Chapter 7

Corporations: The Financial Statements

334

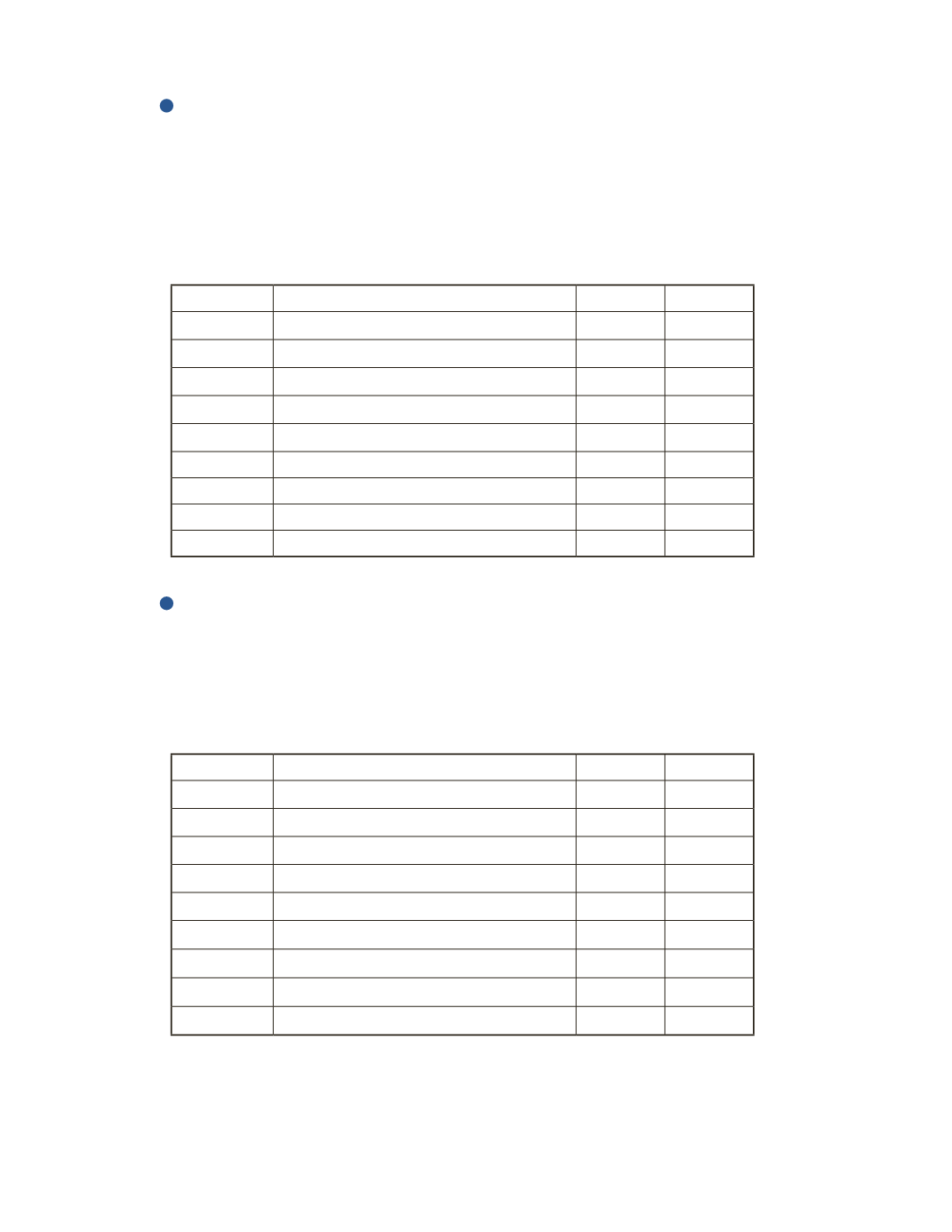

AP-6A (

4

)

On March 17, 2016, the bookkeeper for GIFT Inc. noticed that she made an error when

recording a $44,000 expenditure in the prior fiscal year. She booked the amount to the Repairs

and Maintenance expense account instead of posting to the Equipment account. Write the

journal entry that should be recorded to correct the Equipment account. Ignore the impact of

depreciation. Assume the tax rate is 30%.

