Chapter 10

The Statement of Cash Flow

520

AP-13B (

2

3

6

)

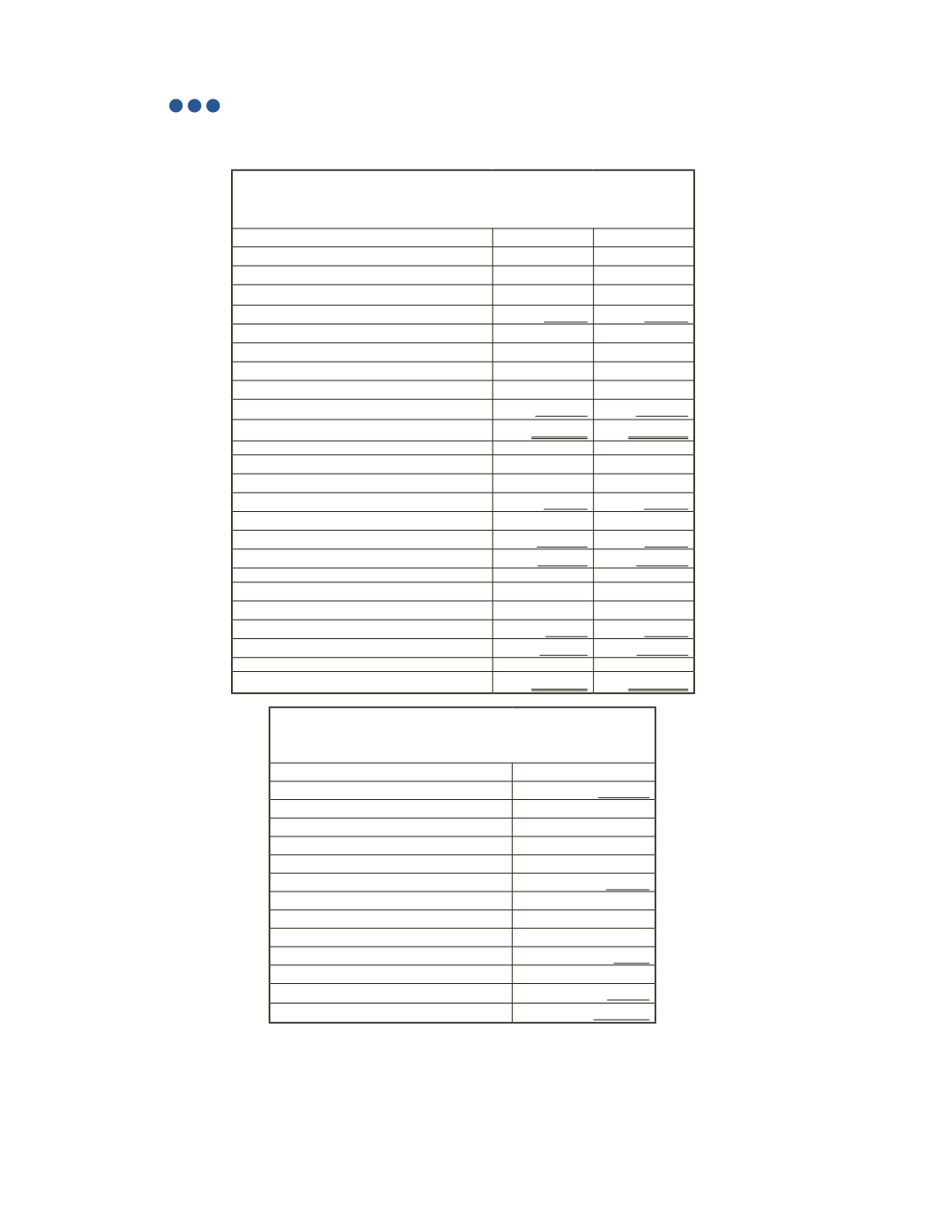

The balance sheet and income statement for Venus Company are presented below.

Venus Company

Balance Sheet

As at December 31

2016

2015

Assets

Cash

$191,410

$94,000

Accounts Receivable

30,000

34,000

Inventory

42,000

50,000

Total Current Assets

263,410

178,000

Property, Plant and Equipment

Land

90,000

100,000

Building

125,000

130,000

Less: Accumulated Depreciation

(62,000)

(60,000)

