Chapter 4

Current Liabilities

197

AP-13B (

8

)

SASA, a manufacturer of photocopying machines, offers customers a three-year warranty

on the purchase of each machine. If a machine breaks down during this warranty period,

SASA is required to repair or replace the machine. On the basis of historical experience, SASA

determines that an average of $80 of parts per machine will be used for warranty obligations.

SASA sold 300 machines during 2016. All journal entries related to warranties are recorded on

December 31.

Required

a) Prepare the journal entry to record the estimated warranty liability for 2016.

b) Prepare the journal entry recorded in 2017 assuming SASA uses $5,000 in parts for

warranty claims.

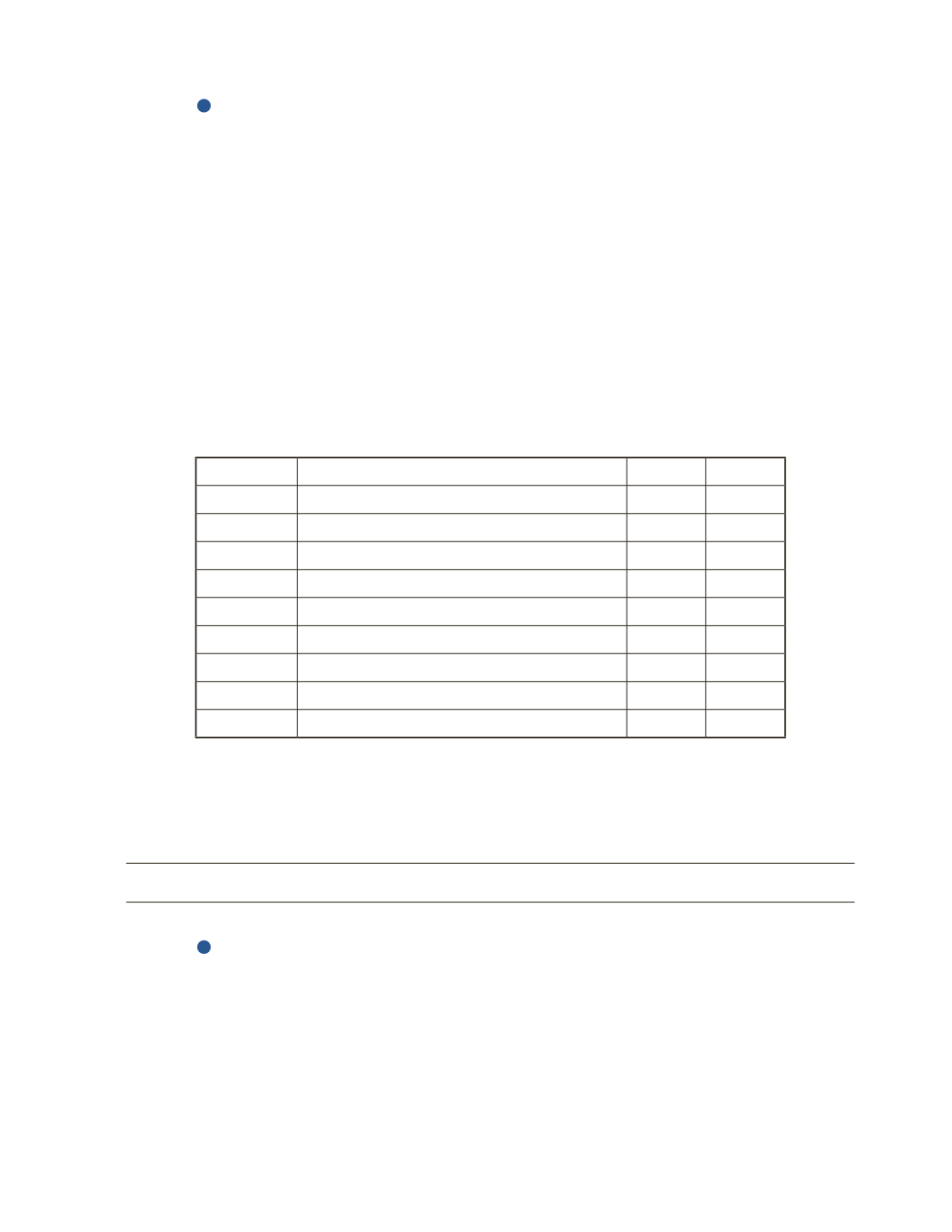

Date

Account Title and Explanation

Debit

Credit

c) How would the income statement be affected if SASA used $5,000 in parts in 2017 for

warranty claims?