Date

Account Title and Explanation

Debit

Credit

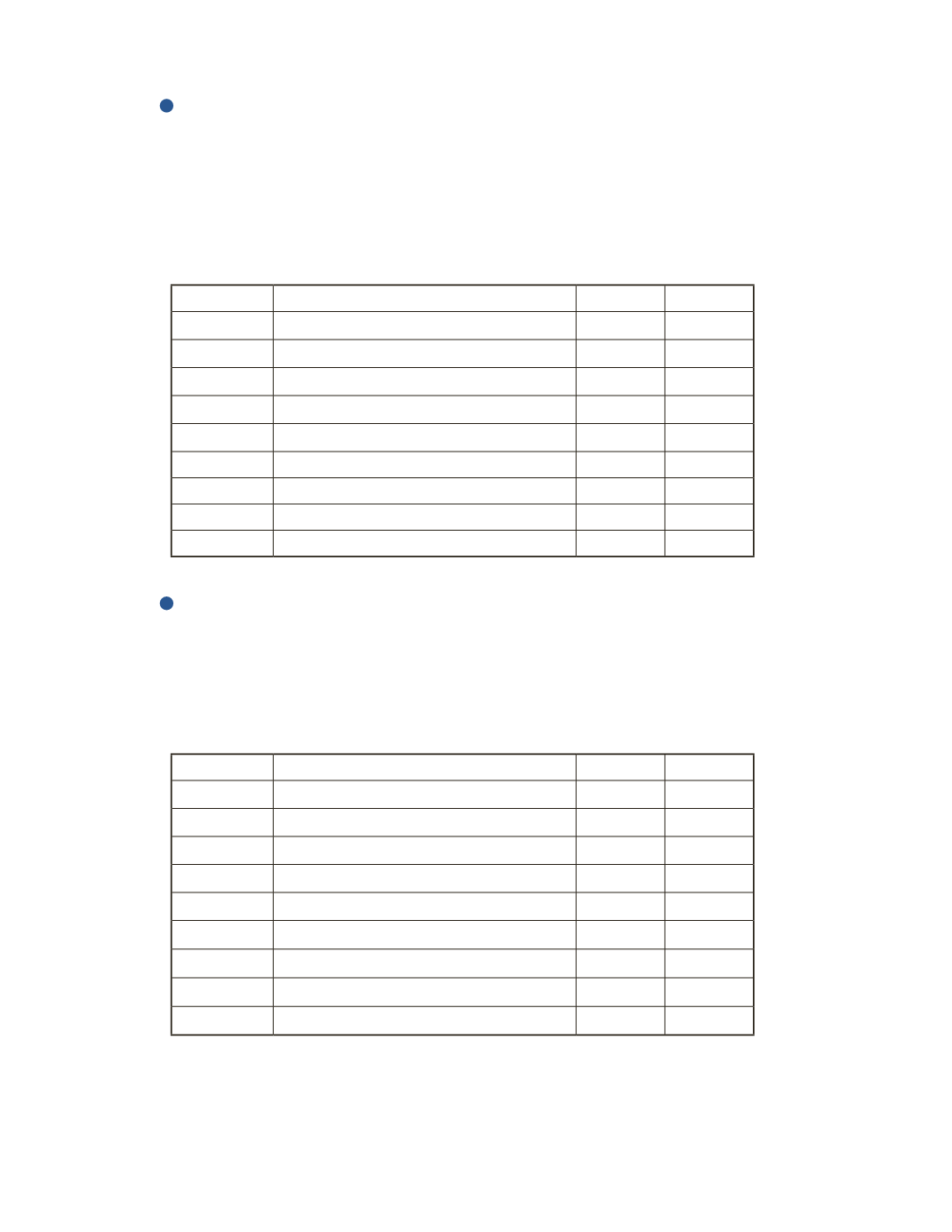

AP-7A (

4

)

On April 4, 2016, an auditor noticed that TFK Inc. accidently recorded an insurance

expenditure of $50,000 as an expense instead of as a prepaid. The purchase was made on the

last day of the fiscal period. Write the journal entry that should be recorded in the next fiscal

period to correct the Prepaid Insurance account. Assume the tax rate is 30%.

Date

Account Title and Explanation

Debit

Credit