Chapter 7

Corporations: The Financial Statements

332

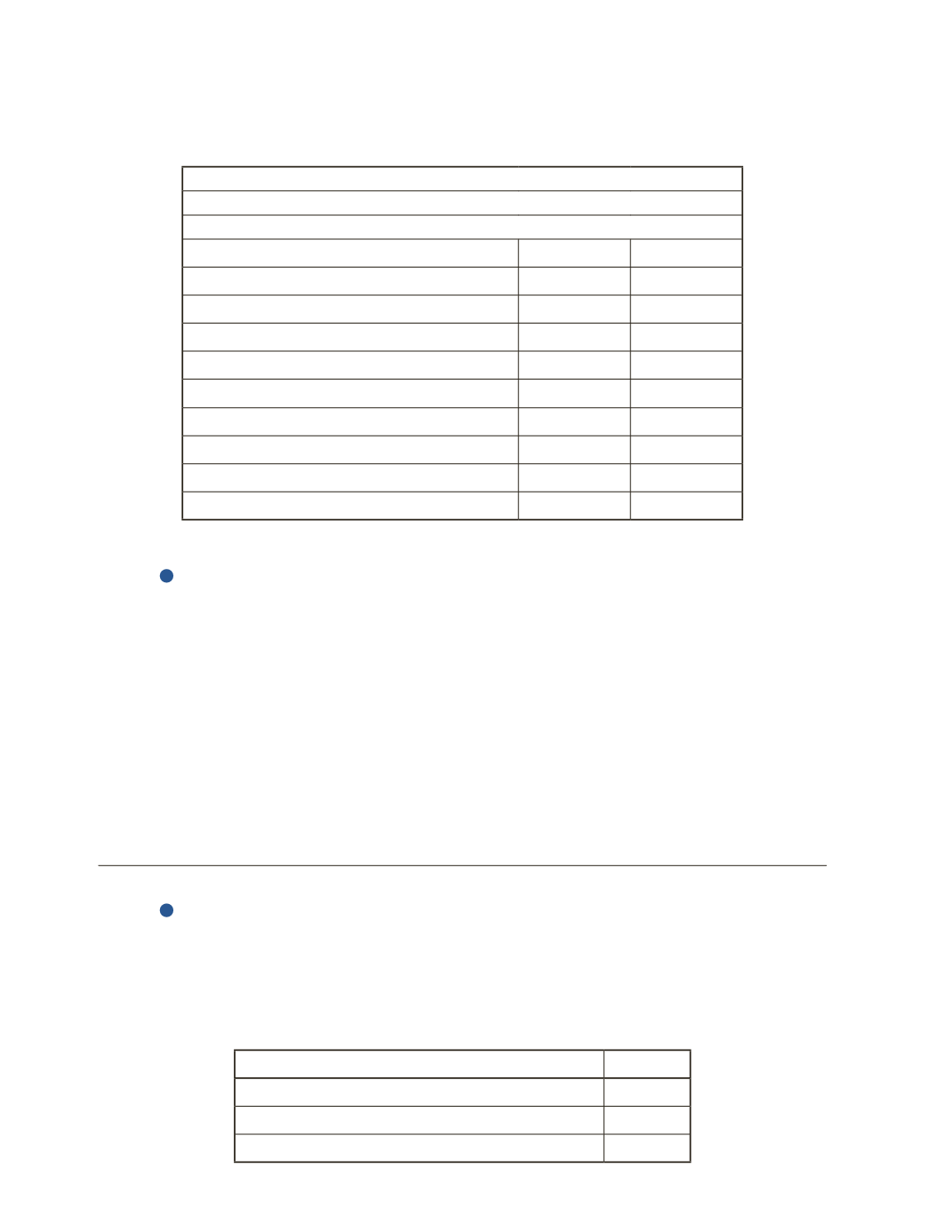

b) Prepare a statement of comprehensive income (by function) under IFRS for the year ended

December 31, 2016.

AP-3A (

2

)

Born off the coast of Mykonos, Gregory displayed an aptitude for singing at a very early age.

In high school, he joined a musical club that participated in numerous singing competitions.

Gregory wants to start his own singing school and is taking an accounting course to help him

become financially literate. He is posed with the following question on his test. Help him solve

this question.

