Chapter 4

Current Liabilities

177

AP-16A (

6

)

On September 1, 2017, Express Company purchased a delivery truck from MJ Trucks, costing

$80,000. However, due to cash flow problems, Express Company is currently unable to make

the payment. Therefore, to assure MJ Trucks that it will be paid, Express Company signed a

one-year note with 3% interest per annum, to be payable at maturity on August 31, 2018.

Express Company’s year-end is on December 31. Prepare all the necessary journal entries

related to the notes payable from the time it is signed to the maturity date.

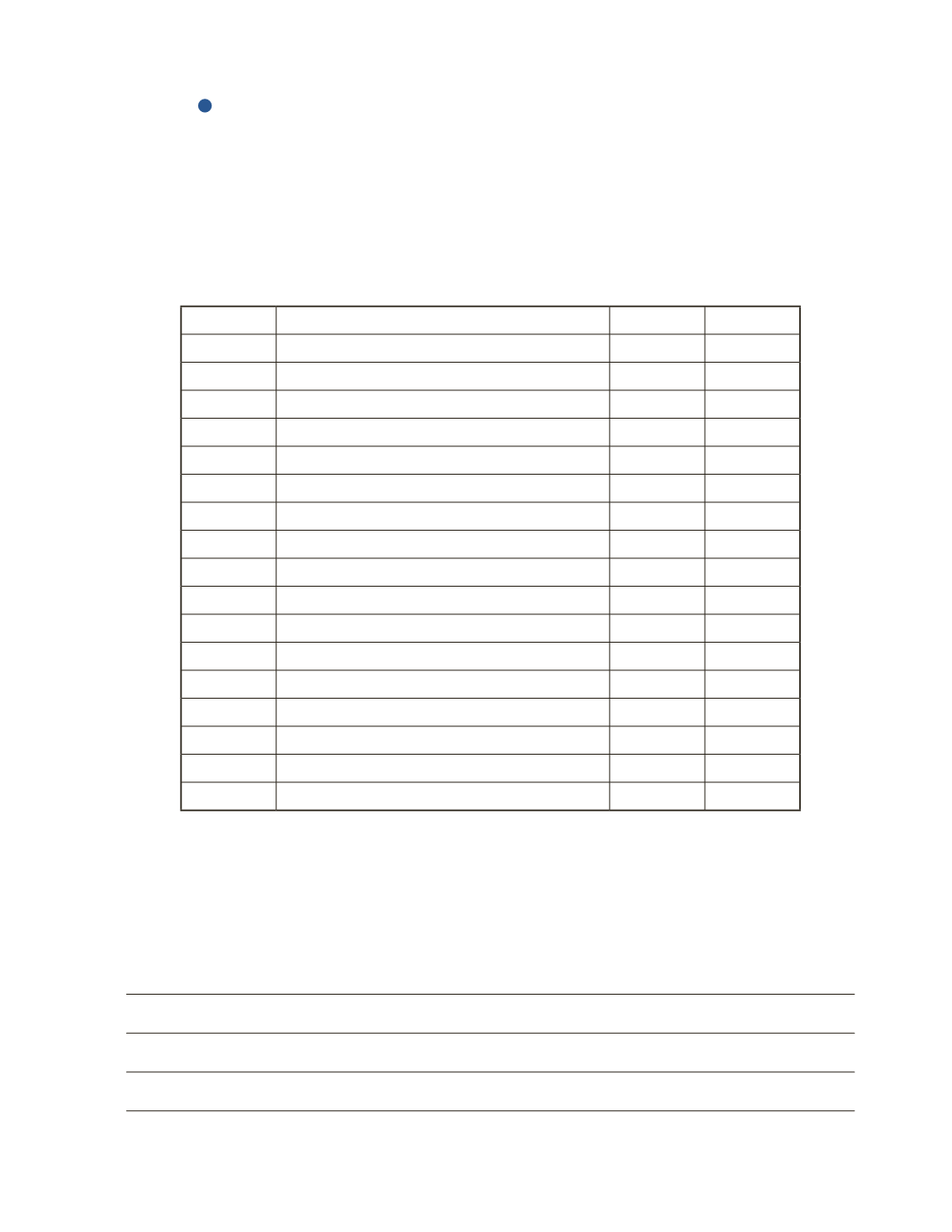

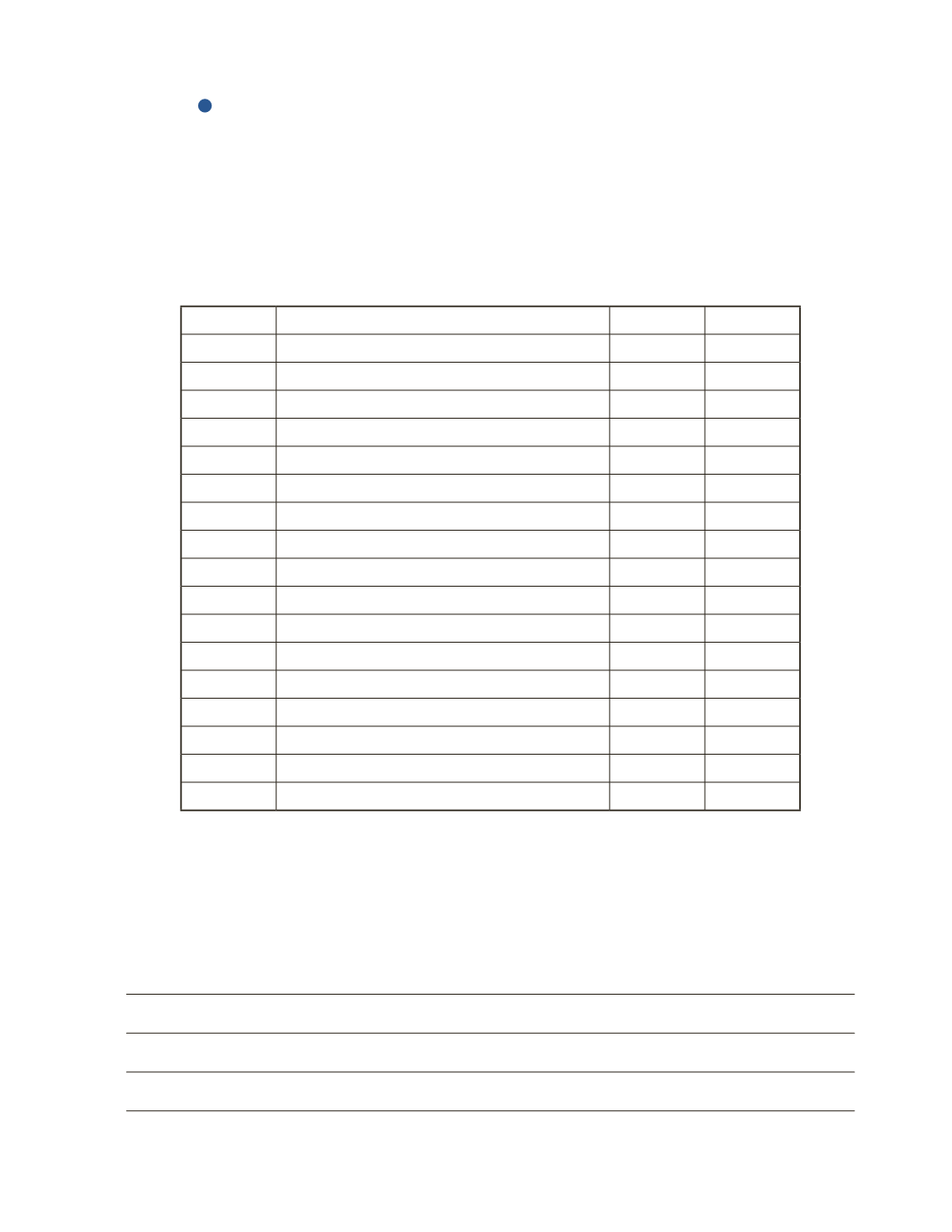

Date

Account Title and Explanation

Debit

Credit

Analysis

Businesses are supposed to accrue expenses (such as interest expense) at the end of their

fiscal years to report them on their financial statements. Why do you think businesses should

not wait until cash is paid to record the expenses?