Total Assets

$416,410

$348,000

Liabilities

Accounts Payable

$76,000

$65,000

Current Portion of Bank Loan

45,000

40,000

Current Liabilities

121,000

105,000

Non-Current Portion of Bank Loan

120,000

95,000

Total Liabilities

241,000

200,000

Shareholders’ Equity

Common Shares

85,000

75,000

Retained Earnings

90,410

73,000

Shareholders’ Equity

175,410

148,000

Liabilities and Shareholders’ Equity

$416,410

$348,000

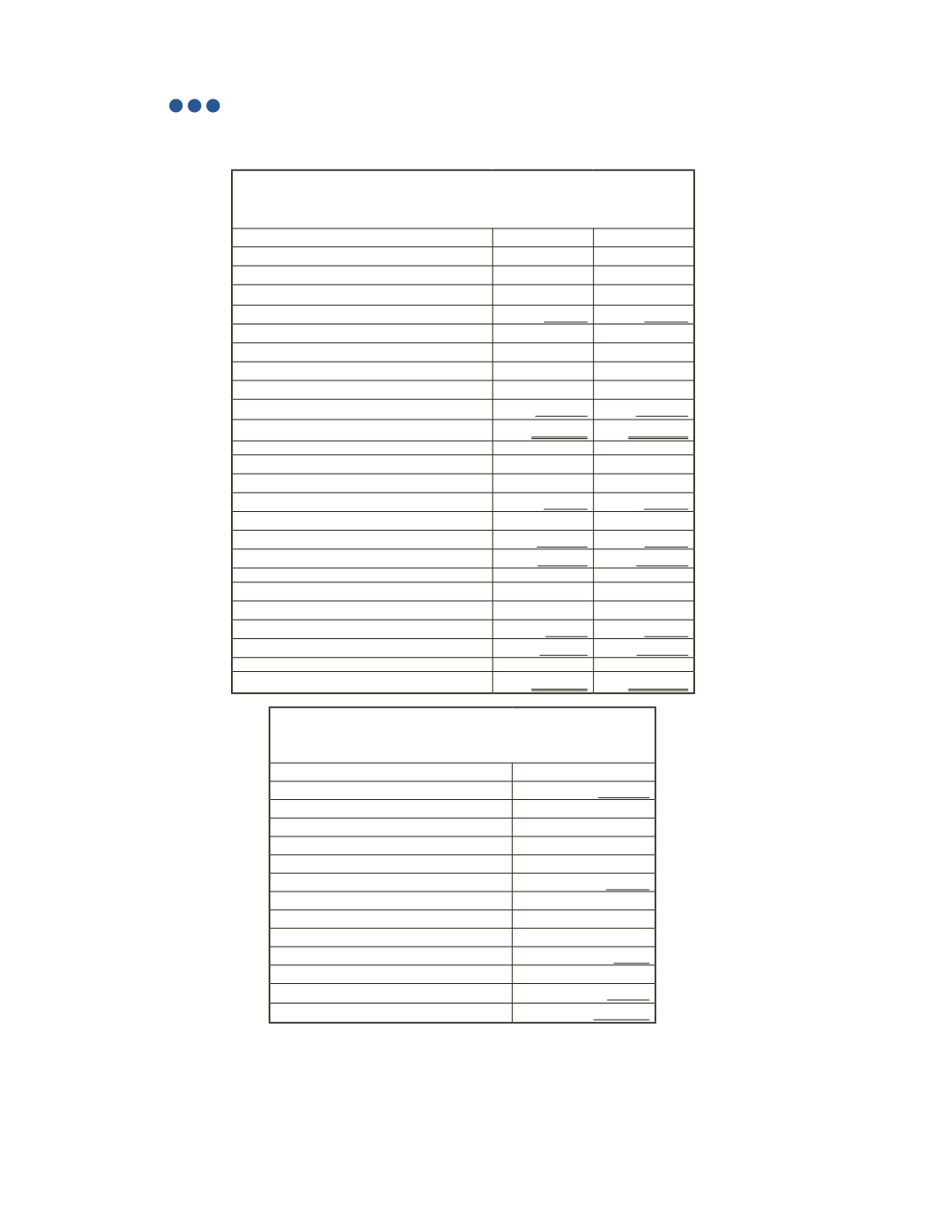

Venus Company

Income Statement

For the Year Ended December 31, 2016

Sales

$380,000

Cost of Goods Sold

255,000

Gross Profit

125,000

Expenses

Depreciation Expense

42,000

Other Operating Expense

28,500

Total Expenses

70,500

Operating Income

54,500

Other Revenue (Expenses)

Loss on Sale of Building

(5,400)

Gain on Sale of Land

3,200

Operating Income before Tax

52,300

Income Tax Expense

15,690

Net Income (Loss)

$36,610

Notes: Building and land were purchased for amounts of $115,000,

and $200,000 respectively.

The company declared and paid dividends during the year.

The company did not pay off any amount of the bank loan.