Chapter 6

Corporations: Contributed Capital and Dividends

289

Application Questions Group B

AP-1B (

7

)

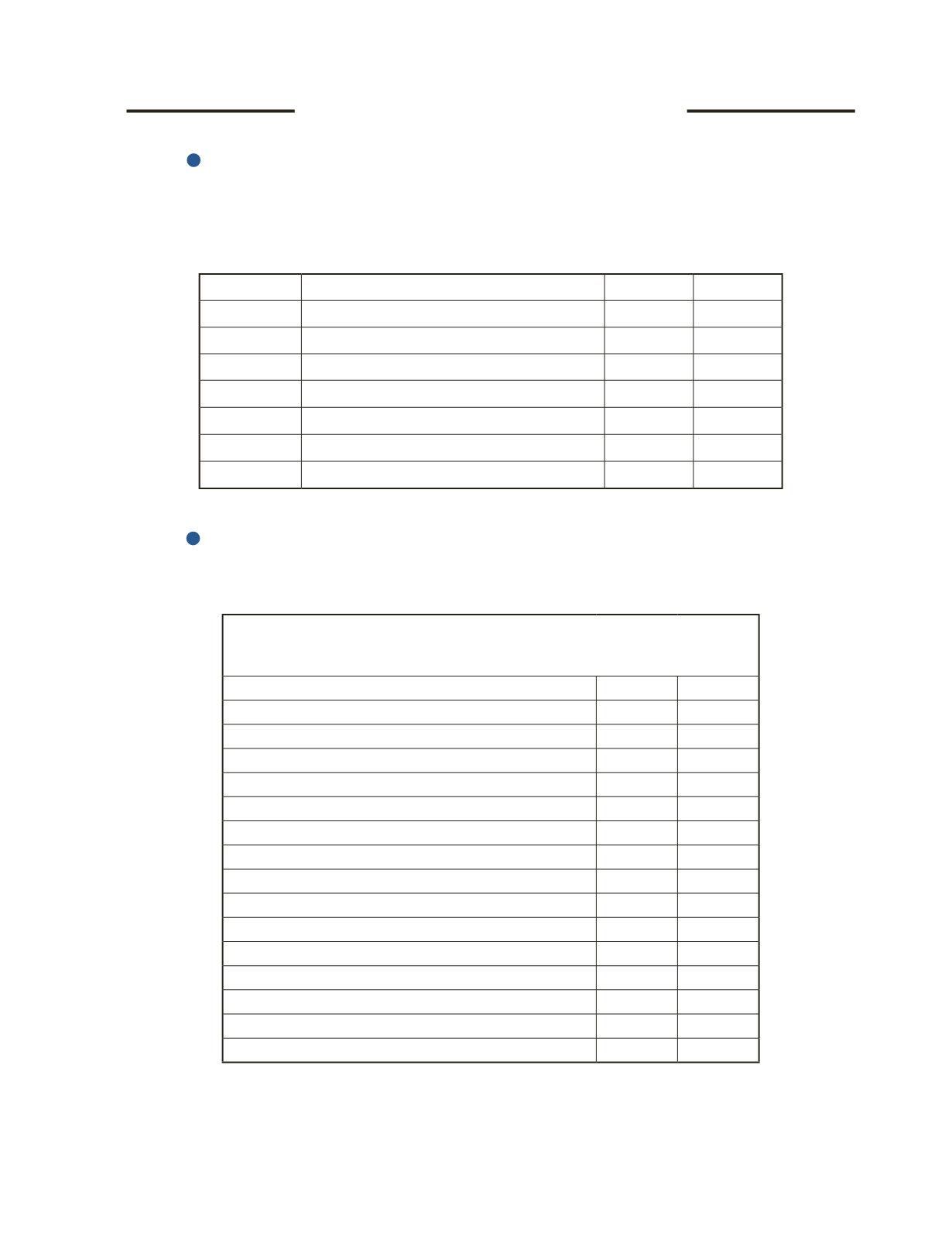

At year-end on December 31, 2016, F’Brae Cheerleading Inc. has accounting income of

$210,000. Write the journal entry to record the income tax expense. Assume the tax rate is

30%.

