Chapter 4

Current Liabilities

209

Sep 30 Sales for the second half of the month amount to $350,000 plus HST. Cost of goods

sold is $210,000. Estimated warranty costs must also be recorded. There is no sales

tax recorded on warranty estimates.

Sep 30 Paid the amounts of payroll owing to employees from September 29.

Sep 30 Paid the HST owing for the month of September.

Sep 30 Paid the payroll remittance to the CRA for the amount owing from payroll for the

month of September.

Sep 30 Accrued one month of interest on the note payable from September 1.

Sep 30 Earned one month of extended warranty revenue from September 1.

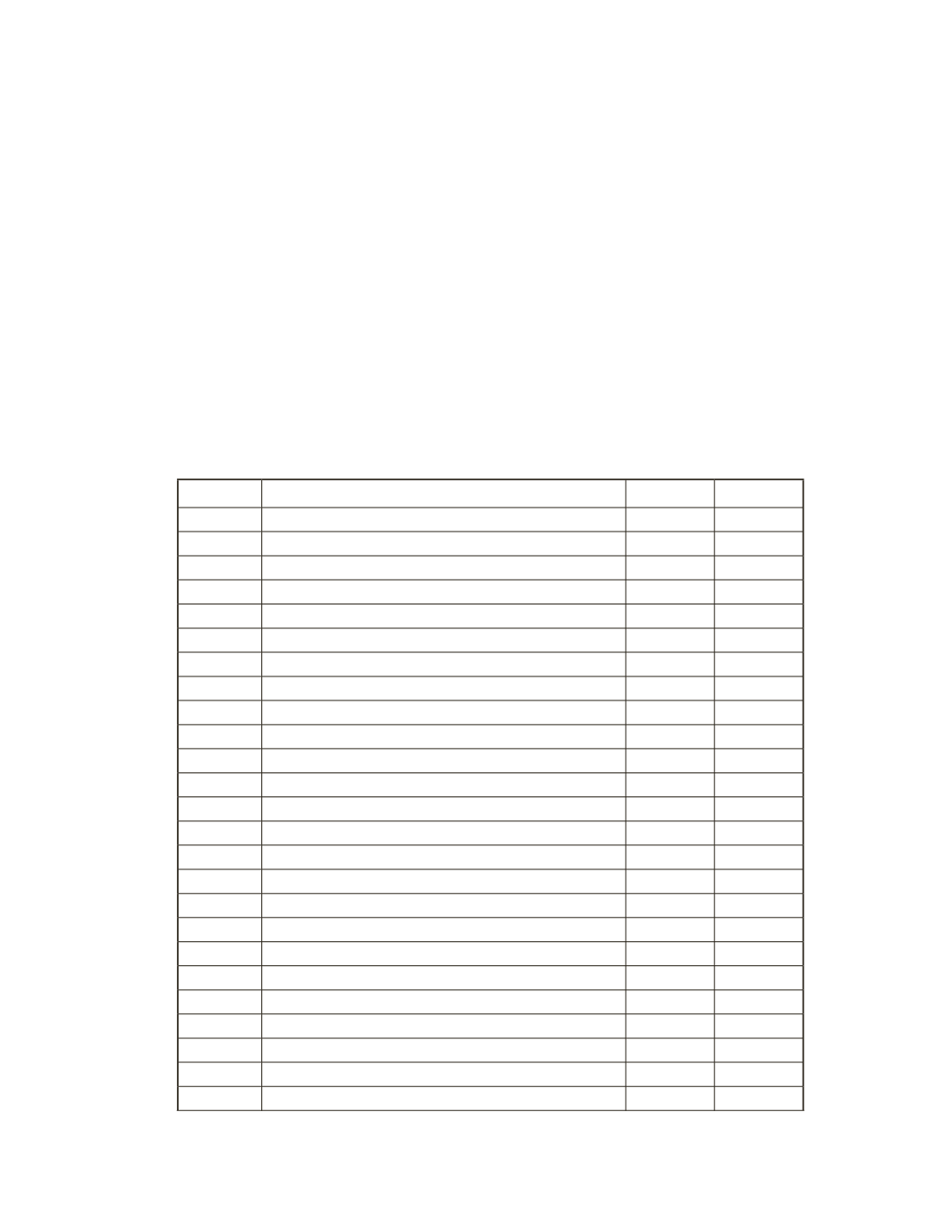

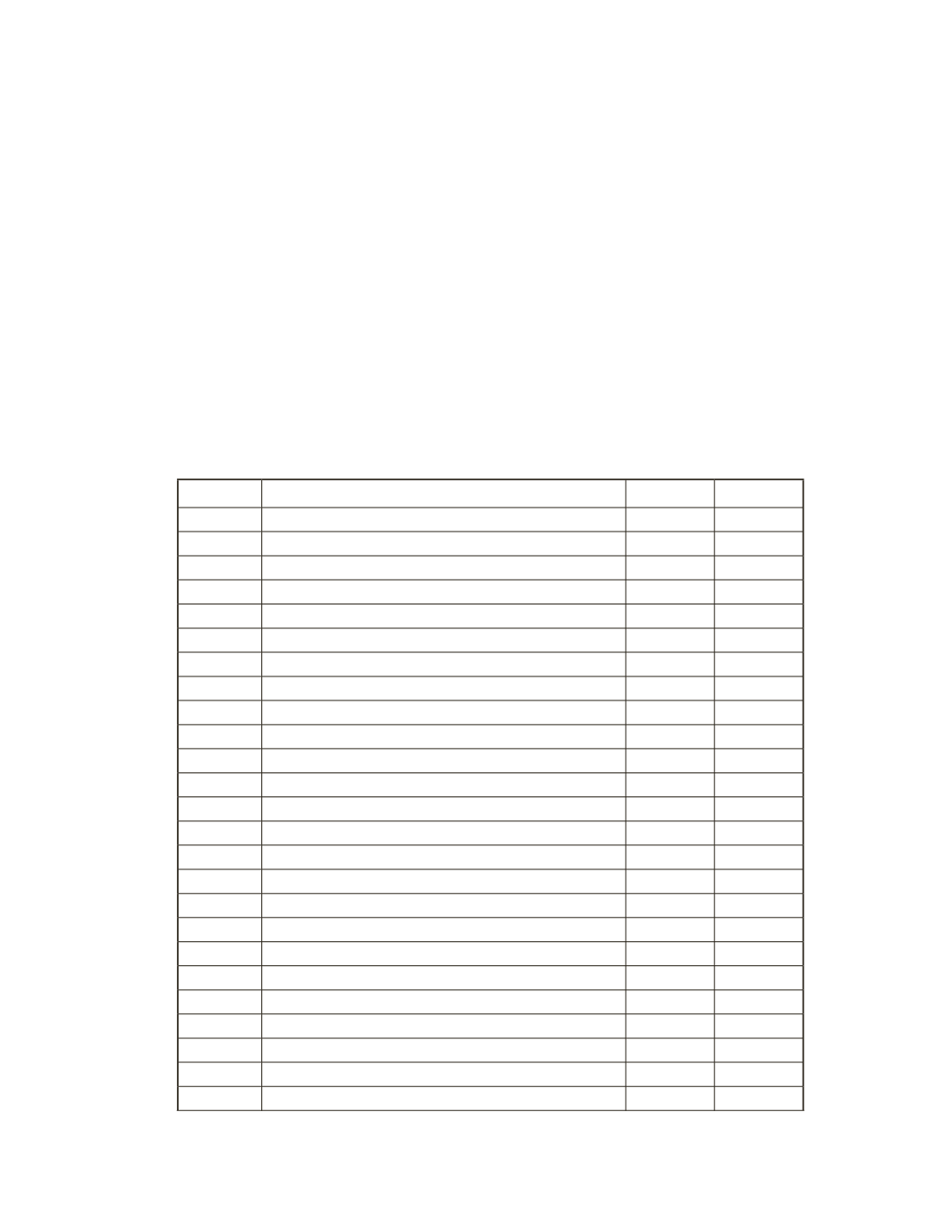

Required

a) Complete journal entries for the above transactions for the month of September 2016.

Date

Account Title and Explanation

Debit

Credit