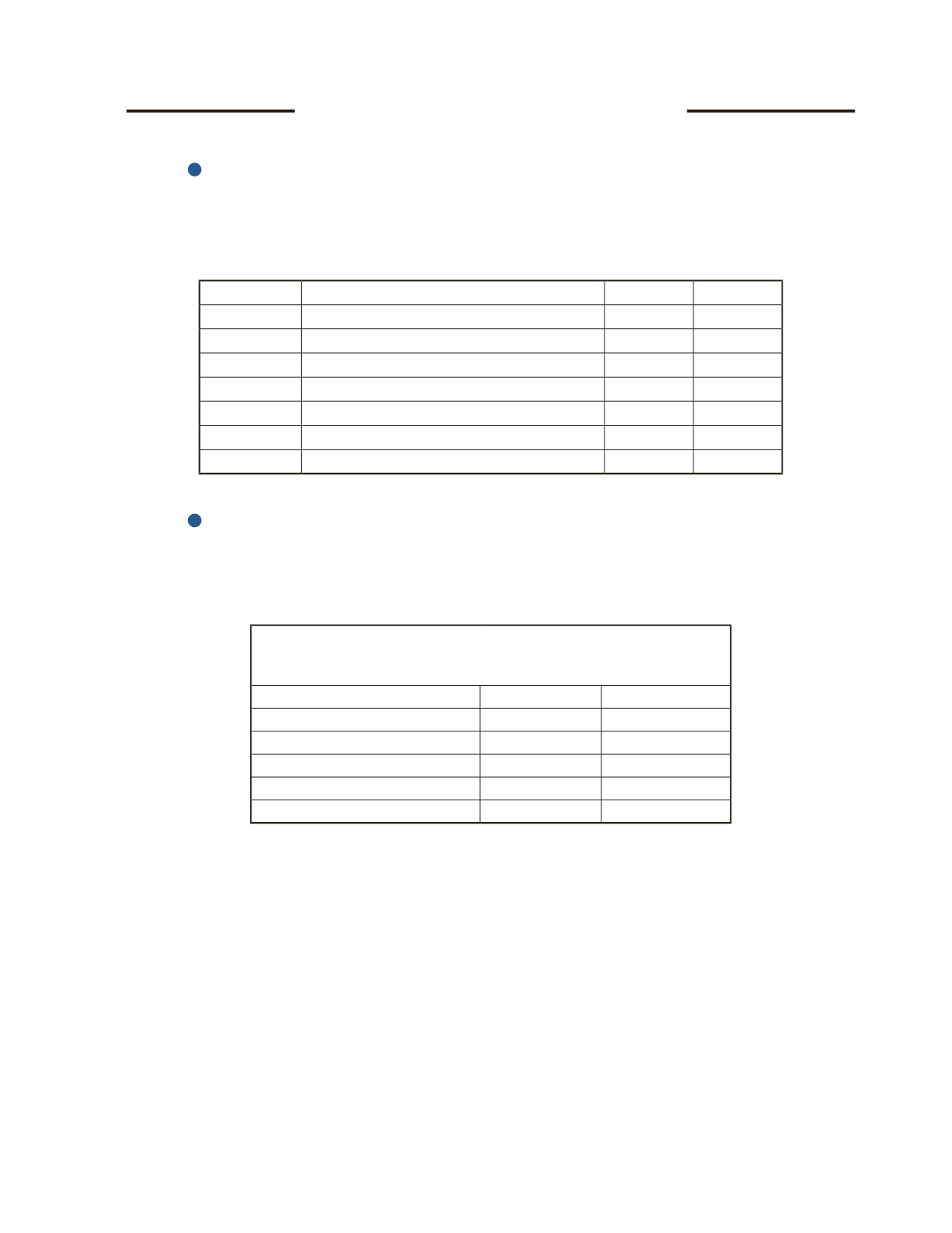

An extract from MC Consulting’s pre-closing trial balance for the year ended December 31,

2016 is shown below. The company’s net income for the year was $82,000.

MC Consulting

Trial Balance (Extract)

December 31, 2016

Account Title

Debit

Credit

Sales Revenue

240,000

Cost of Goods Sold

85,000

Salaries Expense

50,000

Rent Expense

10,000

Income Tax Expense

13,000