AP-14B (

8

)

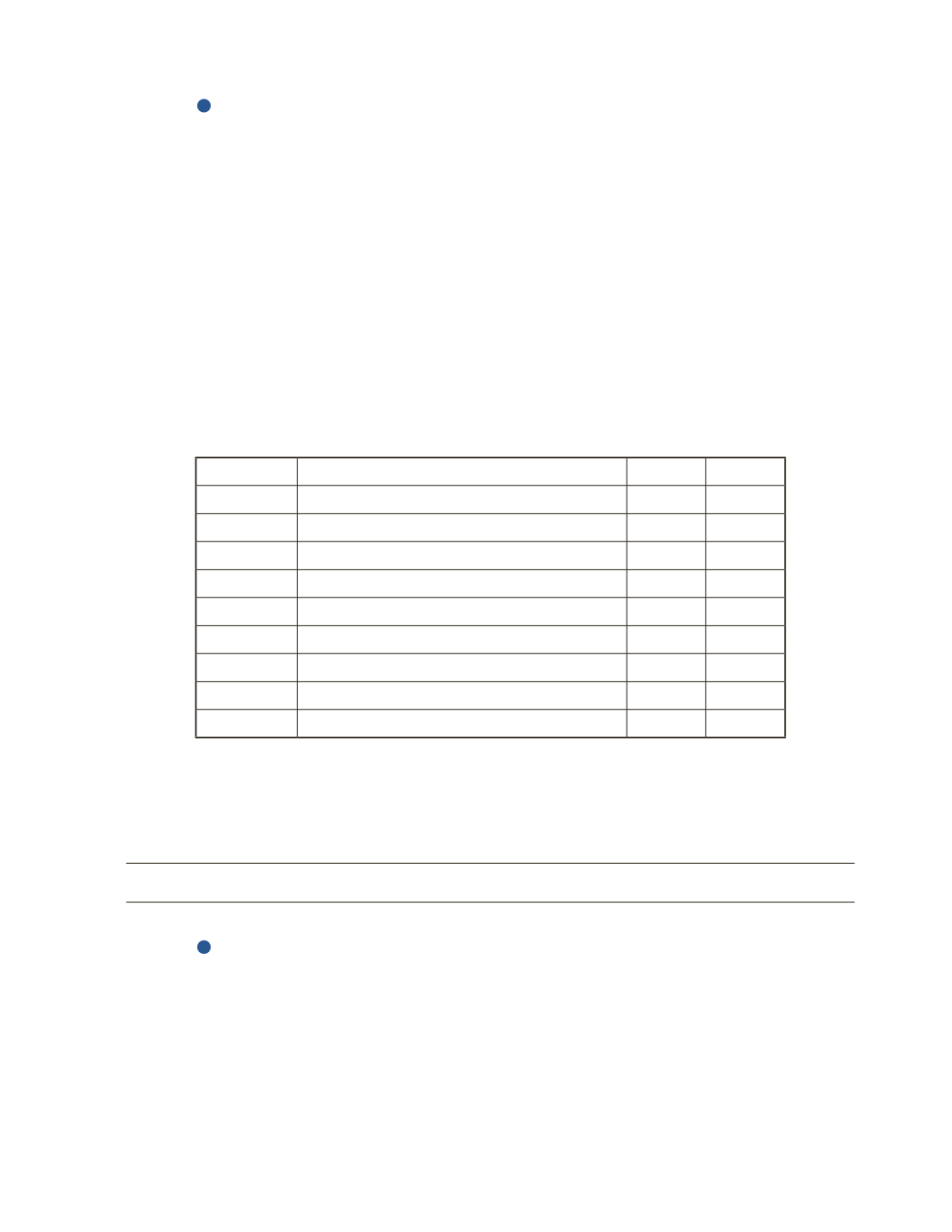

Solace produces and sells sunglasses and provides customers with a one-year warranty on

all products. It is estimated that the company incurs approximately $10 of warranty expense

on each pair sold. During 2016, the company sold 400 pairs of sunglasses. All journal entries

related to warranties are recorded on December 31.

Required

a) Prepare a journal entry to record the estimated warranty liability.