Chapter 6

Corporations: Contributed Capital and Dividends

301

AP-13B

(

5

9

)

On November 1, 2016, the financial records of Sam Inc. showed the following balances.

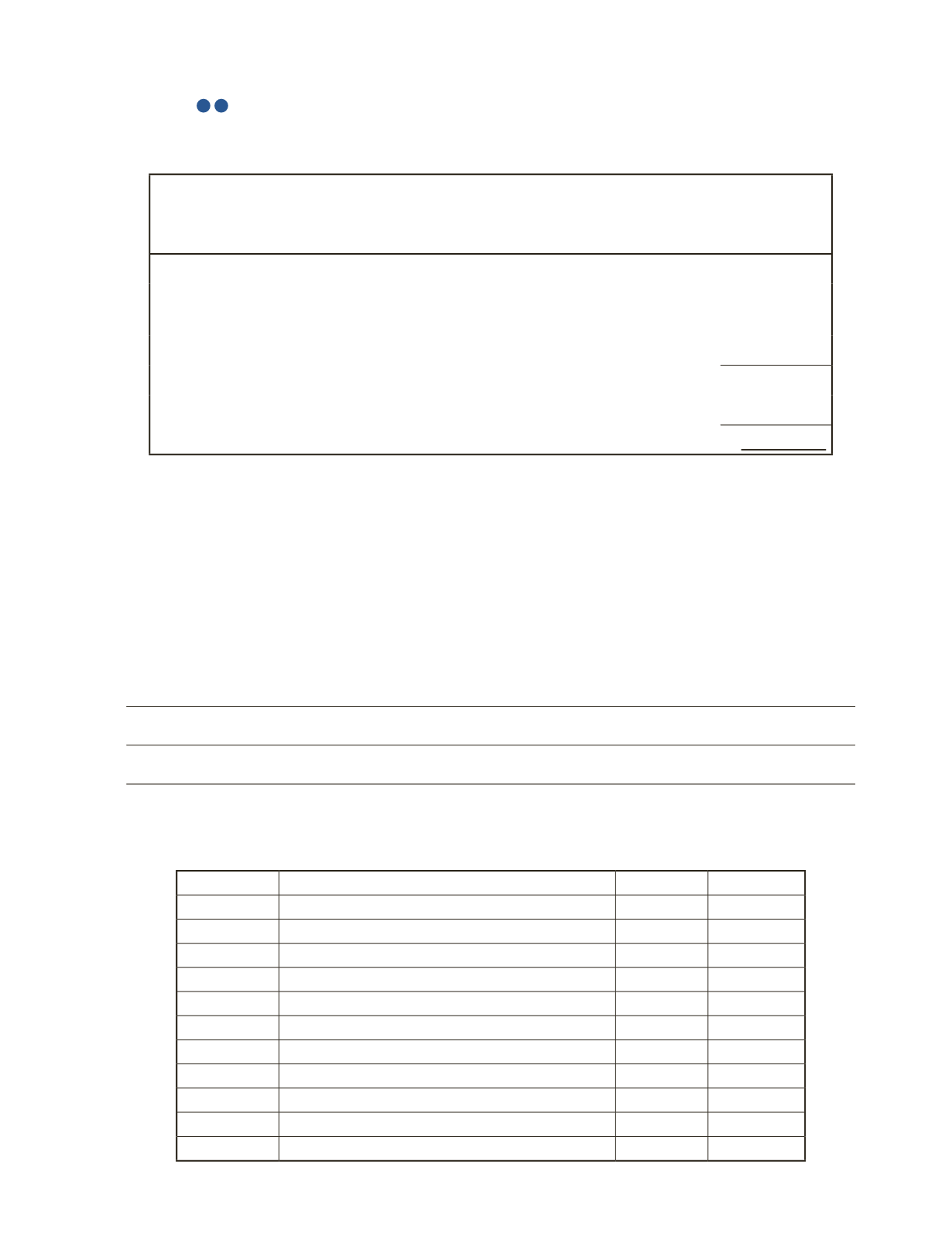

Sam Inc.

Shareholders' Equity

As at November 1, 2016

Share Capital

Preferred Shares, $5, cumulative, 200,000 authorized,

2,000 issued and outstanding

$200,000

Common Shares, unlimited authorized, 25,000 issued and outstanding 1,300,000

Total Share Capital

1,500,000

Retained Earnings

620,000

Total Shareholders’ Equity

$2,120,000

On November 15, 2016, Sam Inc. declared $320,000 of dividends payable to shareholders.

