Chapter 10

The Statement of Cash Flow

485

AP-5A (

2

)

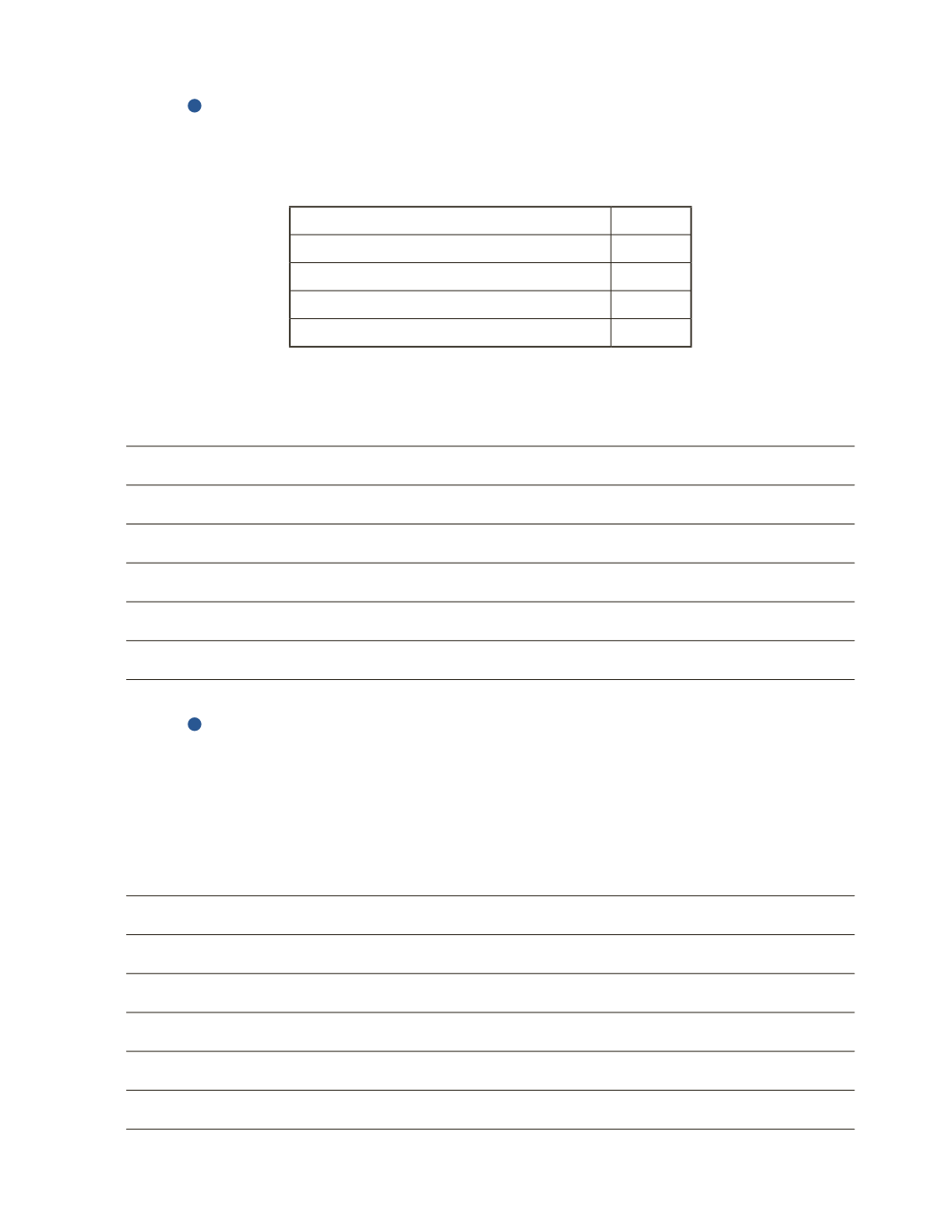

The net income for the year ended on August 31, 2016 for Wonderstruck Corporation was

$147,000. Additional data for the year is provided below.

Purchase of property, plant and equipment

$257,000

Depreciation of equipment

$11,000

Dividends paid

$42,000

Net increase in accounts receivable

$22,000

Loss on sale of property

$17,000

Calculate the increase or decrease in cash from operating activities.

AP-6A (

2

)

Mellon Incorporated had a net income for 2016 of $320,000. Included on the income

statement was a loss on sale of equipment for $5,000, a gain on the sale of investments for

$15,000, depreciation of $8,000 and interest of $3,000. Calculate the increase or decrease in

cash from operating activities using the indirect method.