Chapter 10

The Statement of Cash Flow

514

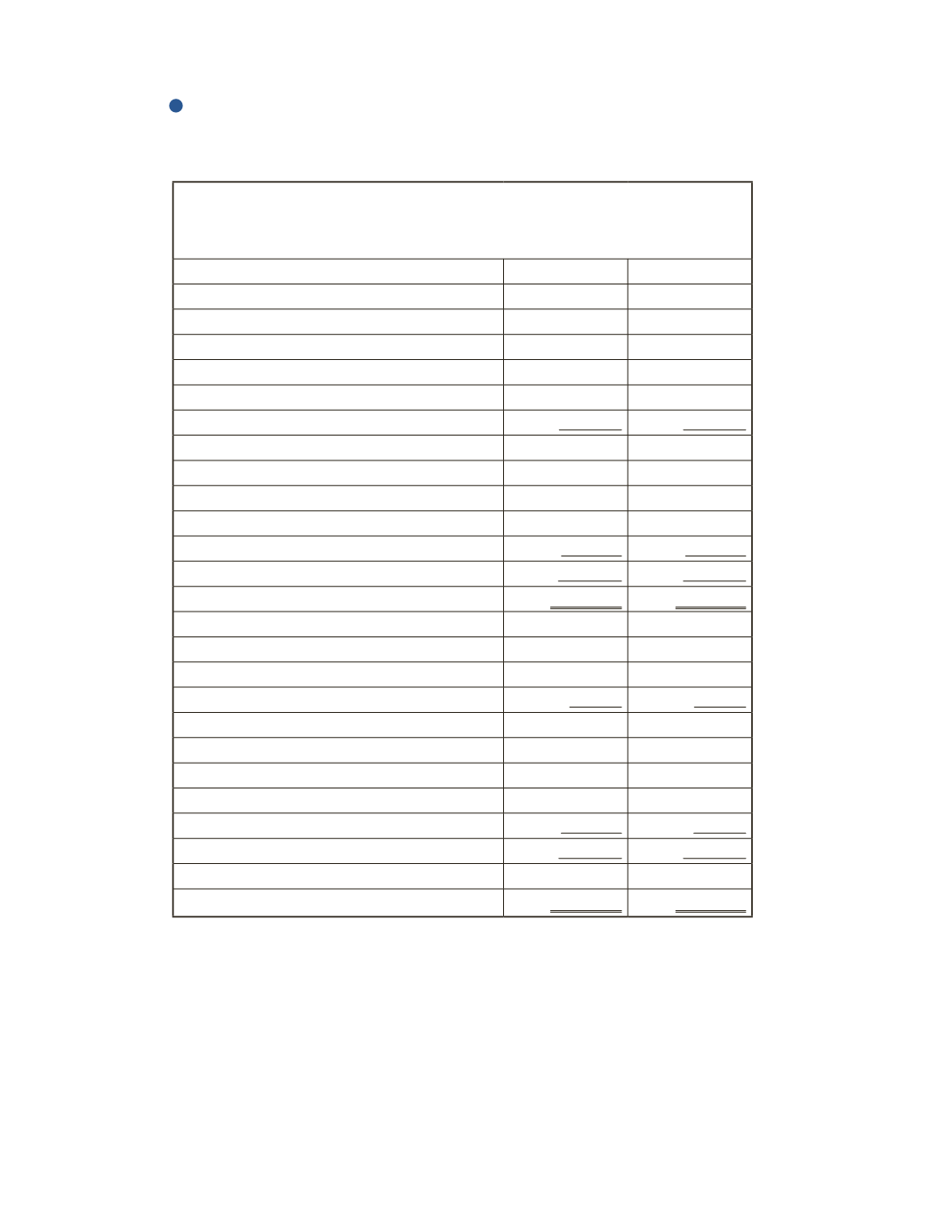

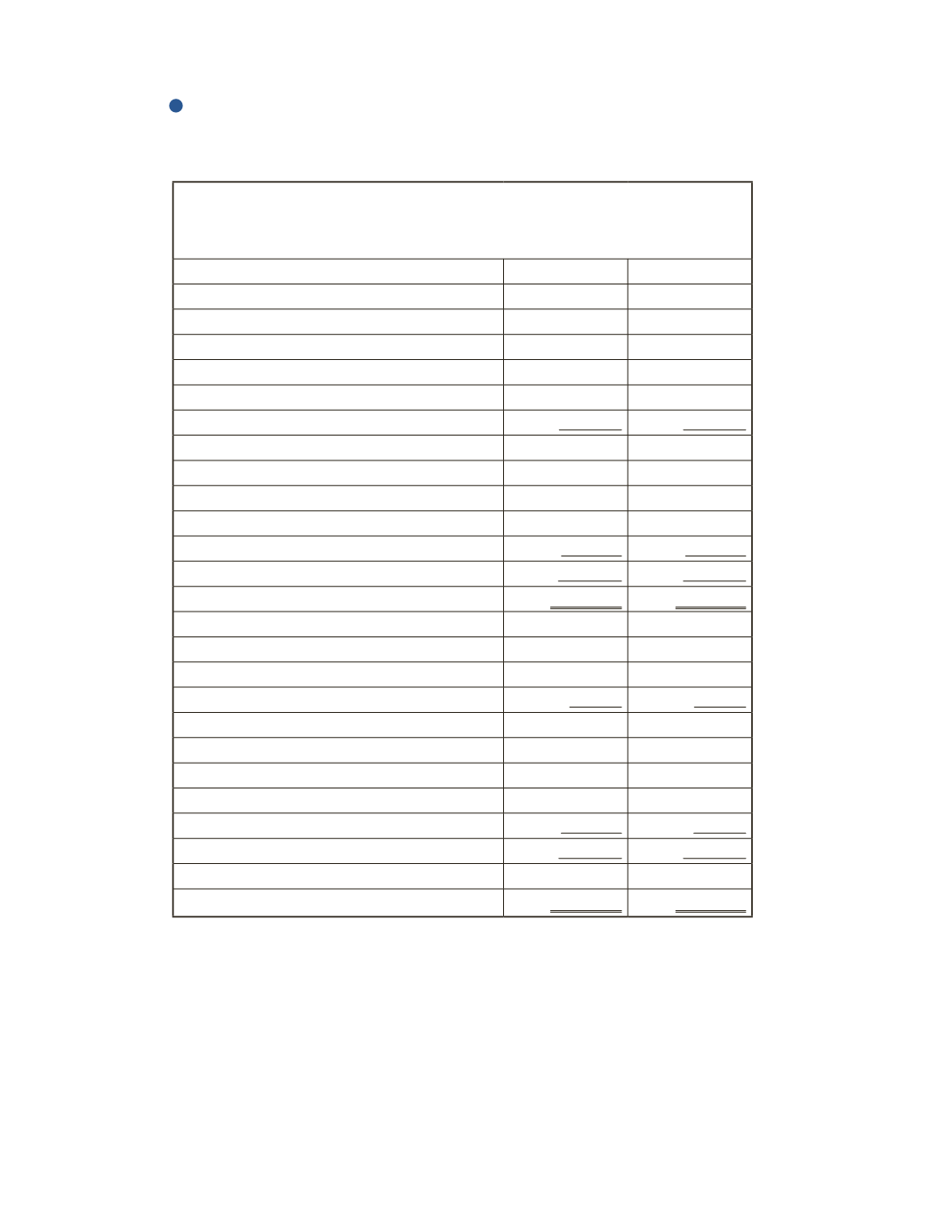

AP-11B (

2

)

Flax Corporation’s balance sheet accounts as of December 31, 2016 and 2015 are presented below.

Flax Corp.

Balance Sheet

As at December 31

2016

2015

Assets

Current Assets

Cash

$460,000

$300,000

Short-Term Investments

600,000

-

Accounts Receivable

1,020,000

1,020,000

Inventory

1,360,000

1,200,000

Total Current Assets

3,440,000

2,520,000

Long-Term Assets

Long-Term Investments

400,000

800,000

Equipment

3,100,000

2,500,000

Less: Accumulated Depreciation

(900,000)

(600,000)

Total Long-Term Assets

2,600,000

2,700,000

Total Assets

$6,040,000

$5,220,000

Liabilities

Current Liabilities

$2,300,000

$2,000,000

Non-Current Liabilities

800,000

700,000

Total Liabilities

3,100,000

2,700,000

Shareholders' Equity

Common Shares

1,800,000

1,680,000

Retained Earnings

1,140,000

840,000

Total Shareholders' Equity

2,940,000

2,520,000

Total Liabilities and Equity

$6,040,000

$5,220,000

Assume current liabilities include only items from operations (e.g. accounts payable, taxes

payable). Non-current liabilities include items from financing (e.g. bonds and other non-

current liabilities).

Note that there was no sale of equipment throughout the year.