Chapter 6

Corporations: Contributed Capital and Dividends

305

Required

a) Explain each journal entry.

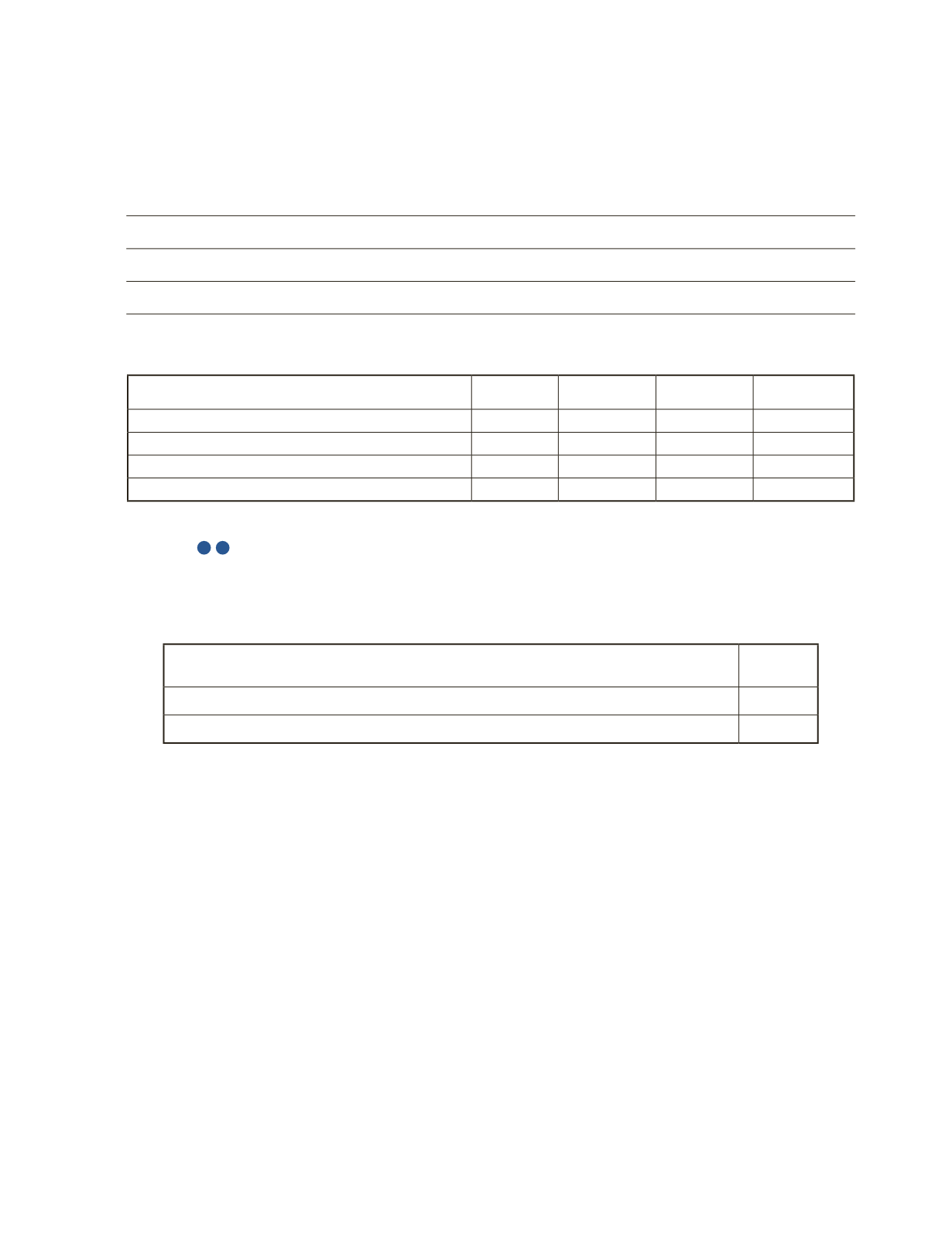

b) Complete the following table showing the equity balances at each indicated date.