Date

Account Title and Explanation

Debit

Credit

AP-2B

(

8

)

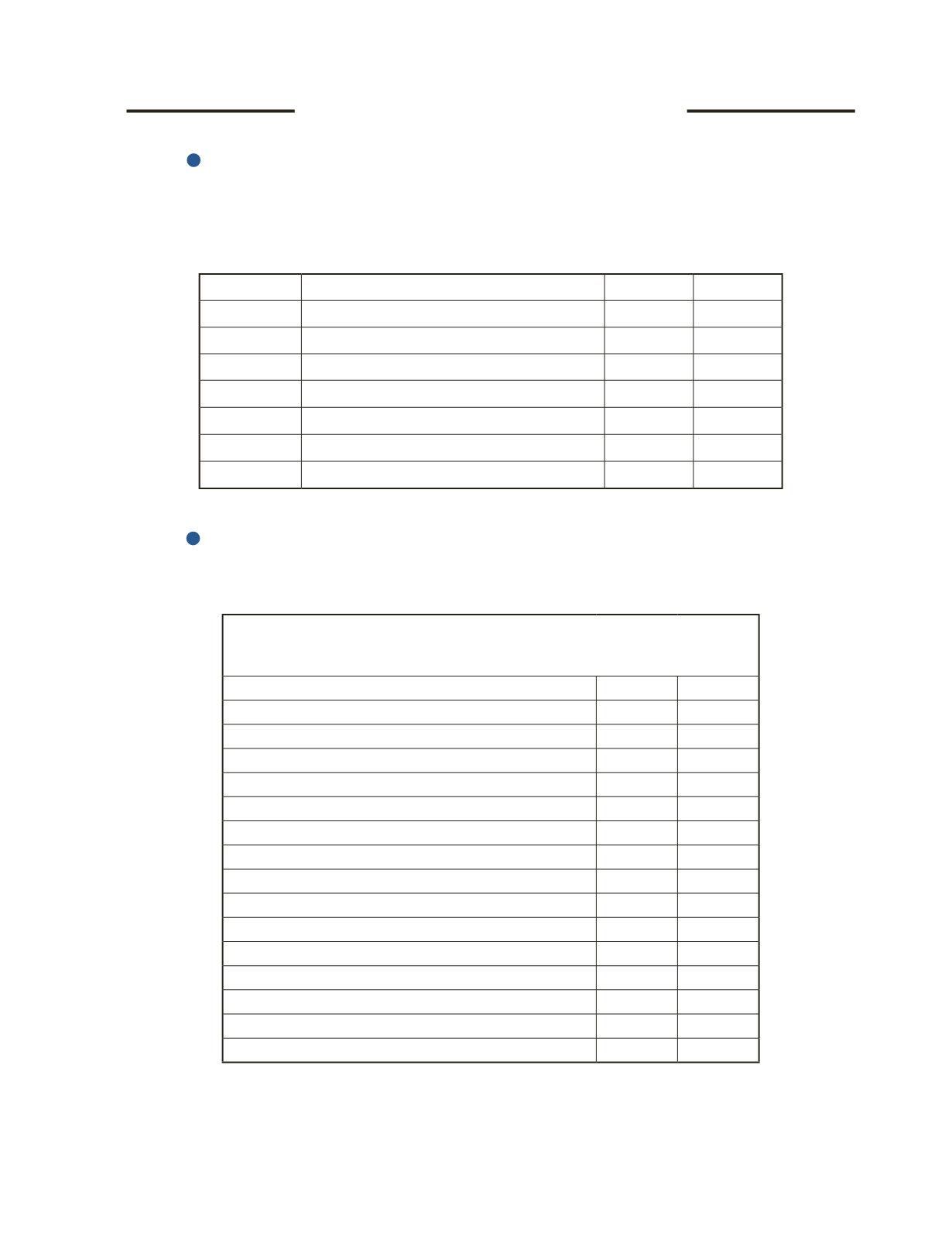

Aniston Corporation has the following trial balance at the end of its fiscal year.

Aniston Corporation

Trial Balance

For the Year Ended December 31, 2016

Account Title

Debit

Credit

Cash

$51,000

Accounts Receivable

42,000

Prepaid Insurance

5,000

Accounts Payable

$36,000

Unearned Revenue

4,000

Common Shares

30,000

Retained Earnings

6,300

Sales Revenue

162,000

Cost of Goods Sold

72,900

Insurance Expense

2,700

Rent Expense

16,000

Salaries and Wages Expense

38,000

Depreciation Expense

2,300

Income Tax Expense

8,400

Totals

$238,300 $238,300