Chapter 6

Corporations: Contributed Capital and Dividends

293

c) The accountant that handled the issue of shares for Sherm & Co. has sent a bill for $5,600.

The accountant has agreed to accept 550 common shares instead of cash. The company

could not readily determine the fair value of the shares. Record the transaction on June 9,

2016.

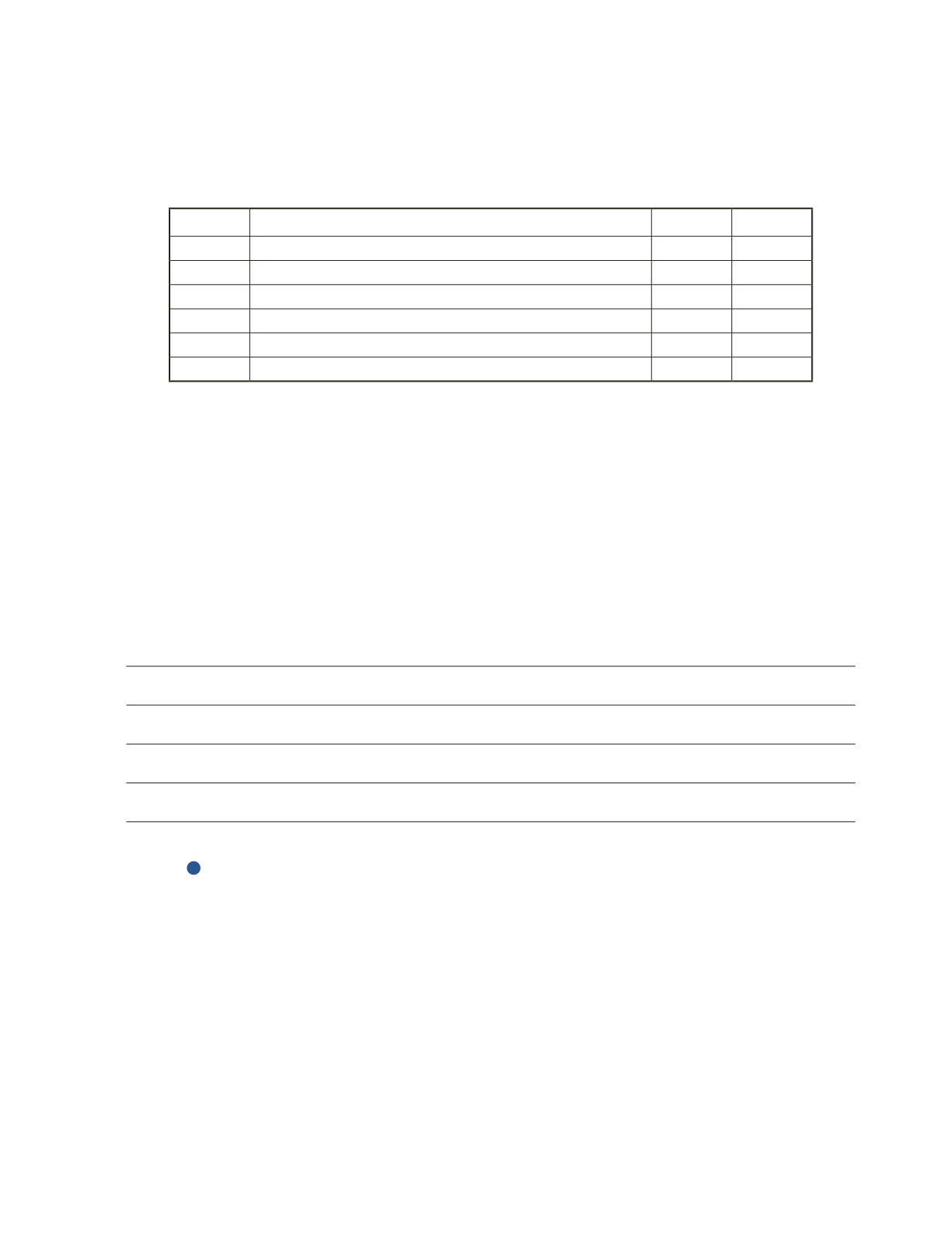

Date

Account Title and Explanation

Debit

Credit

Analysis

In the case of non-monetary exchanges of assets and services exchanged for issued shares a

corporation can choose to evaluate the fair value of shares issued with two options.