October 2 October 25 October 31 November 5

Common Shares

Stock Dividends Distributable

Retained Earnings

Total Equity

AP-16B (

4

6

)

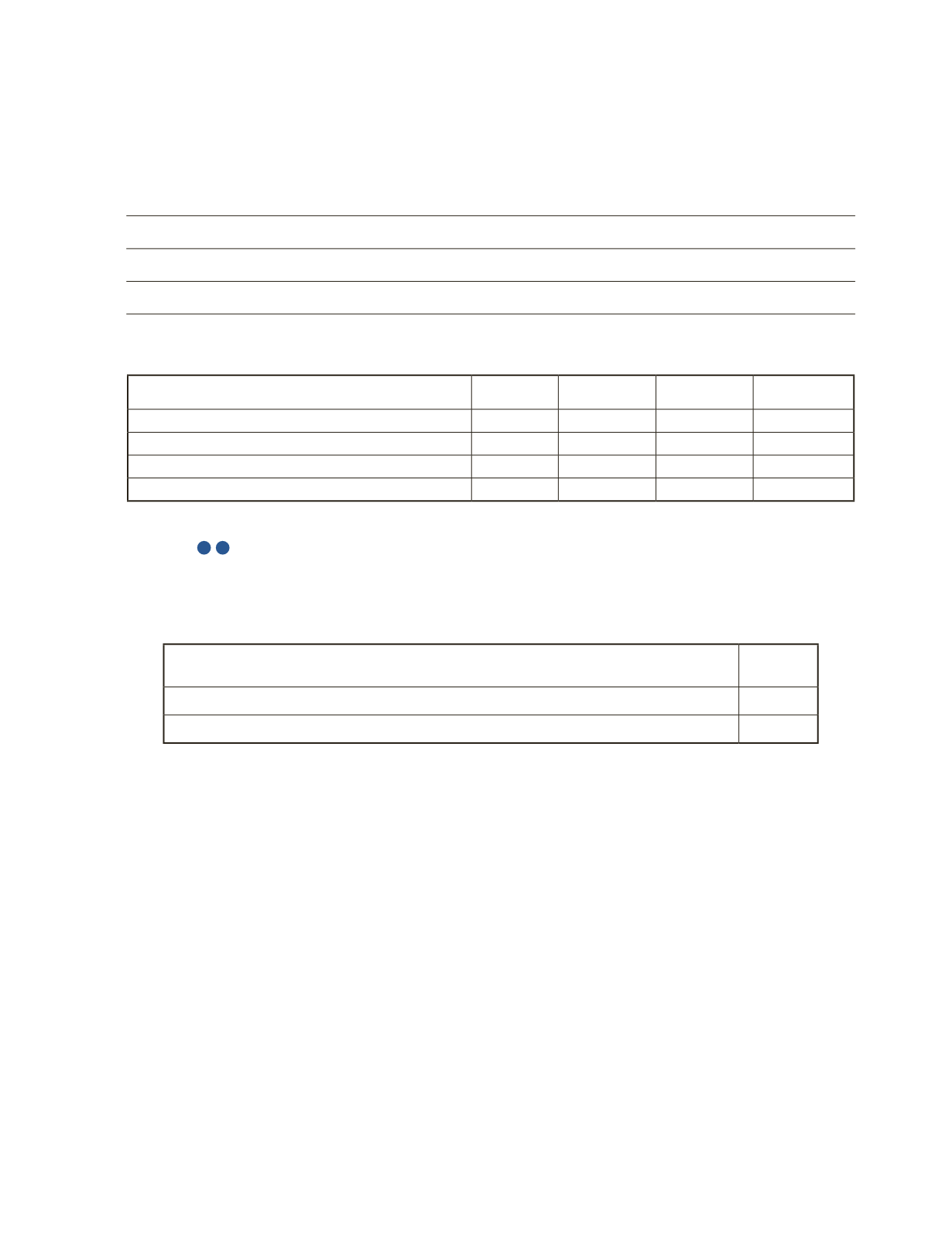

Vitamin Corporation was incorporated and began operations on May 1, 2012. Vitamin

presented the following information at the end of the 2015 fiscal year.

Preferred Shares, $3 cumulative, 300,000 shares authorized, 5,000 shares issued and

outstanding

$14,500

Common Shares, unlimited authorized, 40,000 shares issued and outstanding

280,000

Retained Earnings

645,000

Dividends were last paid out in 2014 fiscal year. The following transactions relating to

shareholders’ equity occurred during the 2016 to 2017 fiscal year.

May 1 Issued 60,000 common shares for $8 per share and 15,000 preferred shares for $3

per share.

Jun 2 Issued 5,000 common shares in exchange for $30,000 in legal services provided by

Vitamin Corp.’s lawyer when setting up the corporation.

Aug 4 Issued 40,000 common shares in exchange for machinery valued at $250,000. The

fair value of the shares could not be readily determined.

Nov 15 Issued 10,000 common shares for $8.50 each and 5,000 preferred shares for $3.25

each.

Apr 30 Net income for the year was $97,200. Dividends of $165,000 were declared and are

payable on May 5, 2016. The company uses the cash dividends method to record

dividends.