Chapter 4

Current Liabilities

194

AP-9B (

6

)

On November 1, 2016, Compression Company signed a $100,000, eight-month note payable

with a 5% interest rate. Compression Company has a December 31 year-end.

Required

Prepare the necessary journal entries to record the following.

a) The signing of the note payable on November 1, 2016

b) The required adjusting entry on December 31, 2016

c) The payment of interest and repayment of the note on July 1, 2017

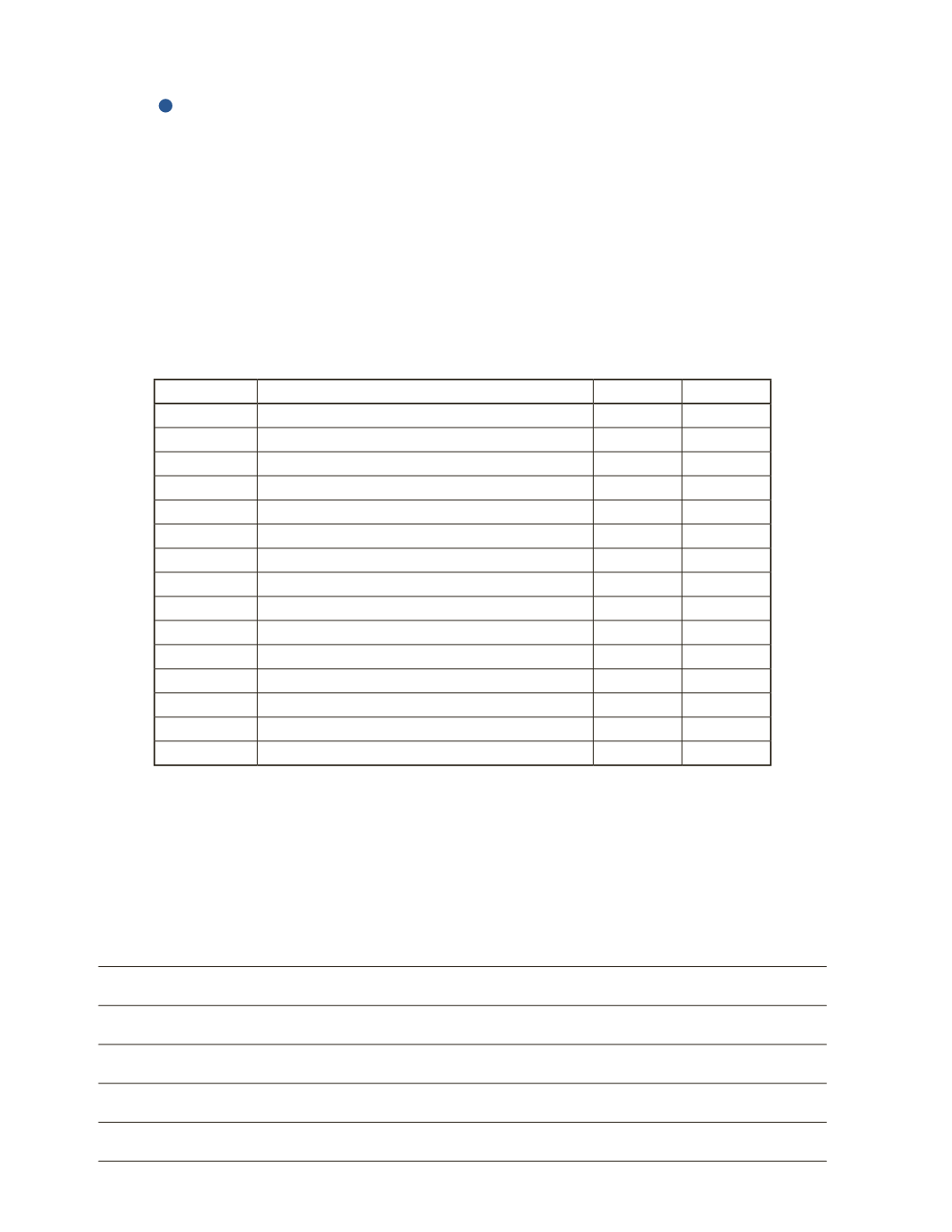

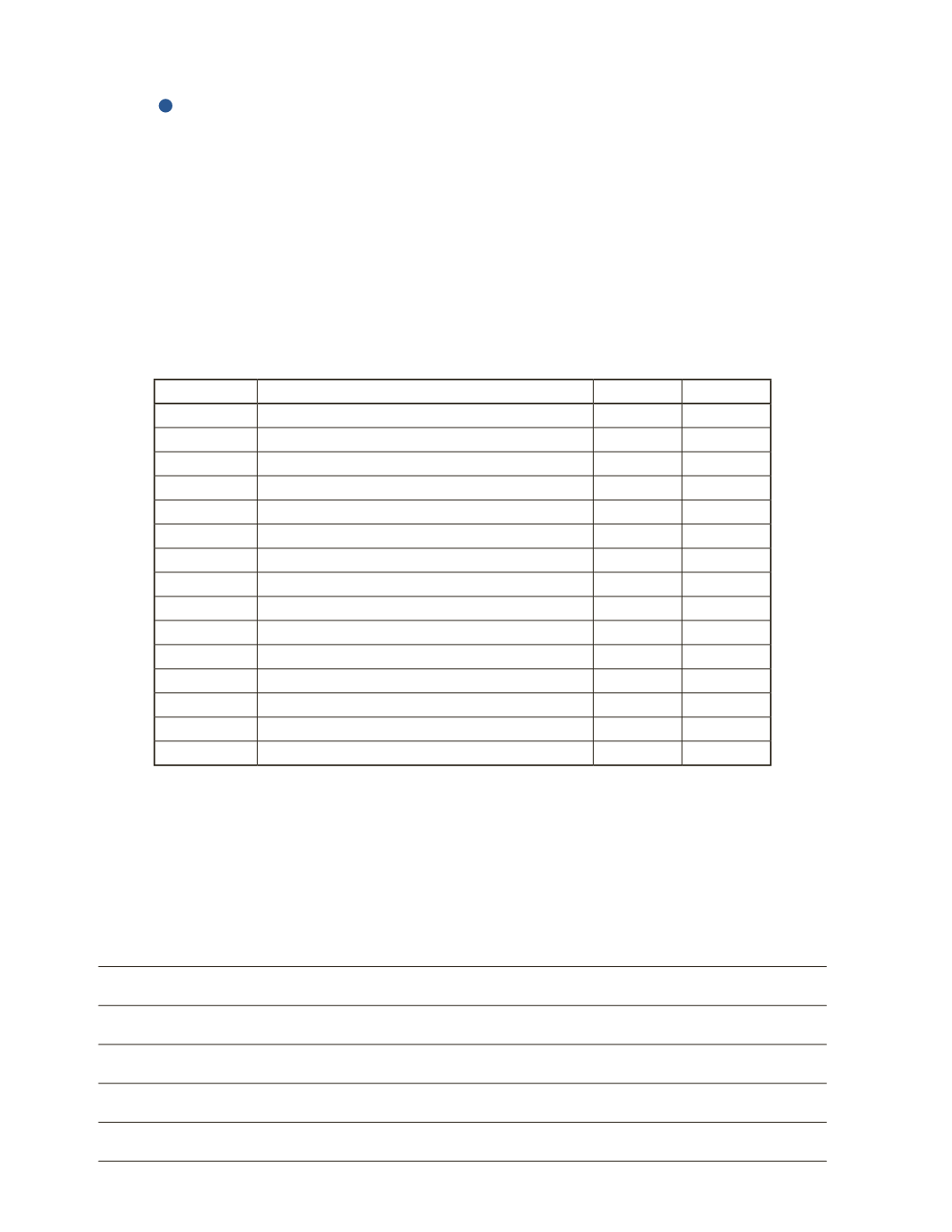

Date

Account Title and Explanation

Debit

Credit

Analysis

The accounting practice of estimating and recording accrued expense is part of accrual-based

accounting. This process is different from cash-based accounting, which is an accounting

practice that records expenses and revenue only when cash is paid or received. What benefit

does accrual-based accounting have over cash-based accounting?