Chapter 8

Non-Current Liabilities

398

AP-10A (

4

)

On April 1, 2016, Hamsar Inc. issued a five-year 8% bond of $500,000 for the premium price

of $542,651. Interest is to be paid semi-annually on October 1 and April 1. The company’s

year-end is December 31. Prepare an amortization schedule for the first four interest periods.

Assume the market rate of interest was 6% on the issuance date.

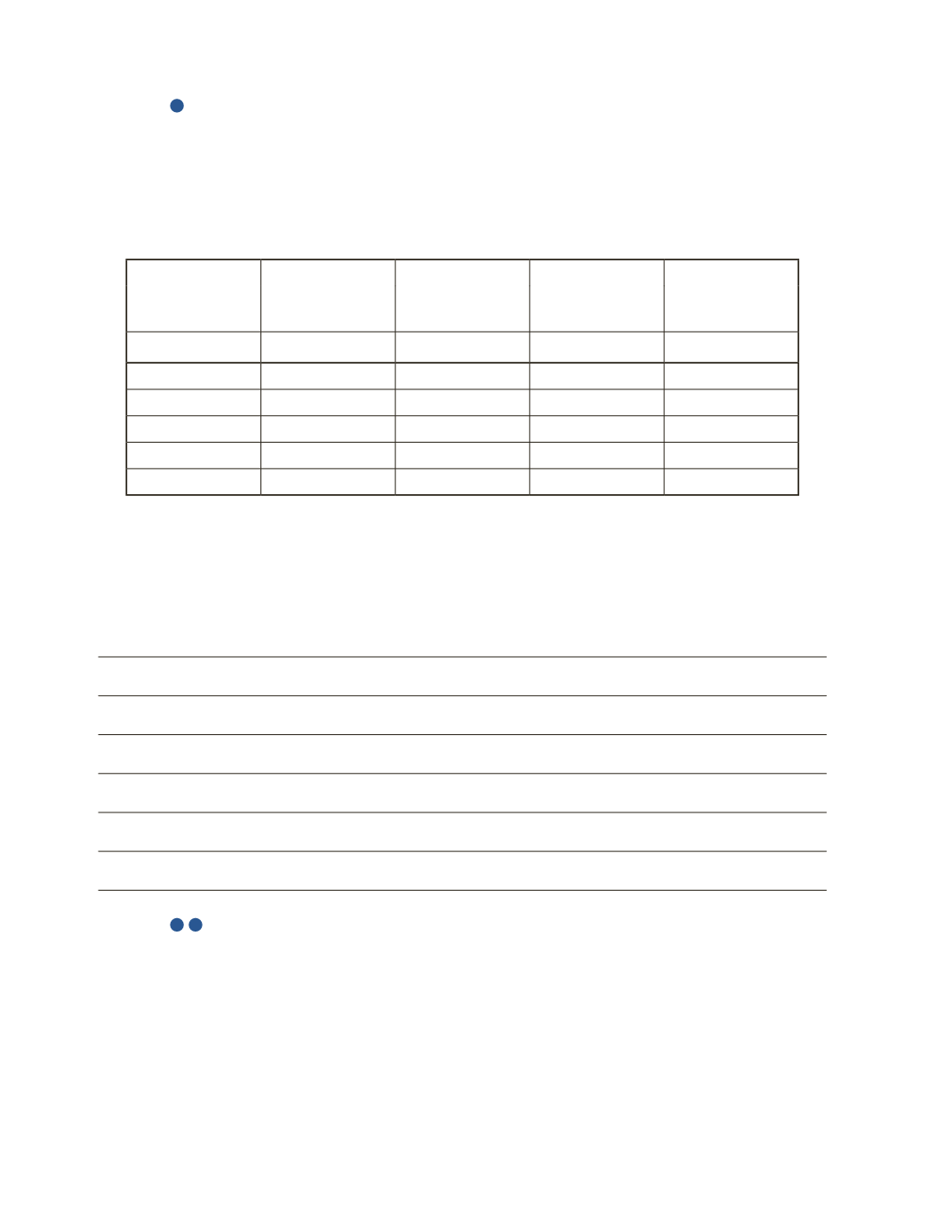

A

B

C

D

Semi-Annual

Interest Period Interest Payment Interest Expense

Premium

Amortization

Bond Amortized

Cost

Analysis

Would the total cash payment for interest be different from the total interest expenses

recorded over the term of the bonds? Explain.

AP-11A (

4

7

)

Burroughs Corporation (with a December 31 year-end) issued $450,000, 9.5% bonds due

in eight years on May 1, 2016. Interest is paid semi-annually on November 1 and May 1 of

each year. On the issuance date, the market rate of interest was 8.5%, resulting in a price of

$475,746 for these bonds.

Note: The premium/discount is amortized using the effective interest method.