Dividends were last declared in 2013. The declared dividend was paid on December 5, 2016.

During the period November 1–December 31, 2016 the company earned a net income of

$50,000.

Required

a) Calculate how much Sam Inc. owes the preferred shareholders.

b) Prepare the journal entries to record the declaration and payment of dividends. The

company uses the cash dividends method to record dividends.

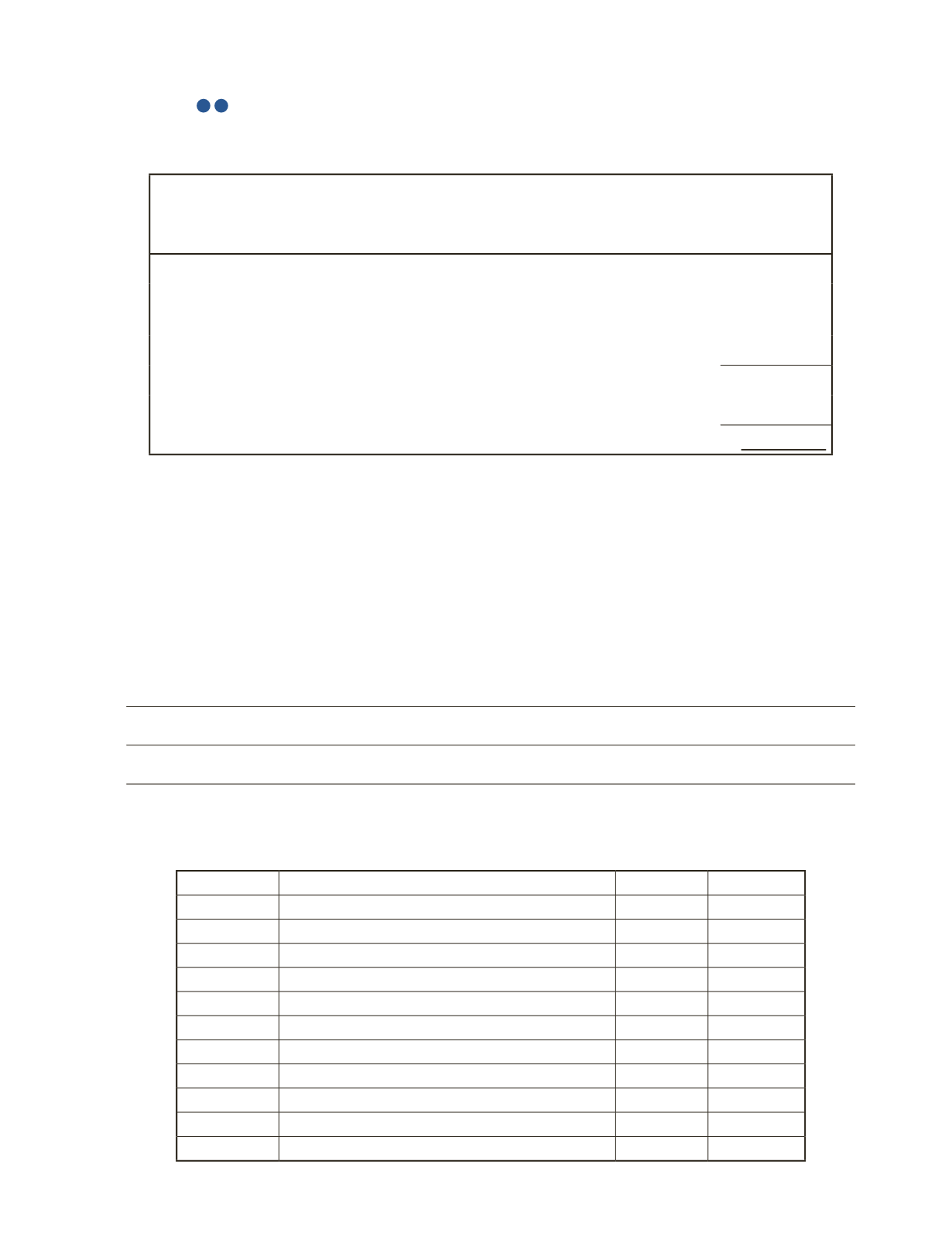

Date

Account Title and Explanation

Debit

Credit