Option 1: Fair value of assets or services received

Option 2: Fair value of the shares issued

Think of a scenario when option 2 is preferred by accountants over option 1 and explain why.

AP-6B (

4

)

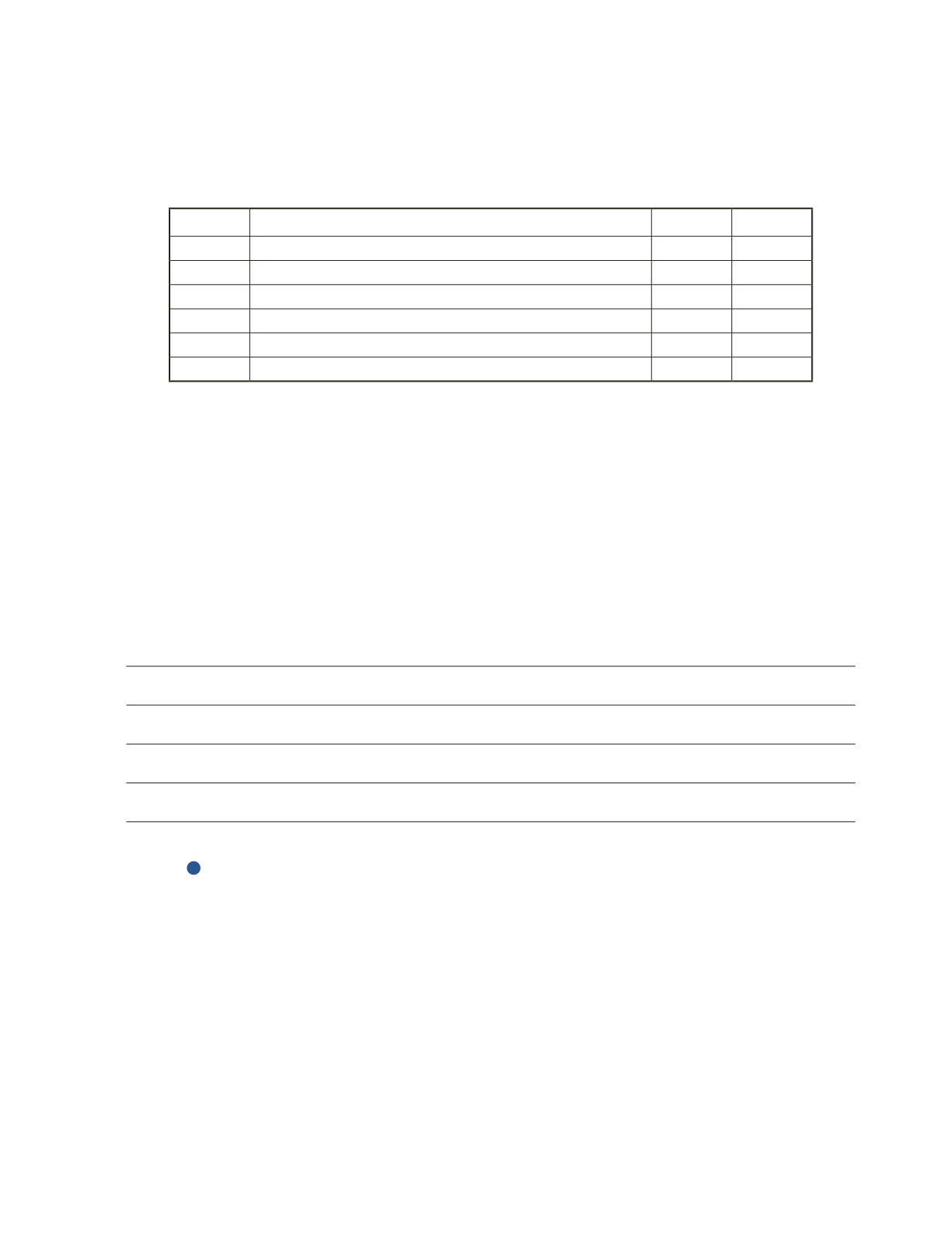

Flanders Inc. was formed on March 1, 2016. Upon formation, it issued 8,000 common shares

for $22 each and 5,500 preferred shares for $30 each. In addition to the initial share issuance,

the following share transaction occurred during the fiscal year.

Jun 7 Issued 1,000 common shares for $25 per share.

Aug 31 Issued 800 preferred shares for $33 per share.

Jan 9 Issued 2,500 common shares for $24 per share and 300 preferred shares for

$32 per share.