Chapter 10

The Statement of Cash Flow

487

AP-9A (

2

)

The Grading Company’s cash account decreased by $14,000. Cash increase from operating

activities was $21,000. Net cash decrease from investing activities was $22,000. Based on this

information, calculate the cash increase (or decrease) from financing activities.

AP-10A (

3

)

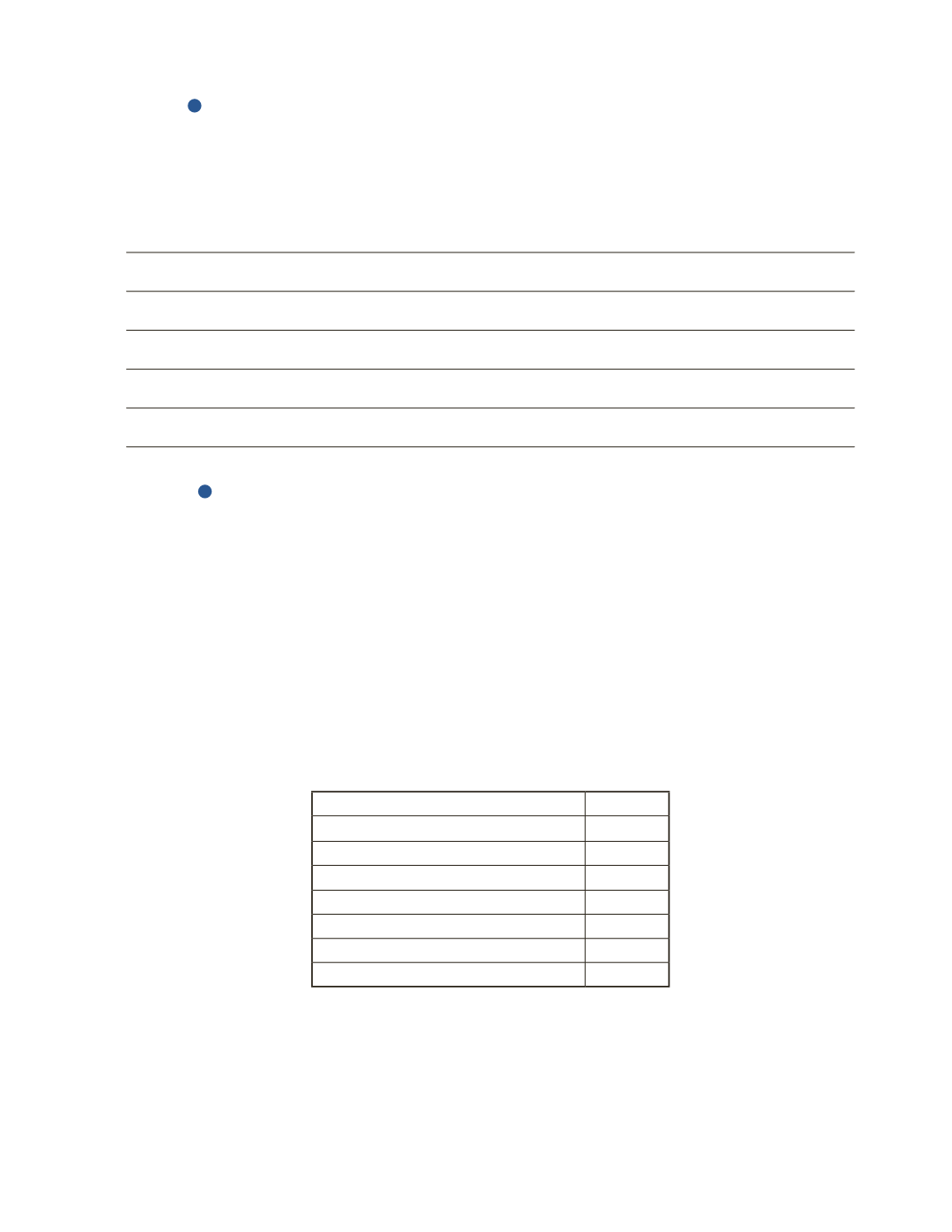

Allen Woods has just started working as an accountant for Stickla Supplies. Unfortunately,

the company had no proper accounting system in place and Allen had to start everything

from scratch. He has been provided with some items from the company’s balance sheet and

income statement for the end of 2016.

Going through the company’s purchase receipts and some other financial documents, Allen

realized that Stickla purchased $2,500 of equipment in 2016 and the balance of property,

plant and equipment and accumulated depreciation at the end of 2015 was $11,000 and

$2,900 respectively. Accounts payable balance was not affected by any investment activities

during 2016.

Accounts

2016

Property, Plant and Equipment

$10,000

Accumulated Depreciation

$3,600

Accounts Payable

$4,000

Current Portion of Bank Loan

$15,000

Retained Earnings

$5,400

Depreciation Expense

$1,200

Loss on Sale of Equipment

$300