Chapter 7

Corporations: The Financial Statements

335

AP-8A (

2

3

)

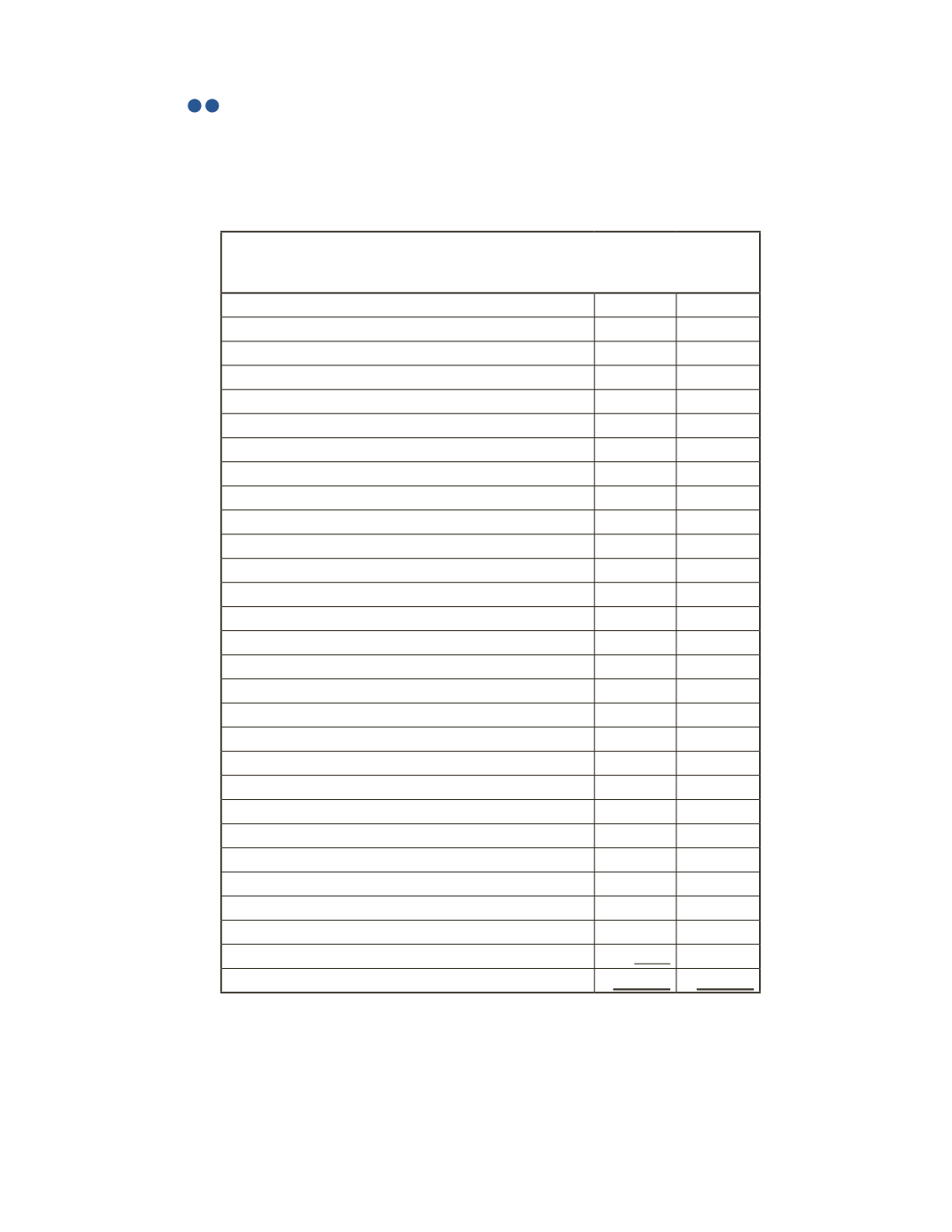

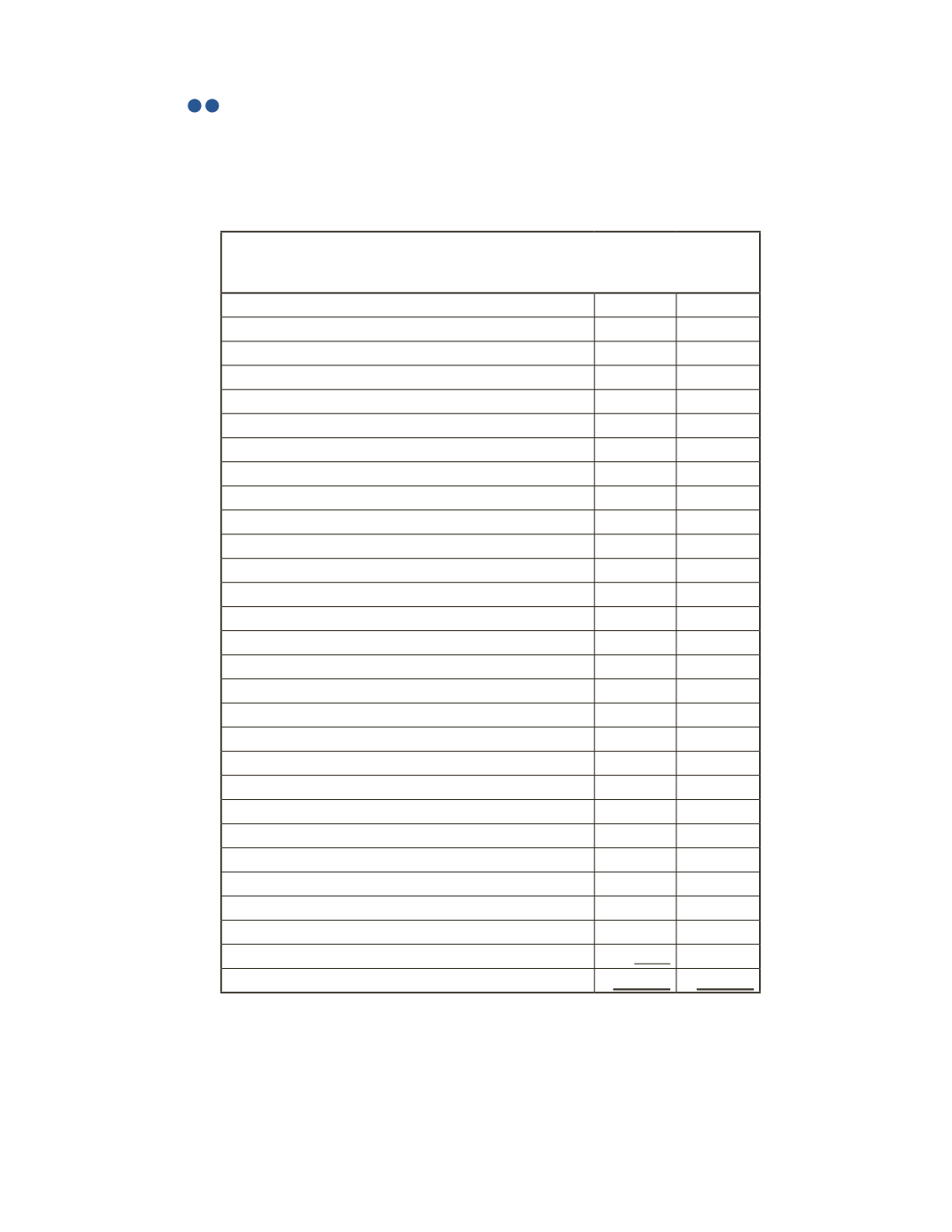

Below is the adjusted trial balance for Simple Town Corporation. The balance of retained

earnings represents the balance at the beginning of the fiscal year. The company decided not

to pay dividends this year.

Simple Town Corporation

Adjusted Trial Balance

June 30, 2016

Debit

Credit

Cash

$78,000

Accounts Receivable

93,000

Prepaid Rent

7,800

Inventory

195,000

Notes Receivable

35,000

Furniture

120,000

Accumulated Depreciation

$42,000

Accounts Payable

24,000

Unearned Revenue

22,500

Interest Payable

6,800

Salaries Payable

18,000

Loan Payable

80,000

Preferred Shares

25,800

Common Shares

105,000

Retained Earnings (beginning balance)

171,290

Sales Revenue

300,000

Net Change in Fair Value of Investments

2,800

Sales Returns and Allowances

12,000

Cost of Goods Sold

60,000

Depreciation Expense

12,600

Salaries Expense

69,000

Rent Expense

16,500

Utilities Expense

19,500

Insurance Expense

23,400

Supplies Expense

36,000

Income Tax Expense

17,990

Loss on Disposal of Equipment

2,400

Total

$798,190

$798,190