“Nacho Libray Inc. follows ASPE and has income from operations of $200,000. Their total other

expenses amounted to $100,000 and the income tax expense was $40,000. Calculate the net

income for the year.”

AP-4A (

3

)

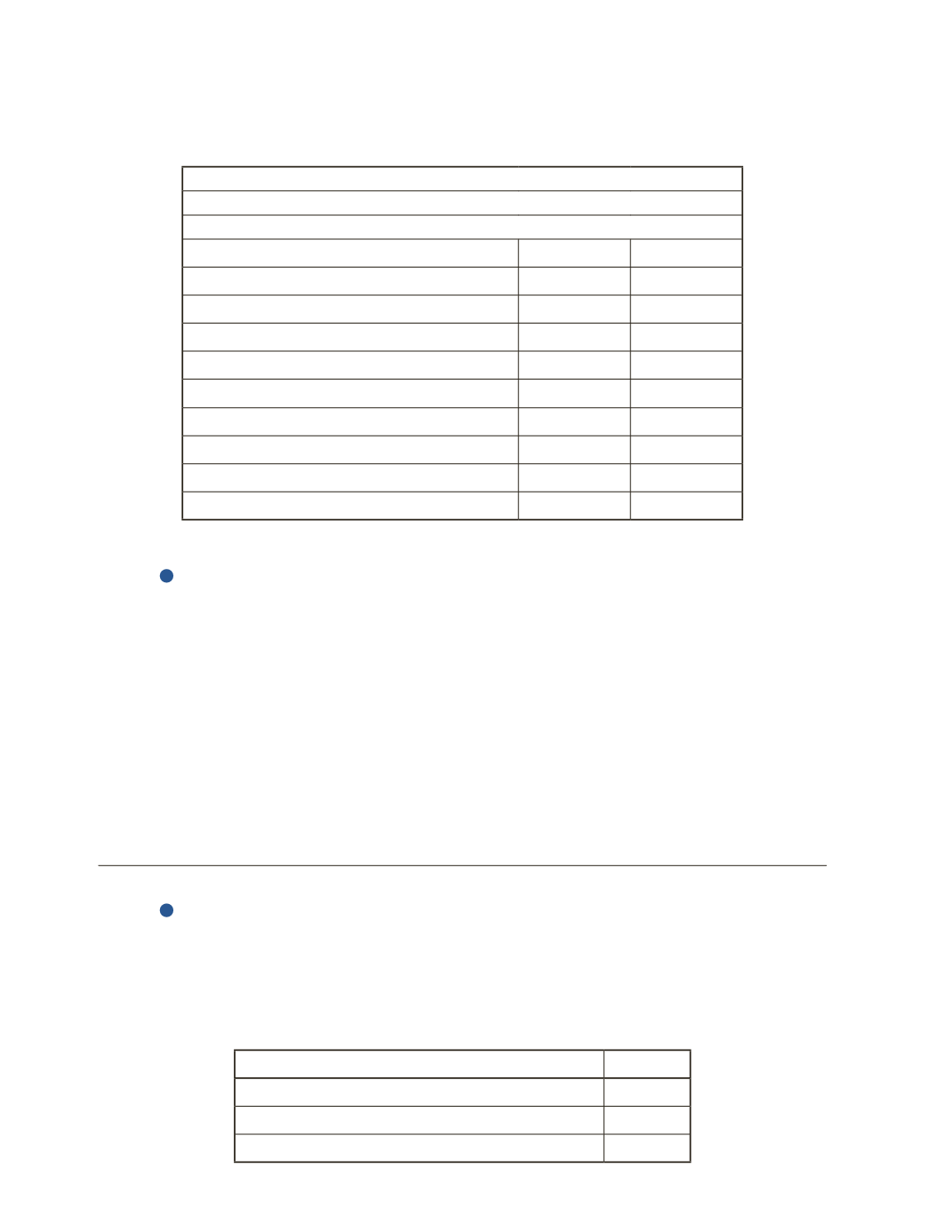

The following information was taken from the accounting records of Montana Inc. at May 31,

2016. Montana Inc. is a private corporation and follows ASPE.

Assume a tax rate of 37%. During the year, no shares were issued or redeemed.

Line Item

Amount

Total dividends paid

$61,000

Retained earnings, June 1, 2015

110,000

Net Income

156,000